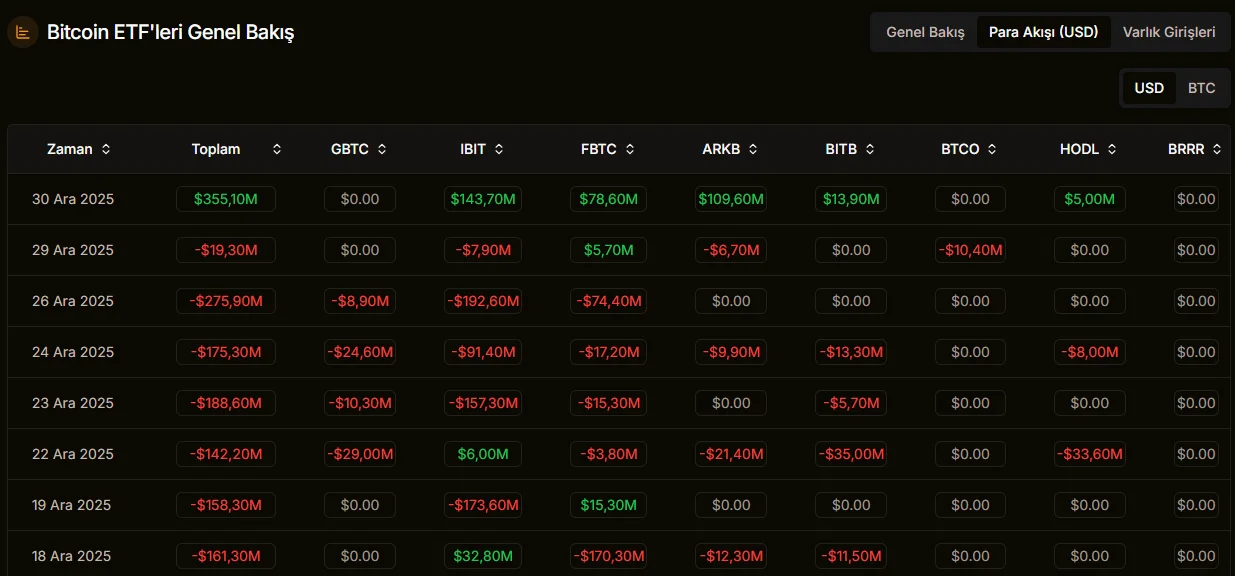

A seven-day outflow from US spot Bitcoin ETFs was replaced by strong inflows this week. This recovery, coinciding with the year-end holiday period, indicates that institutional investor interest remains strong. Net inflows were seen not only in Bitcoin, but also in Ethereum and recently approved XRP, Solana, and Dogecoin-based spot ETFs, reinforcing the view that the crypto ETF market is heading into 2026 on a more solid footing. According to market data, US-traded spot Bitcoin ETFs recorded a total net inflow of $355 million on Tuesday, ending the seven-day outflow streak. The fact that these inflows came from six different funds shows that the recovery was not limited to a single product.

BlackRock leads the way

The strongest daily contribution came from BlackRock's IBIT fund, which leads in net asset size. IBIT alone recorded a net inflow of $143.8 million. Ark & 21Shares’ ARKB fund followed with $109.6 million. Fidelity’s FBTC fund also stood out with a $78.6 million inflow. Positive flows were also reported at the end of the day in spot Bitcoin ETFs belonging to Grayscale, Bitwise, and VanEck.

According to LVRG Research Director Nick Ruck, this picture shows that the impact of year-end tax optimization and risk reduction pressures is beginning to weaken. Ruck stated that these inflows, seen despite the fact that market liquidity generally decreases during holiday periods, reveal that institutional demand is still resilient. It is emphasized that long-term investors, in particular, continue to maintain their positions through the ETF channel despite short-term fluctuations.

The recovery on the Bitcoin side was also accompanied by Ethereum ETFs. Spot Ethereum ETFs recorded a total net inflow of $67.84 million on Tuesday after four days of negative flows. This development showed that institutional interest in Ethereum is also gaining momentum towards the end of the year. In addition, the fact that all of the recently launched spot XRP, Solana, and Dogecoin ETFs closed with net inflows for the day indicated increased appetite for altcoin-based products. Experts agree that crypto ETFs are undergoing a significant maturation process throughout 2025. Nick Ruck reminded that despite some crypto assets generating negative returns throughout the year, ETFs attracted tens of billions of dollars in cumulative inflows. He stated that structural developments in assets such as Ethereum, Solana, and XRP have enabled these products to gain a more permanent place in institutional portfolios. Looking ahead to 2026, expectations are even more optimistic. It is predicted that the crypto ETF ecosystem will open up to a wider range of investors as the regulatory framework becomes clearer across the market. It is stated that if large platforms increase their reach and new products are launched, fund inflows could surpass previous peaks. Another development supporting these expectations is the consecutive new applications made by companies. Bitwise alone applied for 11 different altcoin ETFs today. Some of these products aim to offer direct investment strategies in crypto assets, while others offer indirect strategies. The industry believes this diversification will make the ETF market deeper and more flexible. NovaDius Wealth President Nate Geraci, in a post on the social media platform X, argued that 2026 will be the year crypto fully enters the mainstream. According to Geraci, crypto will no longer be perceived as a standalone product, but rather as a "rail" that forms the infrastructure of the financial system.