According to a new report from CoinShares dated July 14, crypto asset investment products saw net inflows of $3.7 billion last week. This was the second-largest weekly inflow ever, and the total assets under management (AuM) for crypto assets broke a record, reaching $211 billion for the first time.

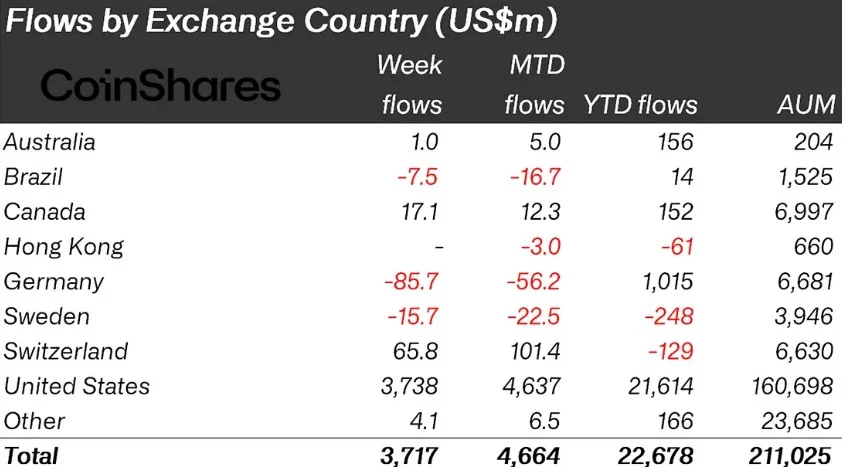

Strong regional inflows led by the US

The majority of weekly inflows came from the US, with $3.7 billion. Canada and Switzerland contributed more modestly at $17.1 million, and $65.8 million, respectively. However, Germany was notable with an outflow of $85.7 million. Sweden also saw an outflow of $15.7 million.

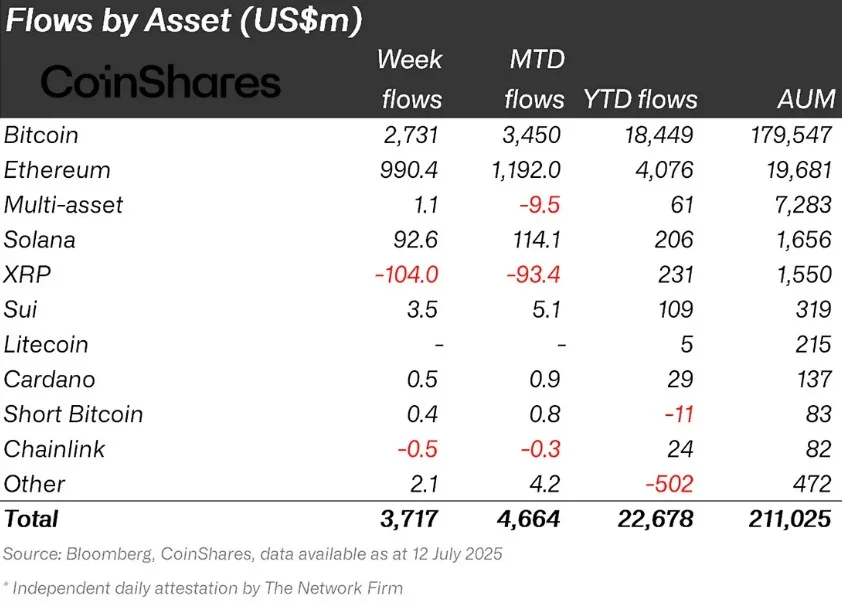

Bitcoin and Ethereum are favored by investors

Bitcoin was the most popular crypto asset last week, with $2.7 billion in inflows. This brings Bitcoin's total assets under management to $179.5 billion. This amount corresponds to 54% of the total assets held in gold ETPs and demonstrates the growing interest of institutional investors in Bitcoin.

Ethereum also remained on investors' radars. Recording positive flow for the 12th consecutive week, ETH achieved its fourth-highest weekly inflow in history with $990 million. Data from the last 12 weeks indicates that Ethereum received new inflows equal to 19.5% of its total AuM, while this rate remained at 9.8% for Bitcoin.

Altcoins are mixed: Solana rises, XRP suffers

The altcoin picture is mixed. Solana was the leading altcoin attracting investor attention with a strong weekly inflow of $92.6 million, while XRP was the biggest loser of the week with a $104 million outflow. XRP's outflow was one of the most notable figures.

The situation for other altcoins is as follows:

- Sui: Notable with a positive flow of $3.5 million. Litecoin and Cardano saw small inflows of $0.5 million and $0.9 million, respectively.

- Chainlink saw limited outflows of $0.5 million.

- Short Bitcoin: Interestingly, with inflows of $0.4 million, there was also limited demand for short positions.

- Multi-asset products experienced a weak inflow of $1.1 million.

- Other assets: Despite seeing inflows of $2.1 million, they still have over $500 million in outflows since the beginning of the year.

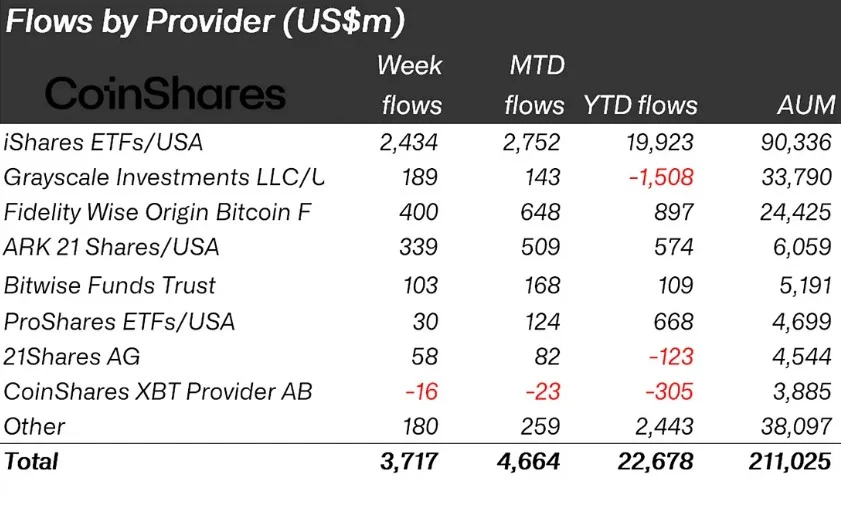

iShares and Fidelity Lead Among Fund Providers

By provider, iShares ETFs led the way with inflows of $2.43 billion. They were followed by Fidelity Wise Origin Bitcoin F with $400 million and the ARK 21 Shares ETF with $339 million. Meanwhile, Grayscale Investments saw weekly inflows of $143 million, but stood out with outflows exceeding $1.5 billion since the beginning of the year. CoinShares XBT Provider, on the other hand, diverged negatively this week with an outflow of $16 million.