Strategy, one of the largest institutional investors in Bitcoin, has once again increased its holdings. Between October 13th and 19th, the company purchased 168 Bitcoins at an average price of $112,051. Approximately $18.8 million was spent on this transaction, bringing the company's total Bitcoin holdings to 640,418. This amount represents more than 3% of Bitcoin's maximum supply of 21 million.

Strategy Holds a Large Amount of Bitcoin

Strategy's total Bitcoin holdings are approximately $47.4 billion. According to co-founder and CEO Michael Saylor, these holdings are worth around $71 billion at current prices. This means the company has over $23 billion in paper revenue. These purchases were financed with proceeds from the firm's perpetual preferred stock sales.

The company has recently been raising funds through these special types of stock, known as STRK, STRF, and STRD. STRK, a convertible stock with an 8% dividend yield, offers investors higher return potential. STRF offers a more stable structure with a 10% cumulative dividend. STRD, on the other hand, is non-convertible and offers a 10% dividend yield, offering a higher risk-return profile. Furthermore, Strategy aims to raise a total of $84 billion in capital by 2027 with a new strategy it calls the "42/42 plan." This plan is an expanded version of the firm's initial $42 billion "21/21" program.

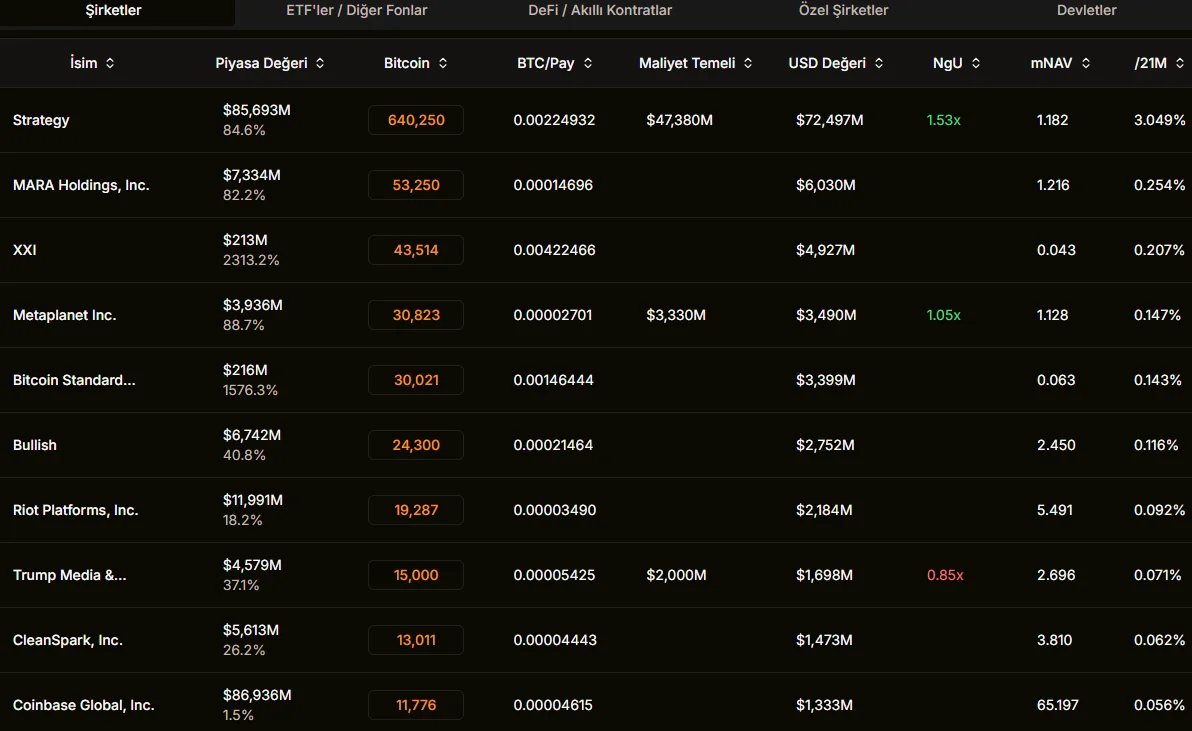

Strategy's aggressive Bitcoin purchase program is still a matter of debate in the traditional finance world. However, Michael Saylor argues that in the long term, Bitcoin will be the digital equivalent of the dollar. Last week, Saylor signaled new purchases in a post on his X account, saying, "The most important orange dot is always the next one." Following this announcement, the company announced another purchase of 220 BTC. According to market data, 190 publicly traded companies currently hold Bitcoin reserves. Strategy is the clear leader in this field, followed by Marathon Digital with 53,250 BTC, Tether-backed Twenty One with 43,514 BTC, Metaplanet with 30,823 BTC, and Bitcoin Standard Treasury Company with 30,021 BTC. Other major institutional holders include Riot Platforms, Trump Media & Technology Group, CleanSpark, and Coinbase.

While the number of these companies is growing, their shares have been declining in recent months. Strategy stock is down 36% from its summer peak. Nevertheless, the company continues to view Bitcoin as a long-term store of value. As Michael Saylor has previously noted, Strategy's capital structure is designed to withstand even a 90% drop in Bitcoin's price. However, Saylor acknowledges that "shareholders would suffer" in such a scenario.