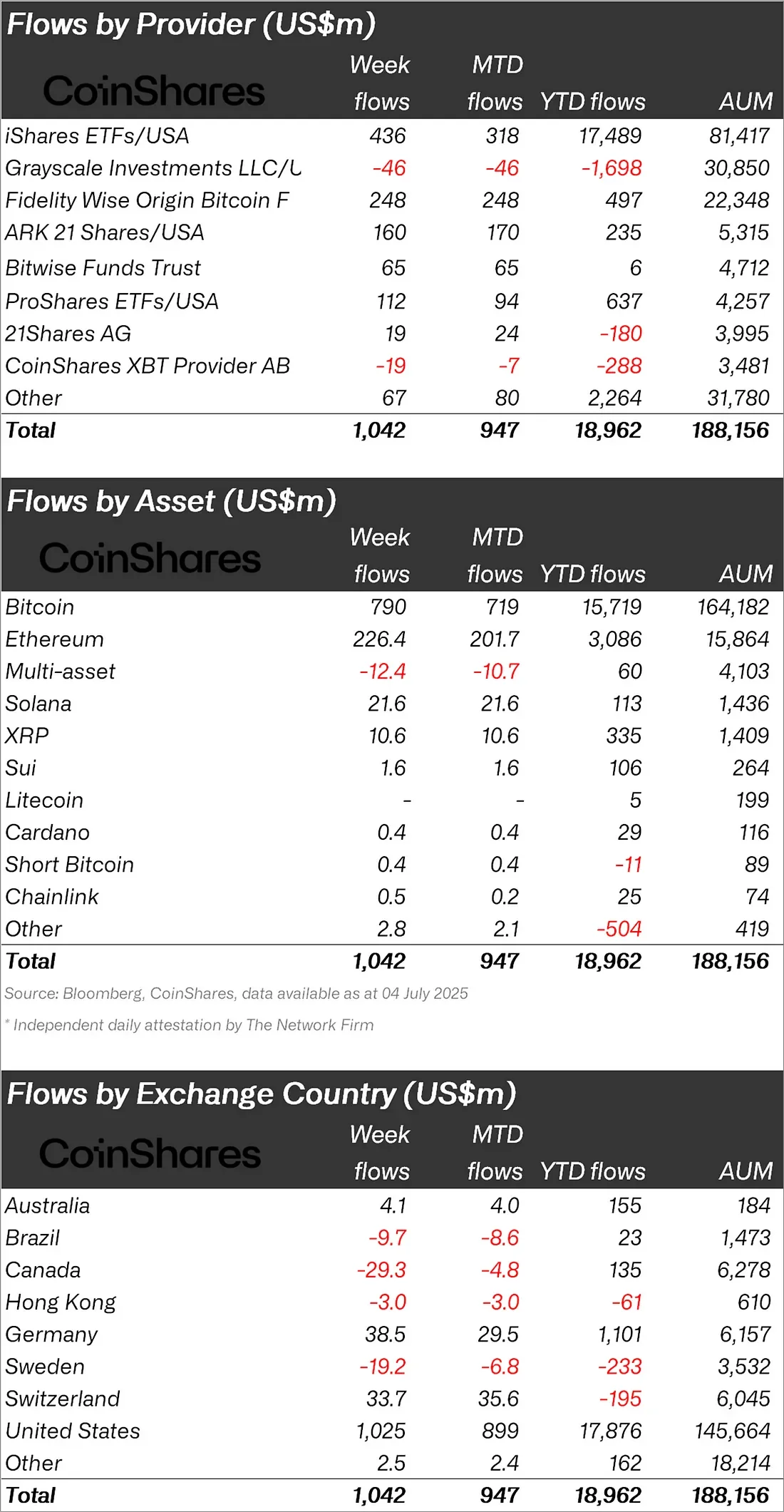

According to the latest report published by CoinShares, cryptocurrency investment products recorded a net inflow of $1.04 billion last week, completing the 12th consecutive week of positive growth. With this increase, the total amount of assets under management (AuM) in digital assets reached an all-time high of $188 billion. The weekly trading volume was recorded as $16.3 billion; this figure is very close to the weekly average for the entire year.

USA leads in regional distribution

When looking at the regional distribution of fund inflows, the US stands out by far with a contribution of $1.025 billion. Germany and Switzerland were the second and third countries in the ranking with $38.5 million and $33.7 million, respectively; Canada experienced an outflow of $29.3 million and $9.7 million, respectively. The outflows in Canada and Brazil in particular reveal differences in regional investor sentiment.

Bitcoin inflows slowed, ETH shines

Bitcoin-focused investment products saw an inflow of $790 million on a weekly basis. Although this figure is high, it indicates a slowdown when you consider that an average of $1.5 billion inflows have been recorded in the last three weeks. It is thought that investors are being cautious as Bitcoin approaches its historical peaks.

Ethereum, on the other hand, attracted attention with an inflow of $226 million. This means the 11th consecutive week of positive inflows for Ethereum. During this period, a total of nearly $3 billion inflows were recorded in Ethereum. More importantly, the average weekly inflow to Ethereum products during this period corresponds to 1.6% of AuM. This rate is twice as much as Bitcoin's 0.8% rate in the same period. In other words, we see that investors' interest in Ethereum is rapidly increasing.

Remarkable movement in altcoins

There were also notable developments on the altcoin side. Solana (SOL) stood out with a weekly inflow of $21.6 million. XRP recorded an inflow of $10.6 million; Sui recorded an inflow of $1.6 million. Other assets such as Chainlink ($0.5 million), Cardano ($0.4 million) also attracted investor attention. Litecoin did not record any inflows or outflows at the beginning of July.

In contrast, multi-asset products experienced a weekly outflow of $12.4 million, while products for some altcoins in the "other" category saw a limited inflow of $2.8 million. This category has experienced an outflow of $504 million since the beginning of the year.

Grayscale has an outflow

Grayscale closed the week with a negative outflow of $46 million. This situation is associated with the company's corporate restructuring and falling volumes since late 2024. In addition, as we reported recently, the U.S. Securities and Exchange Commission (SEC) first accepted and then suspended Grayscale's request to convert its Digital Large Cap fund, which includes many altcoins, into an ETF. CoinShares' own product, XBT Provider AB, also experienced an outflow of $19 million.