Blockchain company Ripple is preparing to take a new step with Japanese financial giant SBI Holdings, with whom it has had a long-standing strategic partnership. The company plans to launch its Ripple USD (RLUSD) stablecoin in the Japanese market in the first quarter of 2026. According to the statement, distribution will be carried out through SBI VC Trade, SBI's cryptocurrency arm.

RLUSD, which Ripple launched at the end of 2024, is backed 1:1 by US dollar reserves, short-term US Treasury bonds, and cash equivalents. With a market capitalization of $666 million, the stablecoin boasts a daily trading volume of approximately $70 million.

A new era in Japan

SBI VC Trade CEO Tomohiko Kondo described the launch of RLUSD in Japan as "a major step forward in the reliability and ease of use of stablecoins." According to Kondo, this move will not only increase investor options but also accelerate the convergence of financial and digital technologies. Ripple Vice President Jack McDonald also emphasized that the partnership is based on harmony and trust. McDonald stated that RLUSD aims to be "a reliable and efficient bridge between traditional finance and decentralized finance." He also stated that they believe this partnership will set a new standard not only in Japan but also in the global stablecoin market.

Growth in the Stablecoin Market

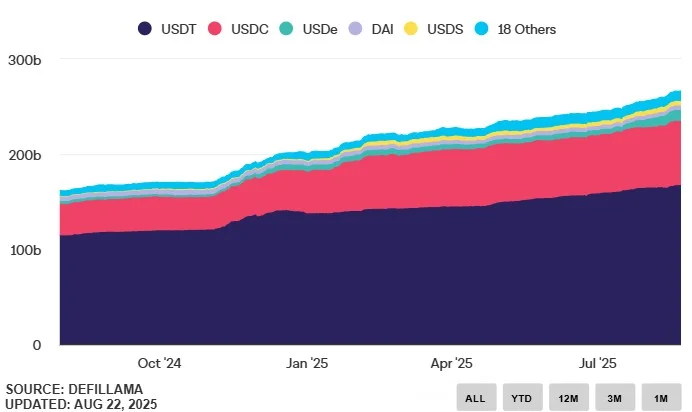

RLUSD's move into Japan coincides with significant global momentum in the stablecoin market. According to market data, the supply of USD-pegged stablecoins rose from $256 billion at the beginning of August to $266 billion by the end of the month. Experts expect the market to reach trillions of dollars in size in the coming years.

The GENIUS Act, passed in the US in 2025, established a new foundation of trust in the stablecoin ecosystem. Following this regulation, new projects, such as World Liberty Financial's USD1 token, listed on Coinbase, have seen rapid growth. Ripple's RLUSD stands out in this second wave of growth, particularly with its focus on institutional transactions and regulation.

Ripple transparently discloses its data by publishing monthly reports from independent auditors for RLUSD.

A Trust Test in Asia

RLUSD recently received approval from the Dubai Financial Services Authority and began its use as a payment instrument in the Dubai International Financial Centre. It also served as a significant boost to confidence by being selected for the Bullish Exchange's $1.15 billion IPO in the US.

RLUSD was first launched in December 2024. Backed 1:1 by the US dollar and short-term government bonds, the stablecoin is primarily used in corporate payments, international money transfers, and decentralized finance (DeFi) applications. Stablecoins are generally preferred in the crypto market to provide price stability, offer safe havens in trading pairs, and expedite cross-border transactions. Ripple's RLUSD aims to be a reliable alternative for both individual users and institutional investors in this area.