The U.S. Securities and Exchange Commission (SEC) has once again postponed its decision on applications for exchange-traded funds (ETFs) focused on Solana (SOL). Official filings indicated that the next deadline for the Bitwise Solana ETF and the 21Shares Core Solana ETF is October 16, 2025. This move aligns with the regulator's frequent postponement strategy for similar crypto-asset ETFs.

Not only Bitwise and 21Shares, but also the Solana ETF applications filed by Canary Capital and Marinade Finance were also postponed. In its justification for the postponement, the SEC stated that it determined "a longer deadline is appropriate to allow sufficient time to approve or reject the proposed rule change."

The tradition of postponements continues

The SEC has recently been faced with dozens of crypto ETF applications, ranging from XRP to DOGE. Previous Solana ETF initiatives by giants like Grayscale and Fidelity were similarly postponed. These delays for the Solana ETF raise questions among investors, especially considering the softening of regulatory stance during the Biden administration and the approval of spot Bitcoin and Ethereum ETFs.

ETF analyst James Seyffart states that these delays are normal, but the process is "persistently slow," particularly for Solana. Some market commentators allege that Caroline Crenshaw, a crypto-opposition figure within the SEC, is slowing down the process by obstructing expedited approval procedures.

Market and Investor Expectations

This SEC stance directly impacts Solana's integration with traditional financial products. Many investors believe that a potential ETF approval would increase Solana's liquidity and institutional interest. Spot Bitcoin ETFs have also been approved in 2024 after undergoing lengthy approval processes. This situation is seen as a promising precedent for Solana ETFs.

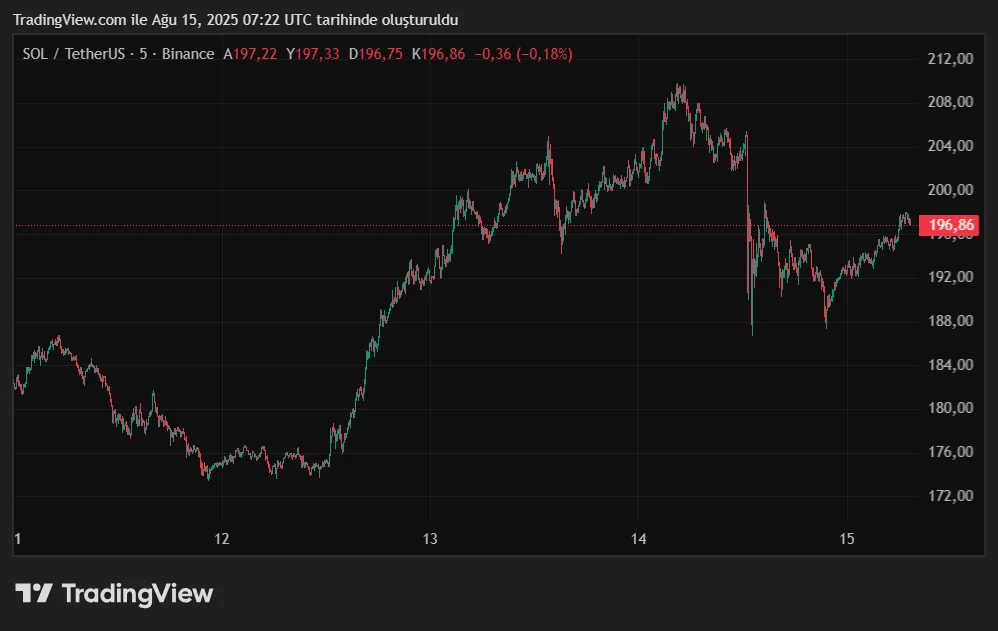

According to market data, Solana is currently trading at $197.39 and has gained 4.18% in the last 24 hours. The 24-hour price range was between $188.80 and $206.21. Solana, with a market capitalization of $106.52 billion, has a fully diluted valuation of $120 billion. Its 24-hour trading volume is $12.14 billion.

What's next?

The October 16th deadline is crucial for the applications. The SEC must approve or reject the applications by this date. However, given past precedents, investors are increasingly speculating that the process will likely drag on rather than receive a clear approval on that date.

Reports suggest the SEC may be working on new approval standards for crypto ETFs. Last month, a basket ETF containing Solana was approved only one day later, and the product was withdrawn from the market. This suggests the agency is cautious, even if it favors certain products. If the new standards are established, the Solana ETF approval process is expected to be shaped by these regulations.