As cryptocurrency markets enter the final quarter of the year, Wall Street giant JPMorgan has released a striking report. The bank stated that Bitcoin is significantly undervalued compared to gold, setting an ambitious year-end price target of $165,000.

Bitcoin and gold comparison

US banking giant JPMorgan stated that Bitcoin is significantly "cheap" compared to gold, setting a year-end price target of $165,000. The bank's analysts highlighted the volatility-based valuation gap between Bitcoin and gold.

In their report, a team led by JPMorgan senior manager Nikolaos Panigirtzoglou highlighted that the Bitcoin-gold volatility ratio has fallen below 2. Accordingly, Bitcoin's risk capital consumption has fallen to 1.85 times that of gold. Analysts stated that Bitcoin's current market capitalization of $2.3 trillion would need to increase by approximately 42% to approach the $6 trillion level of private investment in gold. This theoretically points to a Bitcoin price of $165,000.

At the end of last year, the bank calculated that Bitcoin was $36,000 overvalued compared to gold, but now reports that it is $46,000 undervalued. This rapid change, according to analysts, indicates significant upside potential for Bitcoin.

The "Debasement Trade" Effect

A JPMorgan report stated that investors are increasingly turning to a strategy called "debasement trade." This concept describes a shift to alternative value-preserving instruments due to factors such as inflation, government debt, geopolitical risks, and a decline in confidence in fiat currencies. Significant increases in inflows into both gold and Bitcoin ETFs have been observed in the past year.

While spot Bitcoin ETFs saw strong demand, particularly in the first half of 2025, momentum slowed somewhat during the summer months. In contrast, inflows into gold ETFs accelerated, narrowing the gap between the two assets. JPMorgan noted that this process was driven primarily by the participation of individual investors, while institutional investors primarily held positions in CME futures.

Rising gold prices may be making Bitcoin more attractive

According to analysts, the recent surge in gold prices is making Bitcoin relatively more attractive. JPMorgan, which announced a year-end target of $126,000 in August, revised its new price target upwards for Bitcoin following the gold rally.

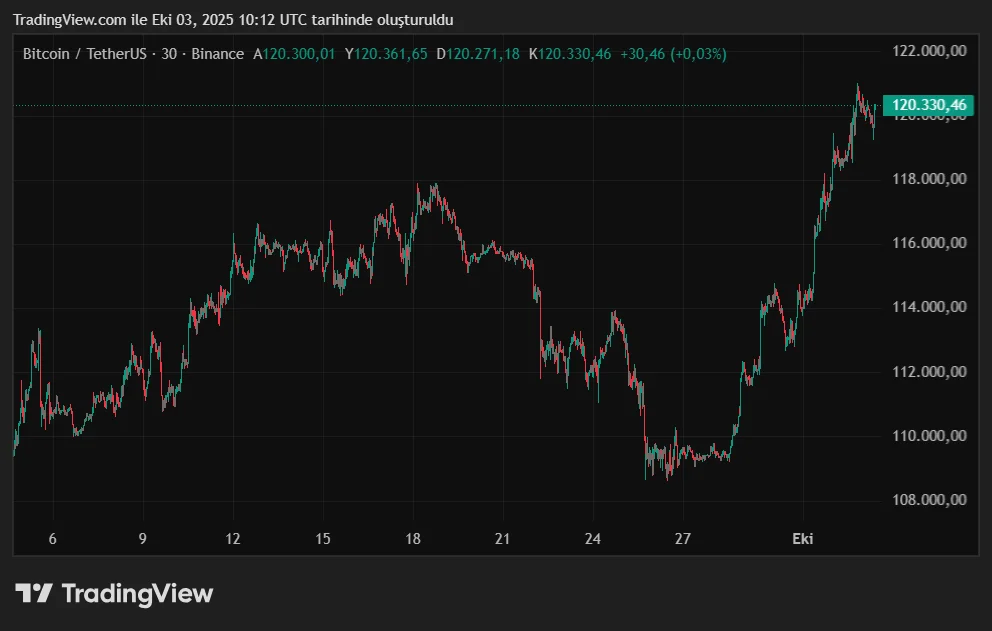

JPMorgan's forecast comes at a time of increasing bullish expectations in the market. In recent weeks, various analysts and financial institutions have begun talking about a $200,000 price target for Bitcoin. Currently trading around $119,000, Bitcoin's ability to reach $165,000 before the end of the year will depend on continued investor interest and a strengthening of the "debasement trading" trend.