The release of the US Consumer Price Index (CPI) data generated excitement in the crypto market. While the Fed is expected to cut interest rates by 50 basis points next week, Bitcoin (BTC) and leading altcoins saw significant gains.

CPI data met expectations

The US CPI came in at 2.9% year-over-year. This rate was fully in line with market expectations and exceeded the previous month's 2.7%. Monthly inflation increased by 0.4%, slightly above the expected 0.3%. The core CPI remained stable at 3.1% year-over-year, while the monthly data came in at 0.3%.

The fact that the inflation data were generally in line with forecasts strengthened the possibility of a rate cut at the Fed's September meeting. Markets had been pricing in a 50 basis point cut for a long time. The released figures supported this expectation.

Bitcoin nears $114,000

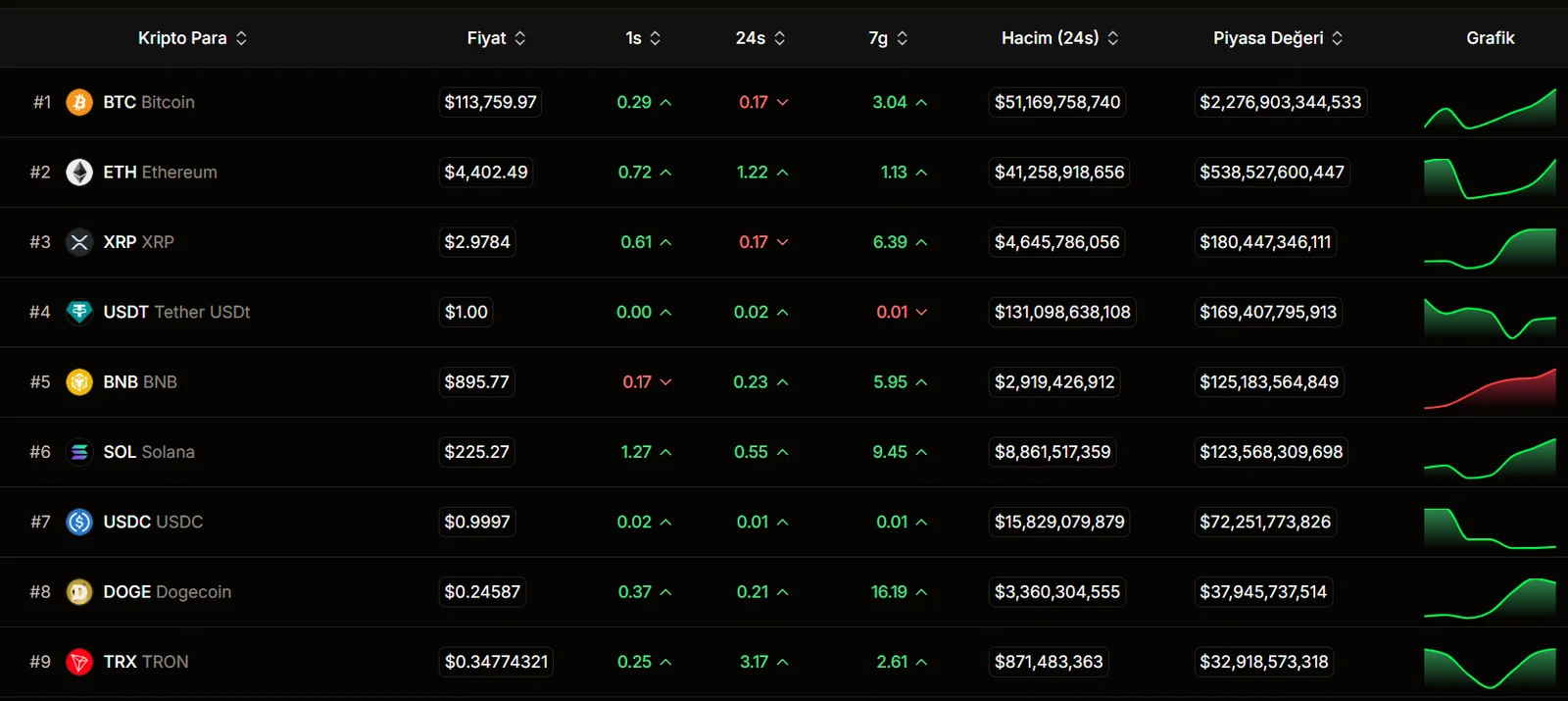

Leading cryptocurrency Bitcoin reached $113,759 following the data release. While there was a limited pullback of 0.17% in the last 24 hours, it increased by over 3% on a weekly basis. Trading volume exceeding $51 billion demonstrates continued investor interest.

Ethereum (ETH) rose to $4,402, registering a 1.22% daily and 1.13% weekly increase. Ethereum's market capitalization exceeds $538 billion, and expectations of strong institutional demand continue to support the price.

Rapid movements in altcoins

XRP traded at $2.97, once again approaching the psychological $3 resistance level. With over 6% weekly gains, XRP attracted investor attention.

Solana (SOL) reached $225, up 0.55% in the last 24 hours and 9.45% weekly. Solana's strong ecosystem data and growing developer interest are supporting its price performance.

Dogecoin (DOGE) was one of the stars of the week. With a weekly gain exceeding 16%, DOGE rose to $0.24, solidifying its leadership in the memecoin market by surpassing $37 billion in market capitalization.

TRON (TRX) also saw strong momentum, posting a daily gain of over 3% and reaching $0.34.

Investors await the Fed's decision

All eyes in the crypto market are now on the Fed's interest rate decision next week. A 50 basis point cut could increase capital inflows into risky assets. The recent recovery in Bitcoin and altcoins suggests this expectation is already factored in.

If the Fed does not surprise the markets and lowers interest rates as expected, a new wave of upward movement in crypto assets is expected. However, the fact that inflation data exceeded expectations on a monthly basis also reminds us of the need for caution before any decision.