Strategy, a pioneer in institutional Bitcoin investments, plans to sell up to $4.2 billion in new stock to expand its cryptocurrency strategy. According to the company's filing with the U.S. Securities and Exchange Commission (SEC), this capital increase will be made through a new series of preferred stock codenamed "STRC" and will be used primarily to purchase Bitcoin.

This new plan follows Strategy's $2.5 billion sale of STRC shares in July. STRC shares, which began trading on the Nasdaq Global Select Market, offer flexible dividend payments aligned with the company's strategic objectives. The first dividend payment was announced on July 31st and will be distributed to shareholders on August 31st.

A New Phase in Bitcoin Purchases

According to Strategy's CEO, Phong Le, this new stock program is not only a fundraising tool but also a key part of its plan to position Bitcoin as a corporate treasury tool. According to the company, the majority of the funds raised will be used directly for Bitcoin purchases. The remaining portion will be used for general corporate purposes, such as operating expenses and dividend payments on previously issued preferred shares.

STRC is a product designed with a variable-interest, perpetual preferred share structure. This structure allows Strategy to raise capital flexibly based on market conditions. Other preferred share programs the company has previously launched, such as STRD, STRK, and STRF, similarly fuel a Bitcoin-based investment strategy.

Strategy's Performance in Numbers

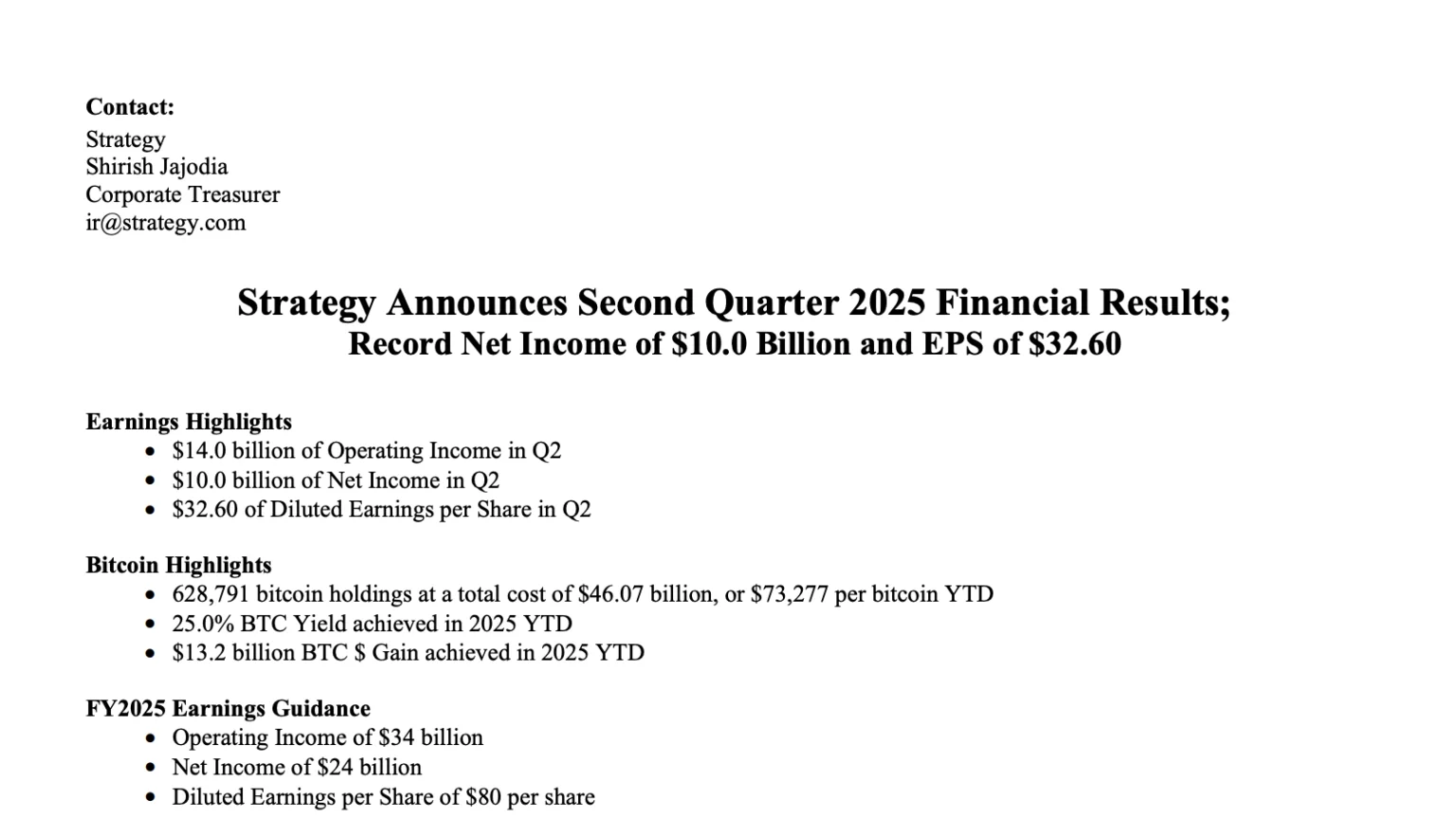

Strategy reported a net profit of $10 billion in the second quarter of 2025. The company's operating income increased by a remarkable 7,100% year-over-year to $14 billion. This increase was largely due to the appreciation of the company's Bitcoin holdings. Strategy, which currently holds 628,791 BTC, stated that the total value of these holdings is $73.3 billion.

In July alone, an additional 21,021 BTC were purchased with the proceeds from the STRC sale. According to the company's statements, the proceeds from the new $4.2 billion sale could purchase approximately 36,000 more BTC at current prices.

Saylor's "42/42" plan is in effect

These new share sales are crucial as part of Strategy co-founder Michael Saylor's "42/42" strategic plan, which aims to purchase a total of $84 billion in Bitcoin. The company's aggressive capital-cryptocurrency conversion strategy aims to increase the role of Bitcoin in corporate treasuries and maximize the amount of Bitcoin per share.

Phong Le argues that the company is significantly undervalued relative to its market capitalization under this strategy. Despite ranking among the top 10 companies with the highest operating income on the S&P 500 index, Strategy, with its 96th market capitalization, has been described as "one of the most misunderstood and undervalued stocks."