Western Union, one of the world's most established money transfer companies, is opening a new chapter in its digital transformation strategy. In an interview with Bloomberg, CEO Devin McGranahan explained that they see stablecoins as a major opportunity, not a threat. Western Union is working on infrastructure to enable stablecoin-to-fiat conversions and plans to activate stablecoin use in its global digital wallets.

Stablecoins are no longer competitors, they're partners

McGranahan emphasized that stablecoin integration is a natural innovation process for Western Union. "We've been innovators many times in our 175-year history, and stablecoin is one of them," McGranahan said, adding that the company is committed to leveraging this technology for fast and cost-effective money transfers worldwide. The company's goals are threefold: speeding up cross-border transfers, facilitating the conversion of stablecoins to fiat, and providing users with a store of value in regions experiencing economic instability.

These statements follow the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, signed into law last week by US President Donald Trump, as previously reported. This law requires stablecoin companies to be fully collateralized with US dollars or high-liquid assets and undergo annual audits. For traditional financial institutions like Western Union, this regulation largely eliminates legal uncertainty, making crypto integration more attractive.

Pilots in Latin America and Africa

Western Union is currently testing new settlement models in Latin America and Africa. The goal is to increase transaction speed and reduce costs through mobile wallets in regions where traditional banking is weak. The company is also preparing to establish global on-ramp and off-ramp partnerships for stablecoin buying and selling.

This move suggests that Western Union is under competitive pressure. In recent years, digitally focused new players like Wise and Remitly have gained significant market share with their lower fees and faster transfer options. Meanwhile, rival MoneyGram was the first to launch the MoneyGram Wallet last year, enabling USDC-based stablecoin transfers.

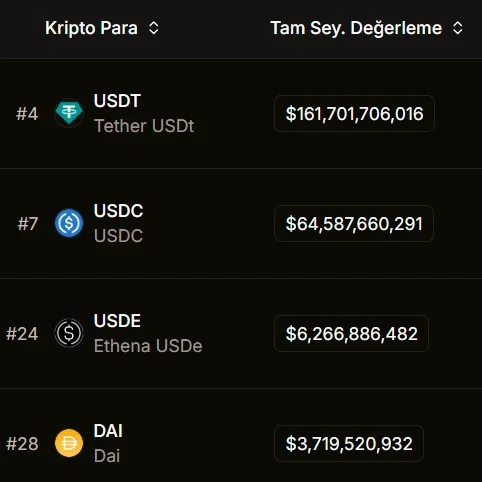

According to Matthew Sigel, VanEck's director of crypto asset research, mobile app downloads for giants like Western Union are experiencing a significant decline. This is forcing companies to adapt more quickly to new technologies. The stablecoin market is currently at an all-time high: According to market data, the total market capitalization has surpassed $262 billion. Furthermore, Ripple CEO Brad Garlinghouse predicts this figure could reach $1-2 trillion in the next few years.