The global cryptocurrency market is struggling to regain investor interest in mid-2025. Cryptocurrency investment products, which have been strengthening with consecutive inflows for the last seven weeks, closed last week positively. However, this recovery momentum seems to have slowed down due to the US Federal Reserve's upcoming monetary policy decisions. CoinShares' report dated June 9, 2025 reveals that investors are more cautious and carefully observing the risk-return balance. While investors remained cautious, the fact that Ethereum (ETH), the largest altcoin, attracted a lot of attention surprised those in the crypto space. Let's examine the details of the CoinShares report.

Cryptocurrency investment products attracted $224 million

Crypto asset investment products closed last week with a total inflow of 224 million dollars. Thus, the total inflow for the last seven weeks reached 11 billion dollars. However, uncertainty over the US Federal Reserve's (FED) interest rate policy and inflation signals led investors to maintain their cautious stance.

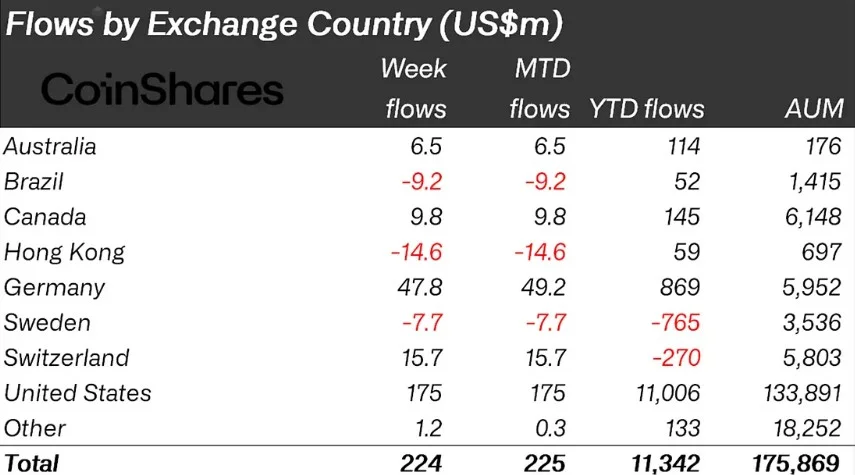

According to CoinShares' weekly report, the highest regional inflows came from the United States with $175 million. Germany ($47.8 million), Switzerland ($15.7 million), Canada ($9.8 million) and Australia ($6.5 million) also made positive contributions. On the other hand, there were outflows of $14.6 million from Hong Kong and $9.2 million from Brazil. Hong Kong, in particular, has fallen after previous record inflows.

Ethereum strengthens, Bitcoin declines

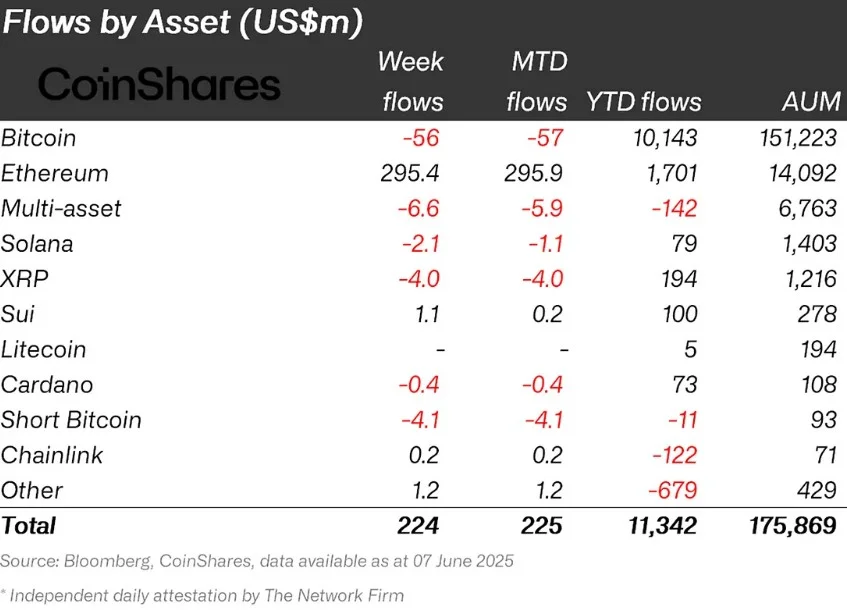

Ethereum was the most notable asset of the week. Inflows into Ethereum reached $295.4 million, making it a positive asset for the seventh consecutive week. Ethereum's share of total assets under management (AuM) rose to 10.5%. This performance marks the strongest investor interest since the US elections in November.

On the Bitcoin side, the outflow continued for a second week. BTC investment products saw outflows totaling $56 million. Similarly, there was an outflow of $4.1 million from short-Bitcoin products. This shows that investors' risk appetite remains weak.

Silence in altcoins

On the altcoin front, low-volume movements were generally observed. Sui received a slight inflow of $ 1.1 million; XRP 4 million dollars, Solana 2.1 million dollars and Cardano 0.4 million dollars worth of outflows. Chainlink closed the week with a limited inflow of $0.2 million. Multi-asset products also recorded outflows of $6.6 million. Litecoin and some smaller assets remained flat.

According to some, this picture suggests that Ethereum may further increase investor interest in the coming period. On the other hand, the inflows/outflows in Bitcoin funds seem to be waiting for clarity on the FED's policies.

In addition, the Consumer Price Index (CPI) and Producer Price Index (PPI) data for May in the US have the potential to determine the direction of the markets. In addition, important topics such as the spot Litecoin ETF application and the “Crypto Market Structure Bill” regarding crypto regulations are also on the radar of investors.