The escalating geopolitical tension in the Middle East has caused a major shake-up in cryptocurrency markets. US President Donald Trump's declaration of the airstrikes on Iran's three nuclear facilities as "successful" and his statements that stronger retaliation would be carried out if necessary have caused panic among investors. These developments, which came after the clashes between Iran and Israel, have created anxiety in global markets. Cryptocurrency investors in particular have suffered heavy losses due to the sudden increase in volatility. This sharp decline became quite obvious on the evening of June 22. The market later recovered slightly.

Crypto market value fell to $3.1 trillion

In the shadow of these developments, the total value of the cryptocurrency market fell by 1.50 percent in the last 24 hours to $3.1 trillion. There was a significant increase of 26.23 percent in trading volume in the same period, and the total volume reached $136.38 billion.

The leading cryptocurrency, Bitcoin (BTC), fell 1.27 percent to $101,497. Ethereum (ETH) lost 1.99 percent to $2,241. XRP, on the other hand, is trading at $2.02, down 2.52 percent. While the level of fear in the market also increased, the Crypto Fear and Greed Index fell to 37.

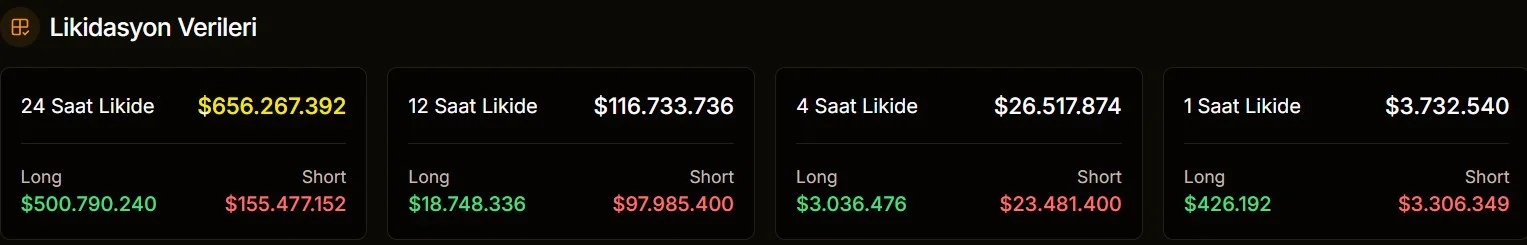

Liquidations reached $650 million: The bulls were trapped

Total crypto liquidations in the last 24 hours reached $650 million. While these liquidations affected more than 185 thousand investors, the majority of the positions (approximately $504.95 million) were long positions. In other words, while most investors had taken positions that prices would rise, these positions were closed at a loss with the sudden pullback in the market. The largest liquidation of the day was a long position of $35.45 million in the BTC-USDT pair on the HTX exchange.

When looking at liquidations in terms of exchanges, Bybit led the way with $252.46 million, followed by Binance ($137.57 million) and Gate.io ($96.57 million). More than 90 percent of liquidations on exchanges such as Bitmex, Bitfinex and CoinEx consisted of long positions. This reveals how dominant the upward expectations are in the market and how sharply these expectations were broken.

Losses deepened in altcoins

While Bitcoin's market dominance reached the highest level in recent cycles with 64.9 percent, the weakness in altcoins also became visible. Ethereum's market dominance fell to 8.7 percent. However, despite everything, some notable increases were also seen in the market. Story IP, which has a micro-market value, became the day’s top earner with a daily increase of 11.35 percent, followed by Four with 10.39 percent and Sonic with 7.68 percent.