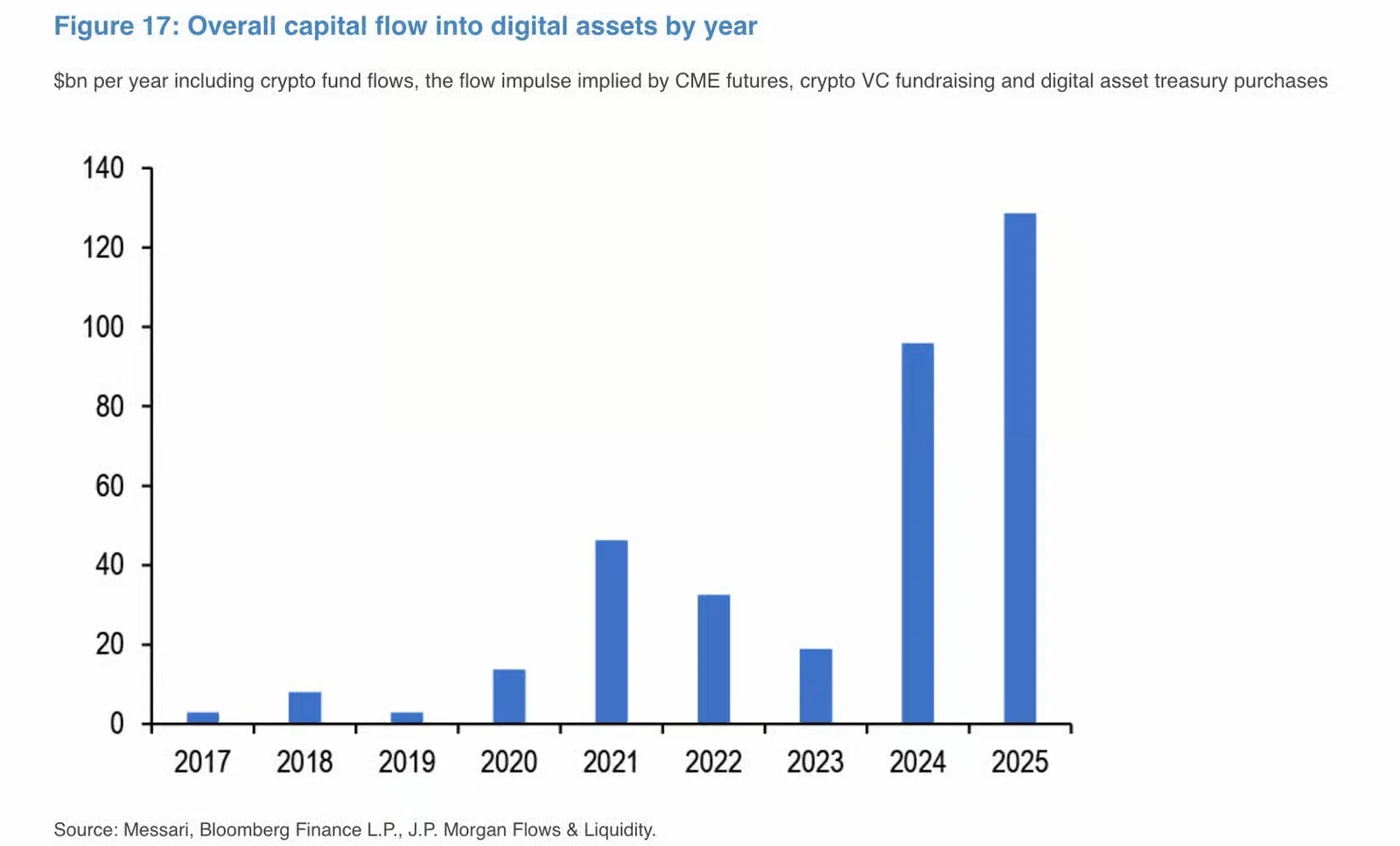

JPMorgan, one of Wall Street's largest banks, predicts that institutional interest in cryptocurrency markets will further strengthen in 2026. According to the bank's analysts, the record capital inflow, which reached almost $130 billion in 2025, will be predominantly supported by institutional investors in the coming period. JPMorgan emphasizes that this momentum will accelerate, especially with the effect of the clarifying regulatory framework in the US.

Institutional investors may be more decisive in the crypto market in 2026

According to the latest report published by JPMorgan, the total capital entering crypto markets increased by approximately one-third in 2025 compared to the previous year. This increase indicates that digital assets are now beginning to be seen not only as speculative tools but also as a permanent part of institutional portfolios. Bank analysts believe that this trend will continue in 2026 and even become more balanced. Nikolaos Panigirtzoglou, JPMorgan's Managing Director of Global Market Strategy and the lead author of the report, notes that the return of institutional investors has been facilitated, particularly by new regulations. Regulations such as the Clarity Act in the US, which aims to bring clearer rules to crypto assets, are said to reduce uncertainty surrounding digital assets. According to JPMorgan, these developments could stimulate not only direct investment appetite but also mergers and acquisitions, initial public offerings, and crypto-focused venture capital investments. The bank considers different channels together when calculating capital flows into crypto markets. These include inflows through exchange-traded funds (ETFs), signals from CME futures markets, crypto venture capital investments, and digital asset treasuries (DATs). This holistic approach more clearly reveals the sources from which capital flows are being fueled. A significant portion of the strong growth in 2025 stemmed from funds directed towards Bitcoin and Ethereum ETFs. JPMorgan analysts believe that these ETF inflows were largely driven by individual investors. In contrast, the picture is weaker on the futures front. Bitcoin and Ethereum futures have slowed significantly compared to 2024, indicating that hedge funds and large institutional players are acting cautiously.

Last year, more than half of total digital asset inflows, approximately $68 billion, were via DATs. While large players like Strategy had a significant share in these purchases, other companies also accumulated digital assets much more aggressively compared to 2024. However, most of these purchases were concentrated in the early months of the year; from October onwards, a noticeable slowdown in purchases by both large players like Strategy and BitMine was observed.

On the crypto venture capital side, the picture is more complex. While total investment volume increased slightly in 2025, the number of transactions decreased significantly. It is stated that investments are mostly directed towards advanced-stage projects, while early-stage startups are struggling to find funding. According to JPMorgan analysts, this slowdown in early-stage investments stems from capital shifting towards more liquid and short-term strategies despite improved regulatory conditions.

The bank predicts that capital inflows into crypto markets will continue to increase by 2026, but this time the leading role will be played by large institutional actors rather than individual investors or DATs. According to analysts, the risk-aversion process seen in the last quarter of 2025 among both individual and institutional investors is largely behind us. Signals of stability in ETF flows and other indicators are paving the way for a new institutional wave in crypto markets.