The long-awaited USDH stablecoin competition in the Hyperliquid ecosystem has concluded. Native Markets, a key team in the ecosystem, has secured the right to use the USDH ticker following a vote and is preparing to launch the testing phase of the new stablecoin shortly.

The voting process marked a critical turning point for the Hyperliquid community. Institutional and crypto-native firms such as Paxos, BitGo, Ethena, and Frax participated in the competition. However, Native Markets stood out with its proposal and community support. The team, which secured the support of a two-thirds majority of HYPE holders in the on-chain vote, will be responsible for issuing USDH.

Native Markets will launch the USDH stablecoin on Hyperliquid's smart contract network, HyperEVM. The company stated that reserves will consist of both off-chain and on-chain assets. According to the official proposal document, cash and US Treasury bonds will be managed by BlackRock, while on-chain reserves will be managed via the Bridge infrastructure connected to Stripe through Superstate. This aims to make USDH a fully collateralized, dollar-backed stablecoin.

The new stablecoin's returns will be split into two channels: HYPE token buybacks and incentive programs to enable broader use of USDH within the ecosystem. Native Markets will initially launch a test phase with limited minting and buybacks. The USDH/USDC trading pair will then be opened, with limits gradually lifted. This process is expected to begin within a few days.

The competition also marked the first major on-chain governance vote on Hyperliquid outside of routine listings. Native Markets submitted its proposal just 90 minutes after the call opened and subsequently revised it based on community feedback. The Hyperliquid Foundation, however, opted to remain neutral and abstained from the vote.

USDC Competitor

The launch of USDH is seen as a direct competitor to Circle's USDC, which currently dominates the Hyperliquid network with approximately $6 billion in reserves. However, it was announced that USDC and other stablecoins will continue to be traded on the network. This will require staking 200,000 HYPE, establishing a robust $1 peg mechanism, and maintaining a certain level of depth against USDC and HYPE.

Native Markets stands out with its founding team of industry leaders. The team is led by Max Fiege, an early investor in Hyperliquid; Anish Agnihotri, an experienced blockchain researcher and developer; and MC Lader, former president and COO of Uniswap Labs.

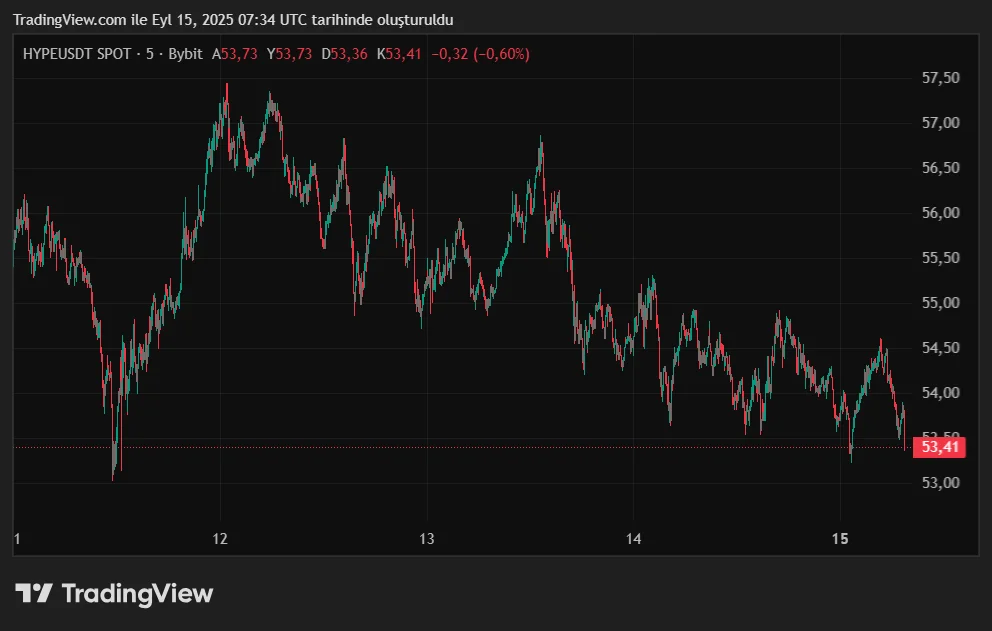

At the time of writing, Hyperliquid's HYPE token is trading at $53.75 and has fallen 0.5% in the last 24 hours.