The Bitcoin price reached $117,600, reaching a one-month high. However, this surge is driven by a critical development that could shake the markets. The $4.9 trillion in options expiring today on Wall Street poses a significant volatility risk for both the stock markets and the cryptocurrency ecosystem.

Analyst Ted Pillows commented on social media, "Today's $4.9 trillion options expiration is even larger than the total value of the current cryptocurrency market. Such a load could cause sharp market volatility." The current crypto market size is approximately $4 trillion.

The "Triple Witching" Effect

Wall Street's quarterly "triple witching" periods are known for the simultaneous expiration of options and futures. This process, seen in March, June, September, and December, can increase trading volumes and lead to sharp price movements. Ted noted that a similar situation occurred in March and June 2025. Following the March expiration, markets experienced a sharp pullback within two to three weeks, while the June expiration paved the way for Bitcoin to fall below $100,000.

Huge Figures in Crypto Options

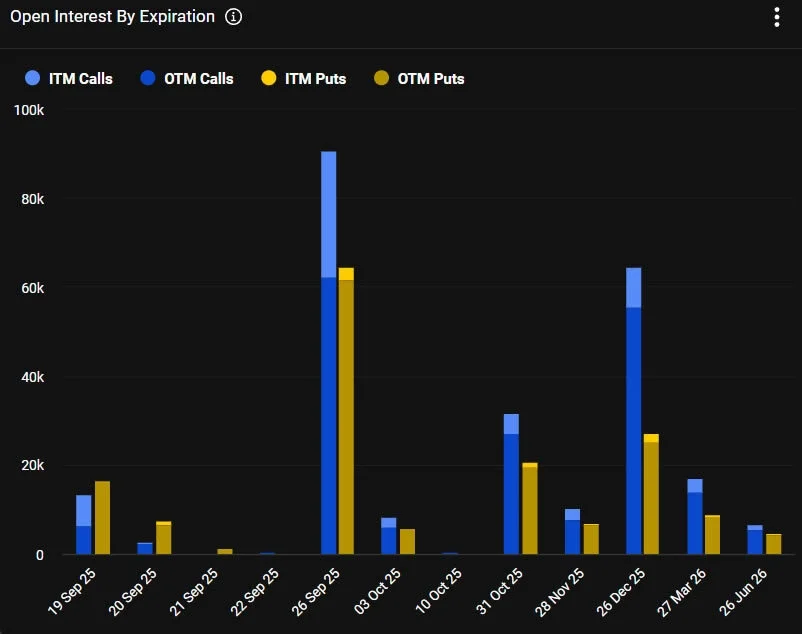

The crypto market is also striking. According to market data, $3.5 billion worth of Bitcoin and $806 million worth of Ethereum options expire today. For Bitcoin, the put/call ratio is 1.23, with a maximum pain point of $114,000. For Ethereum, the ratio is 0.99, with a maximum pain point of $4,500. These levels are generally known for their "magnet" effect, attracting prices. Therefore, it would not be surprising to see sharp fluctuations in the coming hours.

Leverage Overload Creates Risk

According to experts, the biggest risk is the reaccumulation of high leverage levels in the markets. Ted commented, “Leveraged positions are liquidated sooner or later. This paves the way for short-term declines, followed by a new rally.” In March, Bitcoin rose 33% before retreating. In June, this figure remained at 20%, and the decline was much more rapid. In September, Bitcoin was trading around $117,000, and investors are worried that a similar scenario could reoccur.

As a result, both the massive $4.9 trillion expiration date on Wall Street and the critical $4.3 billion threshold in crypto options markets could create a stormy market effect.