The Moscow Exchange (MOEX), Russia's largest stock exchange, has launched futures contracts for the iShares Bitcoin Trust ETF (IBIT) launched by BlackRock, which has attracted considerable interest. Announced on June 4, this new product is designed to be open only to qualified investors. MOEX also plans to introduce a qualification testing process for investors starting June 23.

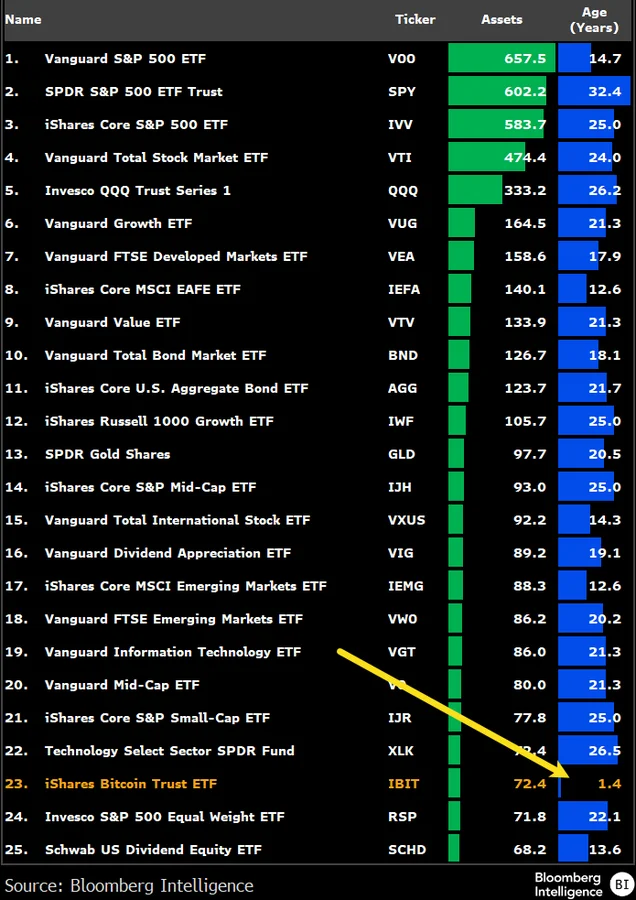

The move coincides with IBIT taking its place among the 25 largest ETFs globally. IBIT's assets under management (AUM) topped $72.4 billion, according to Eric Balchunas, senior ETF analyst at Bloomberg. Launched in January 2024, the fund has made waves in the ETF world, achieving this feat in just 1.4 years.

Demand for crypto products is growing in Russia

MOEX's introduction of the IBIT-based futures product is significant for crypto investment vehicles in Russia. In May, the Central Bank of Russia approved the use of crypto-linked securities and derivatives, limited to qualified investors only. Following this decision, actors such as Sberbank and T-Bank, one of the country's largest banks, started to offer financial products based on Bitcoin. Among the products offered by Sberbank are also structured bonds that track the Bitcoin price and the dollar-ruble exchange rate.

The newly launched futures are priced in US dollars but are exchanged for Russian rubles in cash. With the first maturity set for September 2025, these contracts are in line with MOEX's strategy to offer indirect investment opportunities in crypto. Similarly, the Saint Petersburg Stock Exchange has started testing cash-settled futures products, according to TASS.

Individual investors are not satisfied

Despite these developments, individual investors in Russia are expressing their dissatisfaction that the new products are aimed only at qualified investors. According to MOEX data as of May 2025, there are 36.9 million individual investor accounts on the exchange. Of these, only 315 thousand are qualified investors.

IBIT is making a name for itself with records

IBIT, BlackRock's Bitcoin ETF, continues to break historic records since its launch in January 2024. With nearly $15.5 billion in inflows in just three months, IBIT has become one of the ETFs with the longest fund inflow streak of all time. “It's like a baby hanging out with teenagers,” said Balchunas, Bloomberg's ETF expert.