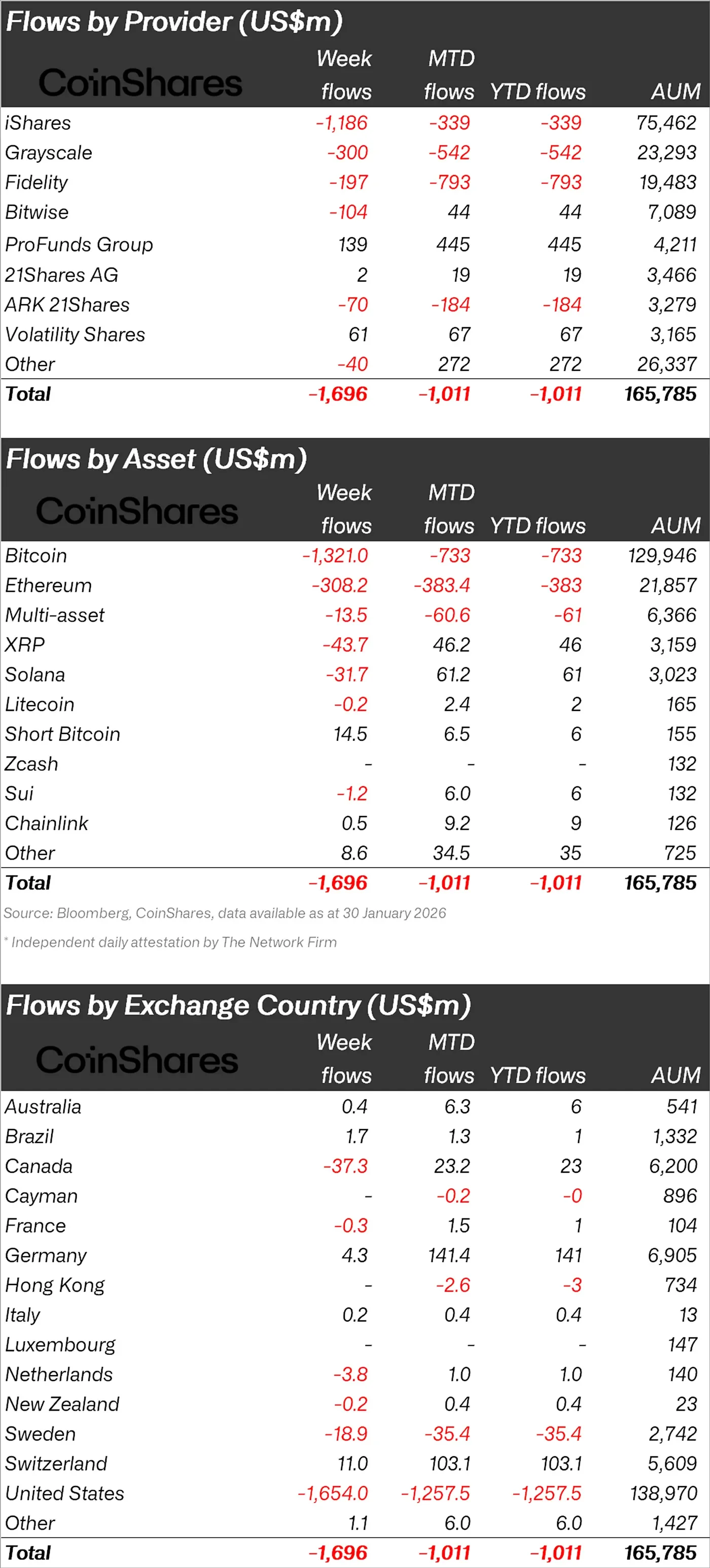

According to CoinShares' weekly report, investor appetite for global cryptocurrency investment products has weakened significantly. Outflows from crypto funds offered by major asset managers such as BlackRock, Grayscale, Fidelity, and Bitwise accelerated for the second consecutive week, with a total net outflow of $1.7 billion recorded last week. This has turned the cumulative flow negative since the beginning of the year, bringing the total outflow to $1 billion by 2026. The strong redemptions seen in the last two weeks have also dragged down total assets under management. According to CoinShares data, assets under management in cryptocurrency investment products have decreased by $73 billion since their peak in October 2025. CoinShares Research Director James Butterfill attributes this deterioration in investor sentiment to a combination of macroeconomic and intra-market factors. According to Butterfill, the appointment of a more hawkish Fed chairman in the US, the continuation of whale selling associated with the cryptocurrency's four-year cycle, and increasing geopolitical uncertainty are among the main factors suppressing risk appetite.

The center of outflows is the US, with the bulk of the burden on Bitcoin

The regional distribution shows that the selling pressure originated mainly from the US. Last week, $1.65 billion of the global total flowed out of US investment products. Canada and Sweden were also among the countries that recorded net outflows, with $37.3 million and $18.9 million respectively. In contrast, Switzerland ($11 million) and Germany ($4.3 million) were among the rare markets that recorded net inflows, albeit limited. Looking at it on an asset basis, the picture becomes even clearer. The majority of outflows were concentrated in Bitcoin products. Bitcoin-focused funds, especially led by BlackRock's IBIT product, saw a net redemption of $1.32 billion on a weekly basis. Ethereum products saw an outflow of $308 million.

The breakdown of altcoins in the table also shows that the selling pressure was not limited to majors. According to CoinShares data, last week there was a net outflow of $43.7 million from XRP products and $31.7 million from Solana products. While a $13.5 million pullback was observed in multi-asset products, it was noted that risk appetite for altcoin baskets weakened significantly. In contrast, some smaller-scale products experienced a limited positive divergence; Chainlink products recorded $0.5 million inflows, and the “Other” category saw $8.6 million inflows. Litecoin and Sui, however, did not show any significant directional movement on a weekly basis.

Some “niche” products stand out

Despite the negative picture, some products were exceptions. Short Bitcoin products attracted a net inflow of $14.5 million, reflecting investors' search for hedging against the decline. It is stated that the increase in assets under management in this segment has reached 8.1 percent since the beginning of the year. In addition, some thematic products classified as “Hype” by CoinShares also attracted attention with an inflow of $15.5 million. According to the report, this interest was supported by the increased on-chain activity towards tokenized precious metals. The sharp pullback on the price front makes the disruption in fund flows more understandable. In the last week, Bitcoin has lost approximately 12% of its value, while Ethereum has fallen by about 22%. In this environment of weak liquidity, investors' risk-averse movement towards cash is emerging as one of the key dynamics accelerating fund redemptions. The overall picture indicates a cautious stance prevailing in crypto investment products in the short term. CoinShares highlights that investor sentiment has been negatively impacted by macroeconomic uncertainties and market cycles, while noting that some products continue to attract interest, albeit in limited amounts.