The Solana ecosystem is making headlines with one of the developments that will mark 2025. The Solana staking ETF (SSK) launched by REX Shares achieved a huge success by reaching a volume of $33 million on its first day of trading. This figure surpassed both XRP futures ETFs and SOL futures ETFs, drawing considerable attention. Bloomberg ETF strategist Eric Balchunas predicts that the ETF's assets under management (AUM) could increase tenfold in the near future following this successful launch.

Strong start from day one: $12 million in inflows

This ETF, coded SSK, allows investors to indirectly access staked SOL assets. According to data shared by Balchunas, the fund received $12 million in inflows on its first trading day, with its AUM value exceeding $1 million. Balchunas noted in a post on X (formerly Twitter) that if these numbers continue, the fund could reach a size of 10 million dollars within a few days. “Given today's trading volume, a few million dollars more could come in tomorrow, perhaps even reaching 10 million dollars,” he stated.

Groundwork being laid for spot Solana ETFs

The successful launch of the SSK is another indication of growing interest in crypto ETFs. Experts believe this development could pave the way for spot Solana ETFs as well. Currently, 13 different companies have filed applications with the U.S. Securities and Exchange Commission (SEC). Eric Balchunas previously estimated the likelihood of spot Solana ETF approval at 95%. This percentage is higher than what he had predicted for XRP.

As there is a general increase in demand for ETFs in the crypto market, altcoins such as XRP, SOL, ADA, and LTC are at the center of investor interest. Staking ETFs offering traditional investors greater access to crypto is one of the main factors driving this interest.

All-time record in SOL futures on CME

Following the SSK ETF launch, the volume of Solana futures contracts on the Chicago Mercantile Exchange (CME) reached an all-time high. With daily trading volume exceeding $1.7 million, this once again demonstrated investors' confidence in SOL.

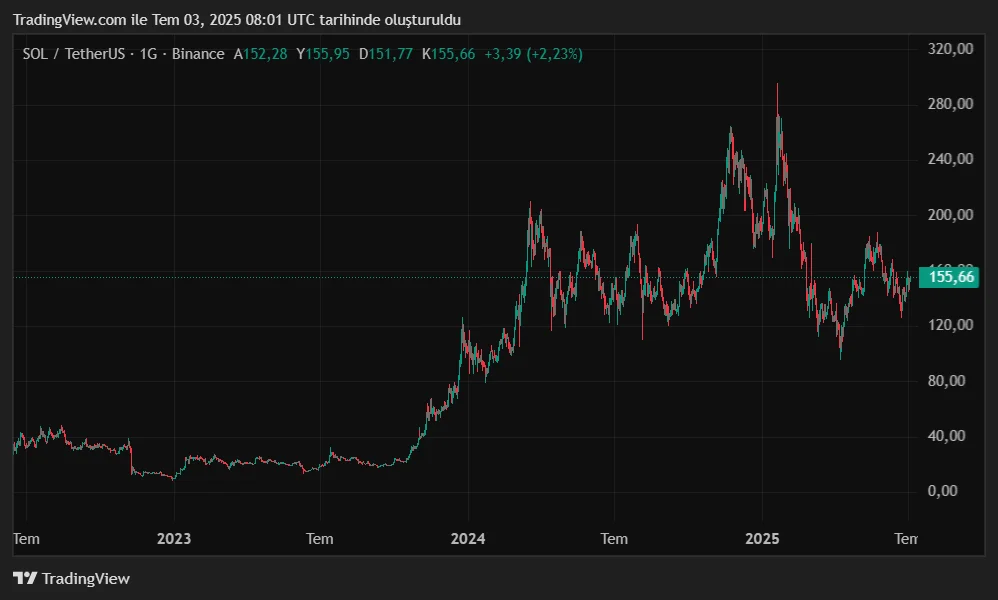

Price increase followed swiftly

The ETF development not only impacted investment instruments but also directly influenced the SOL price. Following the news, the Solana price rose by 5% over the past 24 hours, maintaining a positive trend. The daily trading volume is approaching 4 billion dollars. At the time of writing, the Solana price is trading at 155 dollars. It remains 47% below its all-time high of 293 dollars recorded on January 19, 2025.