Metaplanet, a Japan-based Bitcoin treasury, kicked off the week with a major acquisition. The company announced the purchase of 5,419 Bitcoins. This investment, worth approximately $632.5 million, was the company's largest single-use BTC purchase to date. The transaction was completed at an average price of $116,724.

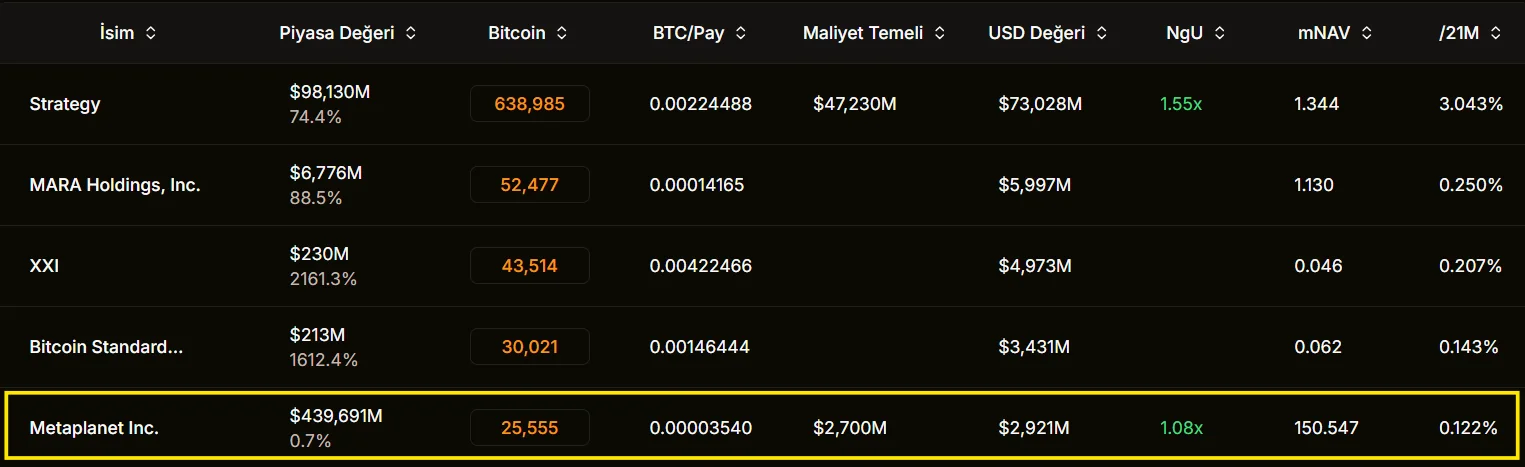

Metaplanet CEO Simon Gerovich stated in a statement on X on Monday, "As of September 22, 2025, we held a total of 25,555 BTC. We acquired these assets at an average price of $106,065, for a total of $2.71 billion." With this latest move, the company surpassed Bullish to become the fifth-largest Bitcoin holder among publicly traded companies. Strategy, managed by Michael Saylor, maintains its leadership with 638,985 BTC. Its ranking among Bitcoin treasury companies is as follows:

Metaplanet's Bitcoin-focused strategy is becoming increasingly aggressive. Having held only 4,525 BTC until mid-year, the company quickly expanded its portfolio, becoming one of the largest institutional buyers. Having reached its target of 10,000 BTC in June, Metaplanet has set new targets, exceeding its 21,000 BTC plan announced for 2026. Under its "555 Million Plan," it aims to raise $5.4 billion to acquire 210,000 BTC by 2027.

To finance this growth plan, the company raised $1.4 billion by issuing 385 million new shares earlier this month. The funds were directed directly to Bitcoin purchases. Last week, the establishment of a new subsidiary, Metaplanet Income Corp., in the US was approved. This new structure will focus on Bitcoin derivatives and income-generating products.

Metaplanet shares are declining

On the market front, however, the picture was different. Metaplanet shares have been volatile over the past day. Opening the week at around $4.30, the stock closed around $3.90. This represents a decline of approximately 3% in single-day performance. The volatility in the Bitcoin price and the company's new acquisitions, in particular, created significant intraday activity.

The weekly outlook is somewhat more moderate. While the share price fluctuated within a narrow range over the past week, it saw a roughly 1% increase compared to the beginning of the week. This rise suggests that the company's aggressive Bitcoin strategy is maintaining investor interest in the short term.

A more steep decline is evident in the monthly performance. Metaplanet shares have lost approximately 27% of their value over the past month. This decline is due to the dilution effect created by the company's capital increase by issuing 385 million new shares and a shift in investor risk perception. The correction in the Bitcoin price also added to this pressure.

The Bitcoin price also fluctuated on the same day. BTC, which has fallen more than 1 percent in the last 24 hours, traded at $112,949. According to experts, Metaplanet's aggressive strategy, which has earned it the nickname "Asia's Strategy," is also increasing the influence of corporate treasuries on Bitcoin.