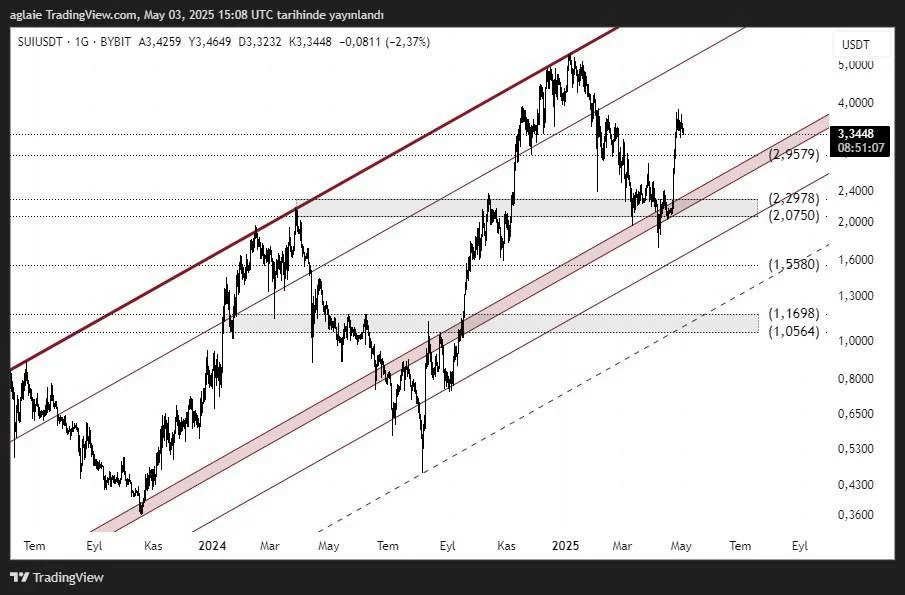

SUI Technical Analysis

SUI has once again drawn investor attention by rising nearly 60% in a short time following strong buying at the $2.07 level.The current price is around $3.34, and the chart shows that this rise is technically built on a solid foundation.

SUI has maintained its ascending channel structure that has been ongoing since mid-2023.In particular, $2.95 is the first support level where a reaction can be expected during pullbacks, and it holds critical importance as a support-resistance flip (SR Flip) from the previous rally.The reaction that followed the pullback to this region confirms that the uptrend is technically healthy.

Technical Levels

Support Zones:

- $2.95 → Closest critical support to the current price

- $2.29 – $2.07 → Previous horizontal support and breakout zone

- $1.55 → Main support near the lower band of the channel

- $1.16 – $1.05 → Major support

Resistance Zones:

- $3.80 – $4.00 → Previous peak and psychological resistance zone

- $4.65 – $5.00 → Upper band of the ascending channel and short-term target area

Looking at the channel structure on the chart, SUI is still moving within an uptrend.Especially the recent breakout and subsequent volume-backed rise show that this channel is not only being maintained but also being validated by investors.

As long as SUI maintains stability above the $3.00 – $3.10 region, upward expectations may continue.Within this structure, the first target is $3.80 – $4.00, followed by the $5.00 zone, which is the upper band of the channel.

In summary, SUI continues to move within a technically strong channel.Especially the recent price action shows that it is supported by investors.As long as the channel structure is preserved, SUI's upside potential continues to grow.

These analyses do not constitute investment advice.They focus on support and resistance levels that are believed to provide short- and medium-term trading opportunities based on market conditions.However, all trading and risk management responsibility lies entirely with the user.Stop-loss usage is strongly recommended for any trades mentioned.