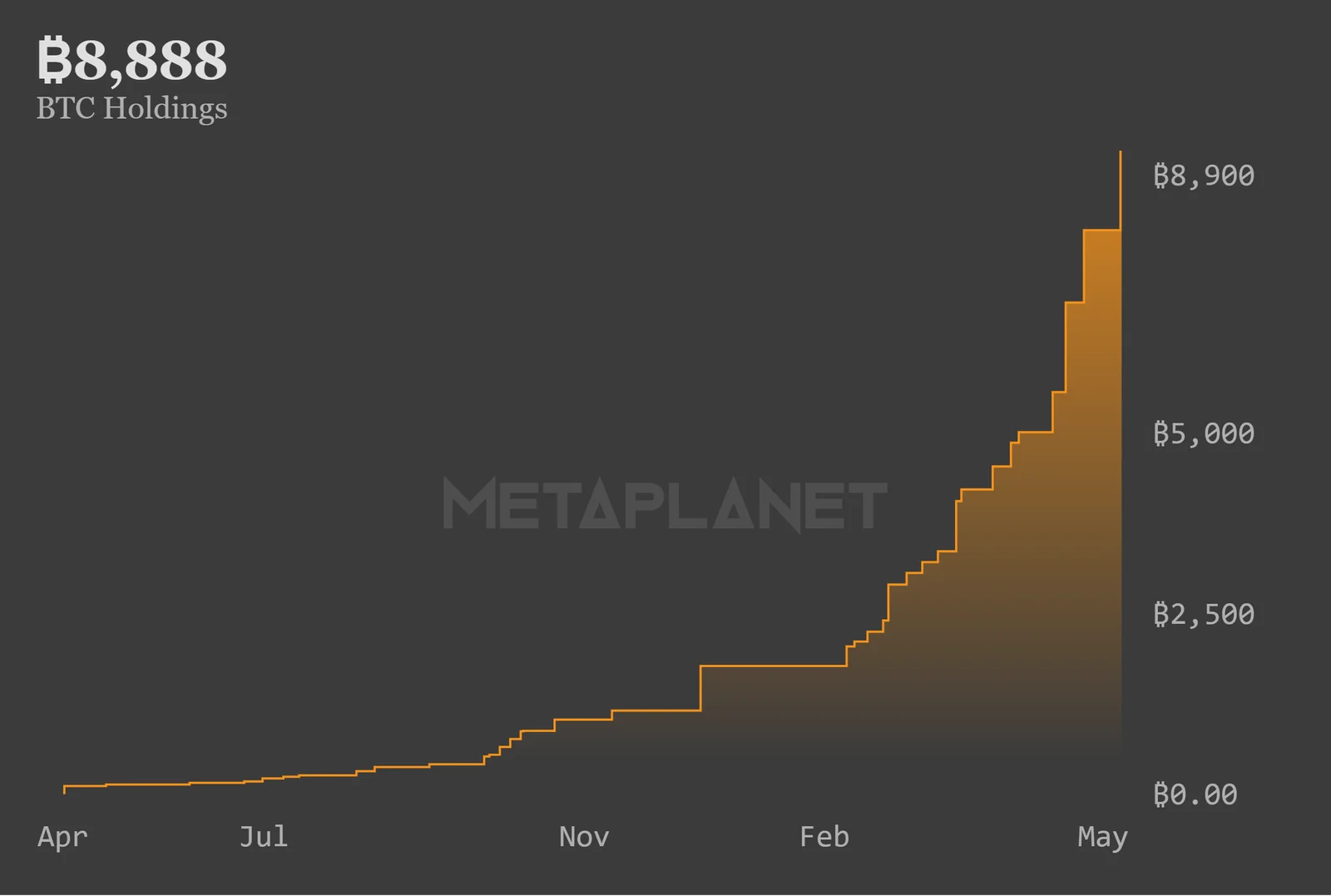

Japan-based company Metaplanet announced that it has purchased another 1,088 Bitcoin (BTC), bringing its total holdings to 8,888 BTC. That's why, now it ranks 10th among the largest publicly traded companies that bought Bitcoin. The company states that its year-end goal is to have 10,000 BTC in its corporate treasury.

Bitcoin purchase from Metaplanet: It now has 8,888 BTC

Metaplanet, which has recently made a name for itself with Bitcoin purchases, has again preferred the leading cryptocurrency. The Japan-based company added 1,088 BTC to its treasury earlier today. This now brings the company's total cryptocurrency holdings to 8,888 BTC, worth $930 million. The latest acquisition cost Metaplanet 16.885 billion yen. That is, Bitcoin was purchased at a price of 15.5 million yen per token.

10,000 BTC target by the end of the year

The latest surge in Metaplanet's purchases brings the company closer to its year-end goal of 10,000 BTC. The company accelerated its Bitcoin accumulation this year, acquiring 7,126 BTC before even reaching the first half of 2025. Apparently, it decided to buy in the early days of the second half of the year as well. However, the company may also be trying to capitalize on Bitcoin's price retreat by buying. After all, the largest cryptocurrency by market capitalization hit an all-time high of $111,800 last week. At the time of writing, it is trading at $105,180. On a daily basis, it retreated to 103,860 dollars. The pullback after the peak may have affected the Japanese company's buying strategy.

After first adopting the Bitcoin treasury strategy in April 2024, Metaplanet continued its cryptocurrency moves unabated. It quickly became Asia's largest public Bitcoin holder and among the top 10 global holders. However, US-based Strategy (formerly MicroStrategy) remains the world's largest BTC holder with 580,250 BTC.

Metaplanet's biggest inspiration: Strategy

Metaplanet CEO Simon Gerovich cited MicroStrategy's institutional Bitcoin strategy and the company's chairman Michael Saylor as the key inspiration for the company's adoption of Bitcoin as a treasury asset. Following the success of Strategy and Metaplanet, several other firms have joined the crypto treasure trove, including Twenty One, led by Jack Mallers.

The company's shares jumped

All these developments had a positive impact on Metaplanet shares. Metaplanet shares on the Tokyo Stock Exchange increased by more than 2 percent today. The company's stock had increased 20 times on an annual basis.