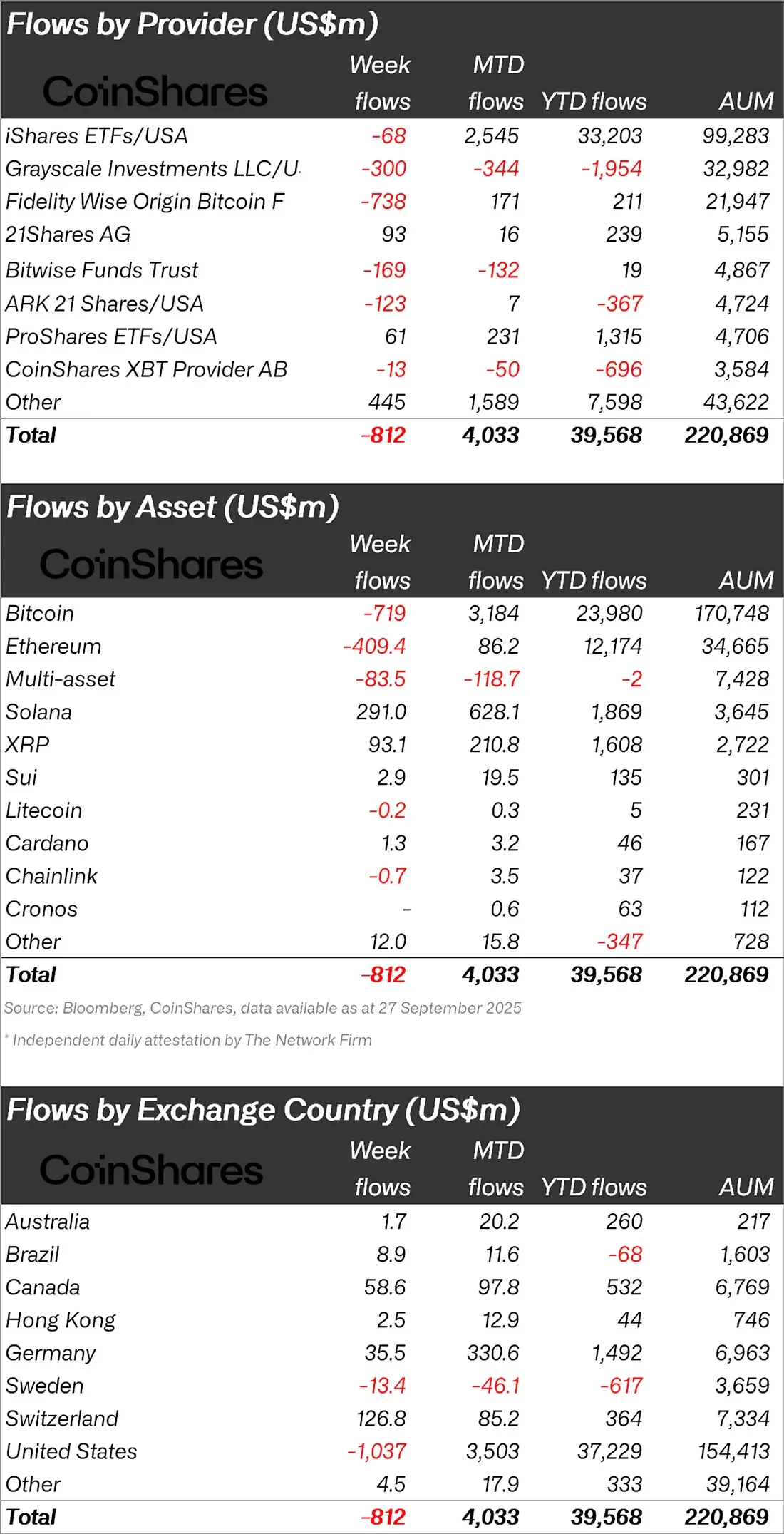

Crypto asset investment products faced severe selling pressure last week. According to CoinShares data, a total outflow of $812 million was driven by strong macroeconomic data from the US and weakening expectations for an interest rate cut. However, inflows totaling $39.6 billion since the beginning of the year indicate that the market still maintains the potential to approach last year's record levels.

Significant outflow from cryptocurrencies

Crypto asset investment products saw an outflow of $812 million last week. According to CoinShares' latest report, this decline is linked to weakening expectations for an interest rate cut following strong macroeconomic data from the US. Nevertheless, total inflows since the beginning of the year remained at $39.6 billion, approaching last year's record.

US-based products led the way with outflows exceeding $1 billion. In contrast, the picture in Europe is more positive: Switzerland recorded net inflows of $126.8 million, Canada $58.6 million, and Germany $35.5 million. This suggests that the negative sentiment was largely confined to the US.

Which altcoins saw activity?

On an asset basis, Bitcoin was the most affected, with an outflow of $719 million. Notably, there was no significant inflow into short-Bitcoin assets, suggesting that the selling pressure may not be persistent. The situation is similar for Ethereum: the weekly outflow of $409.4 million nearly halted the strong inflows of $12.1 billion since the beginning of the year.

Meanwhile, altcoins displayed a different outlook. Solana led the week with $291 million in inflows, reaching a total of $628 million since the beginning of the month. Interest in Solana is rapidly increasing ahead of the anticipated ETF approvals in the US. XRP also saw an inflow of $93.1 million, bringing inflows to $1.6 billion since the beginning of the year. Although smaller, Sui ($2.9 million), Cardano ($1.3 million), and Chainlink ($3.5 million) saw inflows. However, activity in assets like Litecoin and Cronos remained limited.

Despite robust inflows, $83.5 million in outflows from multi-asset products was notable. This category lost more than $118 million in September.

On the fund provider side, the largest outflow came from Fidelity's Wise Origin Bitcoin fund. The $738 million outflow reflected the general pressure in the US market. Grayscale lost $300 million, Bitwise lost $169 million, and ARK Invest lost $123 million, while Switzerland-based 21Shares saw $93 million in inflows.

Macroeconomic data, interest rate expectations, and ETF decisions are expected to continue to drive interest in crypto funds for the remainder of the year.