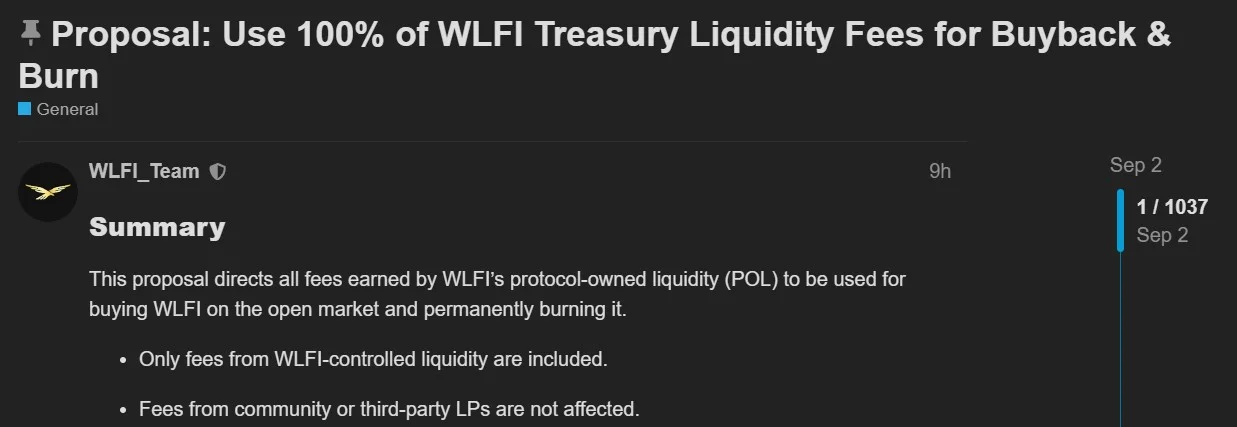

World Liberty Financial (WLFI), a globally recognized DeFi company, has presented a significant proposal aimed at making its ecosystem more attractive to long-term investors. According to the company's new plan, WLFI tokens will be repurchased from the market and permanently burned using all fees earned from liquidity positions held by the protocol.

Aimed to incentivize long-term investors

The proposal emphasized that the program "removes from circulation tokens held by investors who are not committed to WLFI's long-term growth, thereby increasing the relative weight of long-term supporters." The goal is to weed out short-term speculators and place investors who trust the project in a stronger position.

Under the plan, WLFI will be burned from the market using fees generated from the protocol's liquidity pools on the Ethereum, Binance Smart Chain, and Solana networks. The collected tokens will then be sent to a special address called a "burn address" and removed from circulation. However, fees from the community or third-party liquidity providers will not be included in this program.

How will the voting process proceed?

The World Liberty Financial team announced that all burn transactions will be recorded on-chain and transparently shared with the community. Community members are also being presented with a three-option vote:

Divert all protocol revenue to a buyback and burn program,

Continue to retain revenue in the treasury, or

Remain neutral.

The voting and implementation schedule has not yet been announced, but initial reactions appear largely positive. If the plan is approved, the company plans to expand the program to include additional revenue sources in the future.

WLFI Price Drops

World Liberty Financial's native token, WLFI, began trading on major exchanges recently. Launching at $0.32, the token quickly fell 34% to $0.21. As of this writing, the price is hovering around $0.24.

Despite this, the token's trading volume has reached remarkable levels. According to market data, WLFI's trading volume has surpassed $2.5 billion on major exchanges like Binance, Coinbase, and Upbit. Currently, 27.35 billion units of the token, with a total supply of 100 billion, are in circulation.

An interesting detail is that pre-sale investors are still making significant profits. These investors purchased the token for just $0.015. For example, according to blockchain analysis firm Bubblemaps, Tron founder Justin Sun's WLFI holdings have still increased in value by approximately tenfold.

World Liberty Financial, founded in 2024, stands out for both its DeFi solutions and stablecoin initiatives. Publicly supported by US President Donald Trump and his family, the company quickly garnered significant attention. USD1, the dollar-backed stablecoin the company launched, is currently the sixth-largest stablecoin with a market capitalization of $2.6 billion.