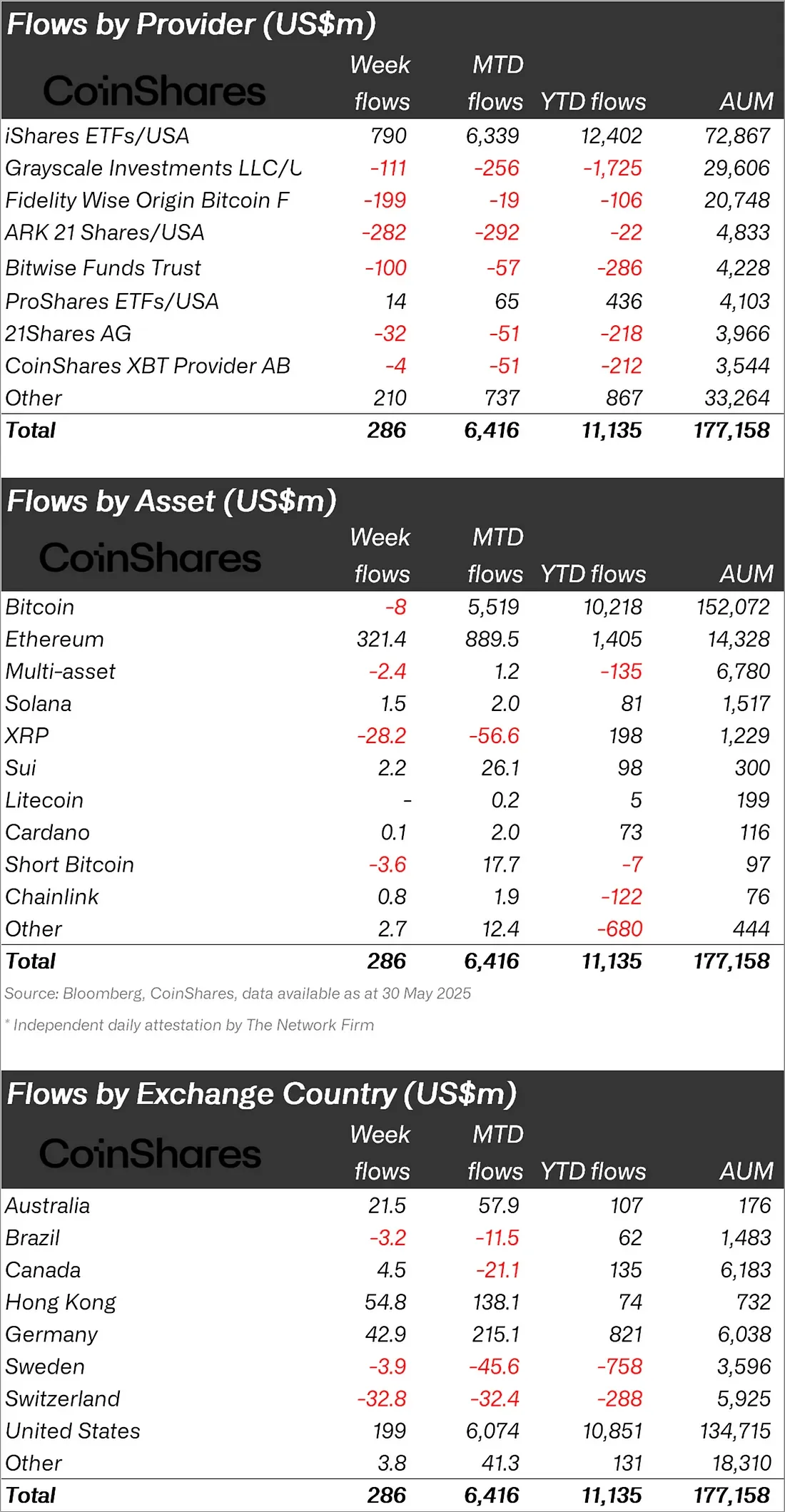

According to the latest “Digital Asset Fund Flows Weekly Report” published by CoinShares, cryptocurrency investment products saw new inflows of $286 million last week. This brings the total fund inflows for seven consecutive weeks to $11.1 billion. Ethereum, in particular, witnessed one of the largest fund inflows. However, despite the positive inflows, total assets under management (AUM) fell from $187 billion to $177 billion due to market volatility.

Bitcoin stalls as Ethereum rally continues

Ethereum led the way with weekly fund inflows of $321.4 million, totaling $1.19 billion over the last six-week period. This performance marks the strongest institutional interest since December 2024. Ethereum's total fund inflows since the beginning of the year have reached $ 1.4 billion.

On Bitcoin's side, inflows, which started strong at the beginning of the week, were reversed by the uncertainty after a US court declared import tariffs illegal. As a result, it closed the week with an outflow of $8 million. This was the first weekly outflow after six weeks of strong inflows of $9.6 billion. Bitcoin's total fund inflow since the beginning of 2025 still stands at $10.2 billion.

Other altcoins have mixed signals

According to the details of the report, Ethereum as well as several altcoins continued to attract investor interest. Sui, while positively differentiating with a weekly inflow of $ 2.2 million, has reached a net inflow of $ 98 million since the beginning of the year. Solana also closed the week with inflows of $1.5 million, maintaining its year-to-date inflow level of $81 million.

However, outflows continued in some altcoins. XRP experienced outflows for the second week in a row, recording a negative flow of $28.2 million. Across 2025, it still has a net inflow of $198 million. Coins such as Litecoin ($200K), Cardano ($100K) and Chainlink ($800K) saw low levels of fund inflows. Chainlink, however, stands out with an outflow of $122 million for the year.

Multi-asset products saw outflows of $2.4 million and Short Bitcoin products saw outflows of $3.6 million. The outflow observed especially in “Short Bitcoin” positions may indicate that short-term bearish expectations in the market are weakening.

The US maintains its leadership

Looking at the regional breakdown, the US was by far the leader with a weekly inflow of 199 million dollars. The US, whose total fund inflows have reached USD 10.8 billion since the beginning of the year, was followed by two noteworthy Asian countries. Hong Kong displayed the strongest weekly performance in this area with a fund inflow of 54.8 million dollars last week. Germany and Australia entered the list with inflows of $42.9 million and $21.5 million, respectively.

In contrast, Switzerland experienced the largest regional outflow of funds with a weekly outflow of $ 32.8 million. Switzerland stands out with a total outflow of 288 million dollars since the beginning of the year. Sweden ($3.9 million), Brazil ($3.2 million) and Canada ($21.1 million) were among the other countries that experienced outflows.