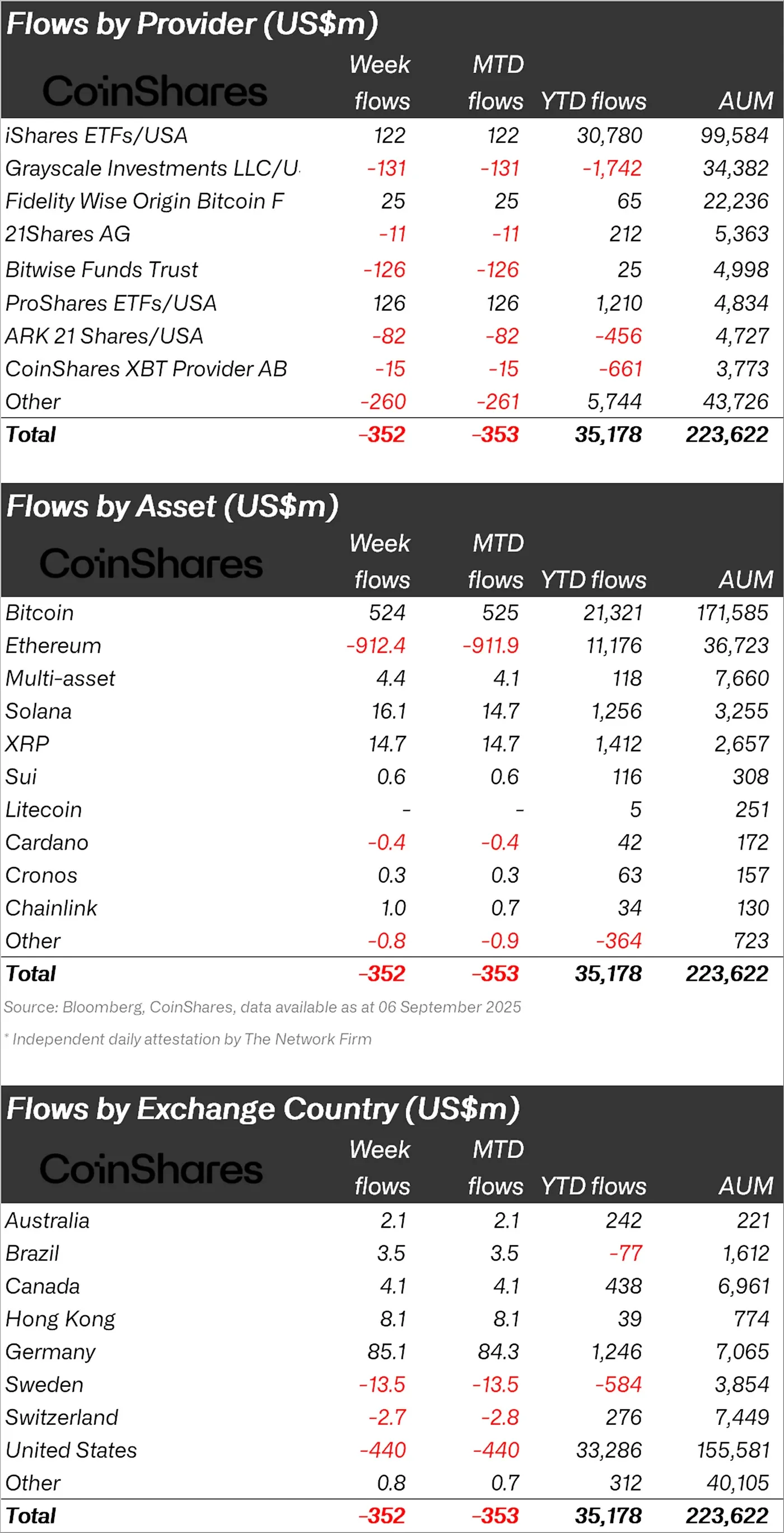

Global digital asset investment products experienced a total net outflow of $352 million last week. A report published by CoinShares reveals that investor appetite remained limited despite weak US employment data and interest rate cut expectations. Trading volumes also fell 27% compared to the previous week. Nevertheless, $35.2 billion in inflows were still expected for 2025, surpassing last year's total inflows by 4.2% on an annualized basis.

Regional Outlook: Outflow from the US, Strong Inflow from Germany

The regional distribution revealed the different trends of investors. US-based funds saw outflows of $440 million, while Germany recorded a strong inflow of $85 million. Hong Kong stood out with an inflow of $8.1 million. Other countries, such as Canada (+$4.1 million), Brazil (+$3.5 million), and Australia (+$2.1 million), also saw positive movements, albeit limited. However, outflows were seen in Sweden (-$13.5 million) and Switzerland (-$2.7 million).

Asset-based Flows: Bitcoin Positive, Ethereum Negative

According to weekly data:

- Bitcoin funds were the main source of investor interest with $524 million in inflows. Total inflows into Bitcoin products since the beginning of the year have reached $21.3 billion.

- Ethereum funds, however, were at the center of the outflows. Last week alone, $912 million in outflows were recorded. Outflows occurred every day for the last seven trading days. Nevertheless, a total of $11.1 billion in inflows since the beginning of the year has remained stable.

- Solana funds closed positive for the 21st consecutive week with $16.1 million in inflows. Total inflows since the beginning of the year reached $1.26 billion.

- XRP funds recorded $14.7 million in new inflows, reaching a total of $1.41 billion.

- Relatively small funds such as Sui, Chainlink, and Cronos also recorded modest positive flows, while the outflows for Cardano and Litecoin remained stable.

Company-based Flows: ProShares and iShares Lead

The difference between fund providers was also notable.

- ProShares and iShares stood out with inflows of $126 million and $122 million, respectively.

- Grayscale (-$131 million), Bitwise (-$126 million), and ARK 21Shares (-$82 million) experienced significant outflows.

- CoinShares XBT Provider products also saw outflows of $15 million.

Consequently, weekly outflows indicate a decrease in investors' short-term risk appetite. The sharp outflows in Ethereum, in particular, suggest that institutional investors are reassessing their expectations for this asset class. Conversely, Bitcoin's steady inflows confirm that the market continues to turn to BTC as a safe haven. The consecutive weeks of inflows from altcoin funds like Solana and XRP indicate that the market remains focused on diversification. In summary, although there has been a “cooling” in fund movements on a global scale, it is possible to say that institutional interest in crypto investment products remained high throughout the year.