Global transportation giant Uber is getting one step closer to the cryptocurrency industry. Dara Khosrowshahi, CEO of the company, said at the Bloomberg Tech Summit in San Francisco that the integration of stablecoins into Uber's payment infrastructure is on the agenda and that this issue is still in the “research phase”.

Interest in stablecoins is growing: Practicality over Bitcoin

Khosrowshahi drew attention to the cost advantage of stablecoins, especially in international money transfers. According to the CEO, stablecoins can provide a significant efficiency boost for companies operating on a global scale by eliminating exchange rate fluctuations and brokerage costs.

“Stablecoin is one of the most interesting forms of crypto that goes beyond being a store of value and provides practical utility. That's why it's really interesting for us,” the Uber CEO said, underlining that stablecoins offer a more viable option compared to Bitcoin. While Khosrowshahi acknowledged that Bitcoin can be seen as a store of value, he noted that it is not preferred as a means of payment due to its volatile nature and open future to different interpretations.

Uber's interest in cryptocurrency is not new. In 2021, the company announced that they were open to the idea of paying with cryptocurrencies. At that time, Khosrowshahi stated that digital assets such as Bitcoin could be accepted as a payment method, but the company did not intend to keep these assets as treasury reserves.

In 2022, the CEO of Uber stated that they would accept cryptocurrencies “definitely in the future”, but pointed out problems such as transaction costs and environmental impacts.

Stablecoin wind is spreading

Recently, not only tech giants but also other financial institutions have turned to stablecoins. In May, John Collison, co-founder of payment giant Stripe, revealed in an interview with Bloomberg that the company was in early talks with banks on stablecoin integration.

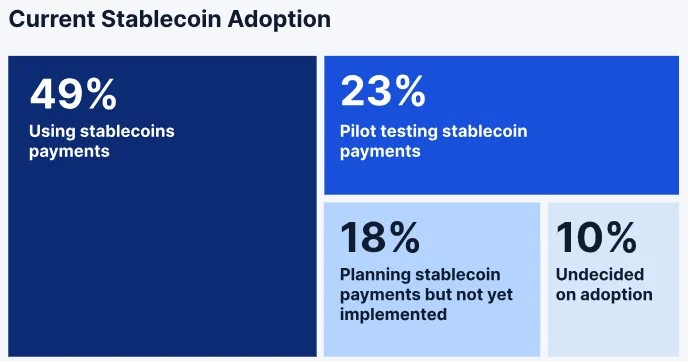

A similar trend is observed on the institutional side. According to a report published by Fireblocks in May, 90% of corporate actors surveyed are taking steps to incorporate the use of stablecoins into their operations.

Interestingly, governments are not indifferent to these digital assets. In April, an official from the Russian Ministry of Finance publicized the idea of issuing a government-backed stablecoin. In the same month, three major Abu Dhabi-based institutions collaborated to create a new stablecoin pegged to the UAE dirham.