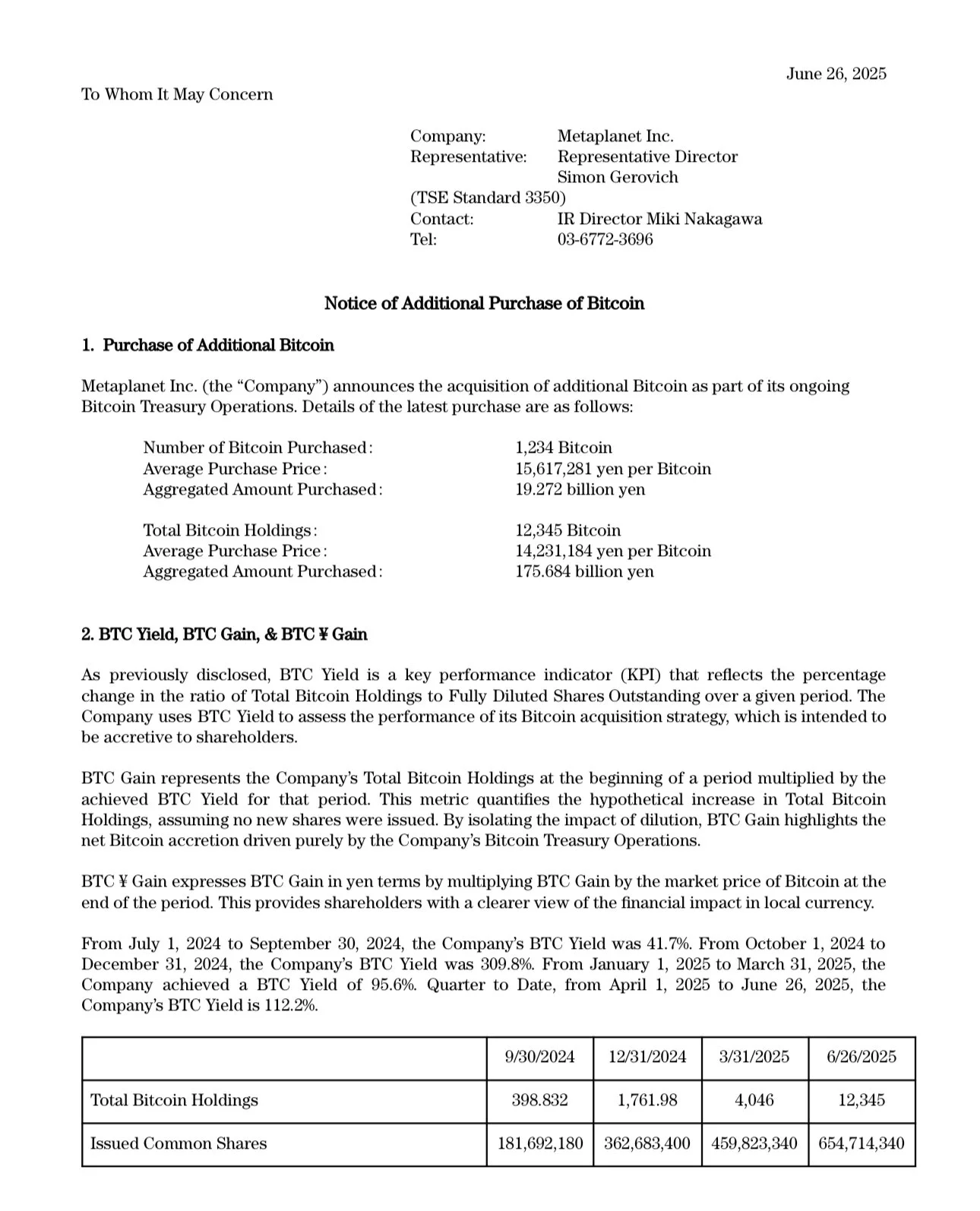

Japan-based investment company Metaplanet continues to make a name for itself in the cryptocurrency market. With its latest move, the company has purchased 1,234 more Bitcoins (BTC), leaving Elon Musk's Tesla behind in the institutional BTC ownership rankings. Following this purchase, Metaplanet's total BTC holdings reached 12,345, with an average purchase price of $98,303. The total value of these assets is around $1.3 billion at current prices.

Tesla is behind, the "big guys" are next

Tesla holds 11,509 BTC. With its latest purchase, Metaplanet has surpassed this figure, becoming the world's fifth-largest publicly traded institutional BTC holder. The company is currently ahead of only major crypto firms: Bitcoin mining giant Marathon Digital Holdings (MARA), Riot Platforms, Galaxy Digital, and Strategy (formerly MicroStrategy), which tops the list.

Strategy, led by founder Michael Saylor, is currently the clear leader with 592,345 BTC.

A huge $515 million capital raise

Metaplanet’s big purchase comes on the heels of a $515 million capital raise it announced the day before. The company said it used the capital as part of its “Bitcoin treasury building strategy.” The Tokyo Stock Exchange-listed firm reported that it issued new shares totaling 74.9 billion yen (about $515 million).

The move is part of Metaplanet’s “555 million plan,” which it calls its goal of 210,000 BTC, equivalent to 1 percent of the total Bitcoin supply. The firm plans to reach this ambitious goal by the end of 2027.

Market reaction mixed

Investor reaction was mixed. Despite the latest news of the purchase, Metaplanet shares were down 0.94 percent in Tokyo. The stock, which has lost 12.2 percent in the last five days, has shown an impressive increase of 353.5 percent since the beginning of the year.

This move by Metaplanet once again shows that institutional investors continue to be interested in Bitcoin. The institutional BTC reserve strategy pioneered by Michael Saylor is no longer limited to US-based technology companies; major players from Asia are also taking their place in this field.

Metaplanet's rapid growth may trigger more Japanese or Asian investment giants to create BTC portfolios in the coming period. The adoption of Bitcoin as a "store of value", especially in the face of rising inflation since 2024, makes this strategy even more attractive.