Japanese investment firm Metaplanet has reached a major milestone in its Bitcoin investments. The company announced that it has purchased an additional 1,112 Bitcoin, bringing its total BTC holdings to 10,000. With this move, Metaplanet has surpassed crypto exchange giant Coinbase to become one of the largest institutional Bitcoin holders.

Metaplanet has acquired an additional 117 million dollars worth of Bitcoin

Metaplanet CEO Simon Gerovich stated in a post on X (formerly Twitter) that the newly acquired 1,112 BTC cost a total of 117.2 million dollars, with an average purchase price of 105,435 dollars. With this latest purchase, the company has fully achieved its 2025 target of 10,000 BTC.

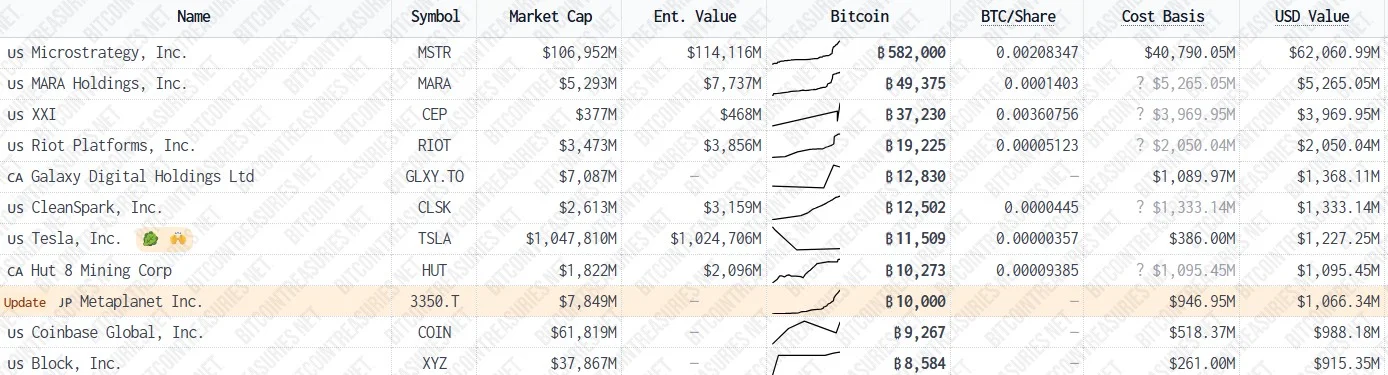

According to the data, Coinbase Global holds 9,267 BTC. Metaplanet's total BTC count reaching 10,000 has propelled the company ahead of Coinbase in this area. Metaplanet has demonstrated remarkable growth in a short period by aggressively continuing its Bitcoin purchase strategy, which it launched in April 2024.

$210 million bond announcement

The company did not limit itself to Bitcoin purchases, but also announced the issuance of $210 million in interest-free bonds. According to the company's statement, the proceeds from these bonds issued to the EVO Fund will be used entirely for new Bitcoin purchases. The maturity date of the bonds in question has been set for December 12, 2025.

Following these developments, Metaplanet shares experienced a rapid rise. The company's shares, which are traded on the Tokyo Stock Exchange, gained 17.23% in value on the day of the announcement, rising to 1,769 yen. Looking at the year-to-date performance, the increase in share prices has reached 408%. Some sources indicate that following these recent announcements, the share price rose by up to 22% during the day, reaching 1,830 yen.

A target of 100,000 BTC by 2026

Metaplanet's Bitcoin targets are not limited to this. The company plans to acquire 100,000 BTC by 2026 and 210,000 BTC by 2027. This equates to 1% of the total Bitcoin supply. To support this goal, the company also announced plans for a $5.4 billion share offering on June 6. Under this plan, 555 million new shares are expected to be issued over the next two years.

In light of these developments, Metaplanet is emerging as one of the most notable institutional Bitcoin investors. The company's total return on its BTC positions since the beginning of 2025 has exceeded 200%.

It is worth noting that neither Metaplanet nor any other company has come close to matching MicroStrategy's BTC holdings. MicroStrategy holds 582,000 BTC – the company began accumulating BTC in August 2020 and set an example for other companies.