Ripple, known for its blockchain-focused financial solutions, is preparing to make a significant acquisition to expand its digital payment infrastructure. The company announced that it will acquire stablecoin-backed payment platform Rail for $200 million. The deal is expected to close in the fourth quarter of 2025.

Toronto-based Rail is a payment infrastructure provider backed by investors such as Galaxy Ventures and Accomplice. The company enables businesses to make fast and cost-effective international payments using stablecoins. This acquisition, which follows Ripple's launch of its RLUSD stablecoin, is considered part of the company's growth goals in the stablecoin space.

Ripple President Monica Long said, “Stablecoins are becoming a cornerstone of modern finance. With Rail, we aim to further expand the use of stablecoins and blockchain technology in global payments.” Long also emphasized that Ripple already has one of the most widely used digital asset payment networks worldwide.

What does Rail offer?

With Rail's acquisition of Ripple, the services offered will be quite comprehensive. Thanks to the new system:

- Users will be able to receive and send payments in multiple currencies, including US dollars, via stablecoins, without having to hold crypto on their balance sheets.

- Companies will be able to easily manage third-party payments or internal financing flows on the same platform.

- High liquidity and competitive pricing will be provided for payments made using RLUSD, XRP, and other digital assets.

- Virtual accounts will allow users to conduct transactions without opening a crypto bank account or centralized exchange wallet.

- A single API will connect to a 24/7 infrastructure, facilitating integration with financial systems.

- Ripple's more than 60 financial licenses will provide regulatory-compliant and secure transaction processes.

Global coverage will be increased through partnerships with more than 12 banks. Commenting on the acquisition, Rail CEO Bhanu Kohli said, “Over the last four years, Rail has distinguished itself with its ability to process international business payments with stablecoins at the fastest speeds. We share the same vision as Ripple and are excited to bring this innovation to millions of businesses worldwide.” Rail is expected to process more than 10% of global B2B stablecoin payments by 2025.

Ripple's Growth Strategy

This move is a continuation of Ripple's active growth and expansion strategy. The company's strategic acquisitions and investments to date have totaled over $3 billion. Ripple aims to ensure regulatory confidence with its payment, custody, and stablecoin solutions for digital assets.

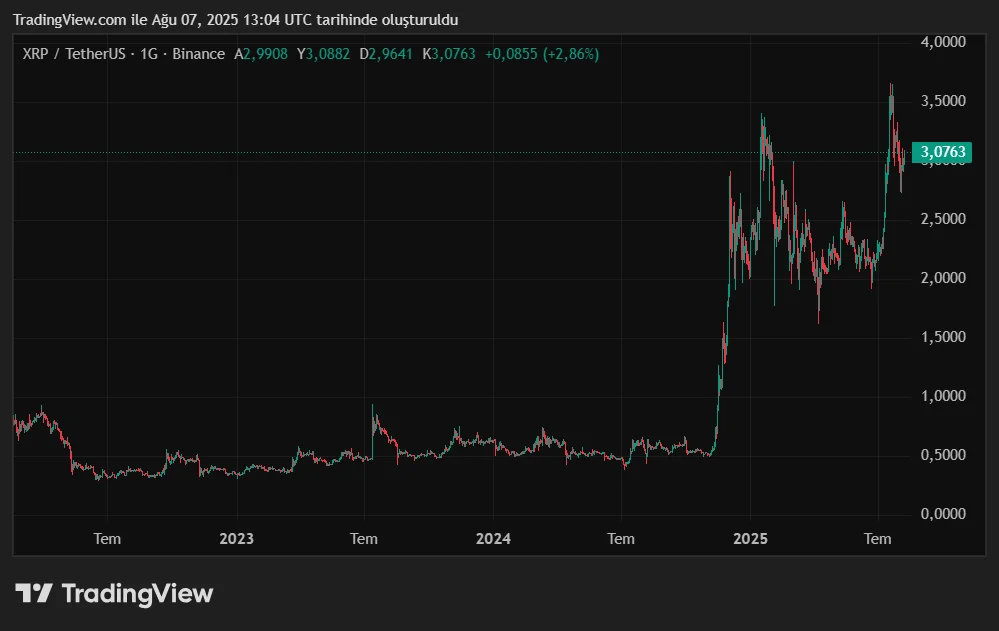

Ripple's solutions integrate traditional financial infrastructure with blockchain technology, providing both lower-cost liquidity access and enabling the secure storage of digital assets. The company continues to aim to deliver fast, low-cost, and scalable transactions with products like the XRP Ledger and XRP token. At the time of writing, XRP is trading above $3, up 4 percent