BitMine Immersion Technologies, the largest institutional buyer of leading altcoin Ethereum (ETH), announced its new acquisition. The company purchased $65 million worth of ETH for its Ethereum treasury. This marked the first purchase of September.

BitMine Continues Ethereum Acquisition

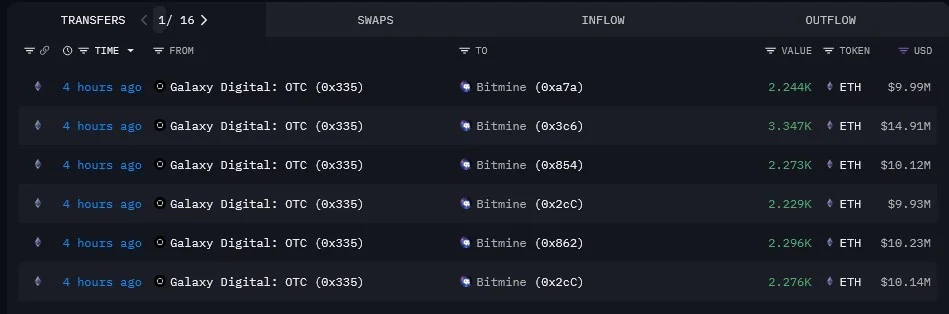

BitMine, which continued to add assets to its Ethereum treasury in September, completed this acquisition in six transactions. According to tracking data from Arkham Intelligence, these transactions were finalized through Galaxy Digital's over-the-counter services.

Other companies are also buying ETH

Crypto-focused consulting firm Etherealize announced that it has closed a new $40 million investment round as part of its efforts to introduce Ethereum to Wall Street.

The investment round was led by leading crypto venture capital firms such as Electric Capital and Paradigm. With this funding, Etherealize aims to develop tools and infrastructure to increase Ethereum's institutional adoption.

Founded in January with the support of the Ethereum Foundation and Ethereum co-founder Vitalik Buterin, the company argues that the financial world, in particular, is still insufficiently informed about ETH and blockchain technology. The company plans to provide training, consulting, and technical infrastructure solutions to address this gap. Danny Ryan, co-founder of Etherealize, stated that Ethereum has evolved from an experimental project into "the world's most tested open finance network" over the past decade. Ryan stated that with the funds they have raised, they will work to make the traditional financial system more secure and globally accessible.

Year-end ETH forecast: Is $6,000 possible?

Nick Forster, founder of crypto options platform Derive, argues that these developments could have a significant impact on the ETH price. According to Forster, if a rate cut is made in the near term and institutional buying continues, the probability of ETH reaching $6,000 by the end of the year could be as high as 44%.

Similarly, Tom Lee of Fundstrat argues that ETH could reach $60,000 in the long term. Lee believes that Ethereum's integration with institutional finance could be a significant turning point, similar to the economic transformation of 1971.