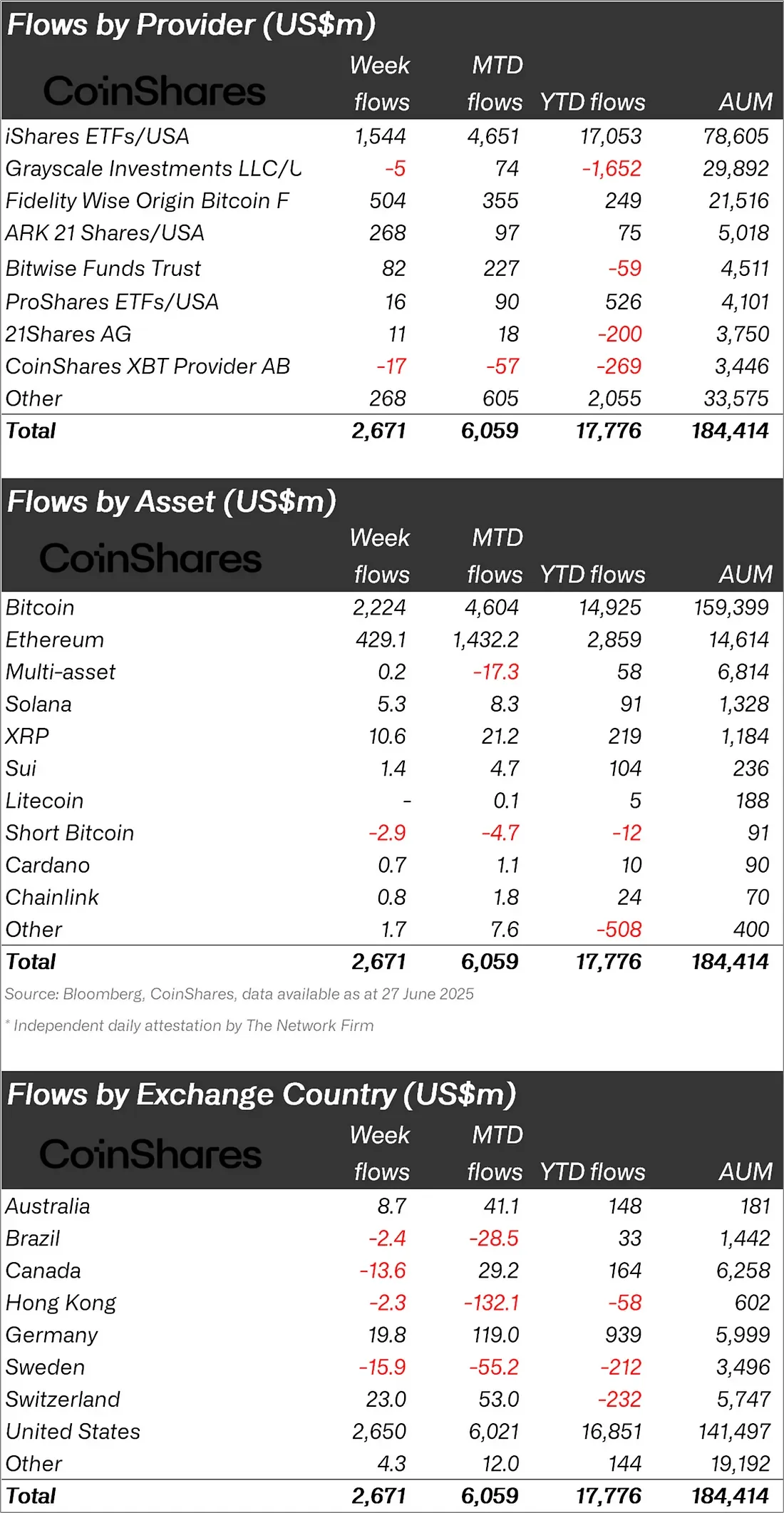

According to CoinShares' latest weekly report, institutional interest in digital asset investment products continues to grow. During the week spanning June 21 to June 27, a total of $2.67 billion in net inflows were recorded for these products. This marks the 11th consecutive week of inflows. The total inflow for the first half of the year reached $17.8 billion, coming very close to the same period last year.

The report notes that this strong performance is driven by macro factors such as geopolitical uncertainties and the lack of clarity regarding central banks' monetary policies. In particular, the massive inflow of 2.65 billion dollars from the US stands out, accounting for nearly the entire weekly total. While inflows of $19.8 million and $23 million were recorded from countries such as Germany and Switzerland, respectively, small outflows were observed in markets such as Canada (-$13.6 million), Hong Kong (-$2.3 million), and Brazil (-$2.4 million).

Bitcoin and Ethereum are the focus of investments

83% of the weekly total inflows were directed toward Bitcoin (BTC). There was an inflow of $2.224 billion into BTC investment products alone, reaching $14.9 billion in the first half of the year. In contrast, there was an outflow of $2.9 million from “Short Bitcoin” products that invest in Bitcoin's decline, reaching a total outflow of $12 million since the beginning of the year. This indicates a generally positive mood in the market.

Ethereum (ETH) ranked second with a weekly inflow of $429.1 million. Total inflows into ETH products since the beginning of the year have reached $2.86 billion.

Altcoin front is mixed

There is no clear trend on the altcoin front. XRP stood out with a weekly inflow of $10.6 million and a monthly inflow of $21.2 million, attracting a total of $219 million in investments since the beginning of the year. Sui (SUI) was another altcoin that attracted attention with a weekly inflow of $1.4 million and a total inflow of $104 million throughout the year.

Solana (SOL) closed the week with $5.3 million in inflows, but total investment for the year remained at $91 million. Chainlink (LINK) contributed $0.8 million to investment products, while Cardano (ADA) contributed $0.7 million.

However, outflows were observed in some altcoins and product groups. A monthly outflow of $17.3 million from multi-asset funds was notable. Similarly, Litecoin (LTC) products ended the week with zero flows, while only receiving $5 million in inflows for the year. Despite a $1.7 million inflow this week from products in the “other” category, there was a total outflow of $508 million for the year.

Institutional demand continues

Another notable data point in the report was provider-based flows. iShares/USA maintained its leadership with a massive weekly inflow of 1.544 billion dollars and a total of 17 billion dollars for the year. Grayscale, on the other hand, saw a weekly outflow of 5 million dollars and has experienced a total investment loss of 1.65 billion dollars since the beginning of the year. CoinShares XBT Provider also saw an outflow of $17 million this week and $269 million year-to-date.

In short, institutional investors' interest in crypto assets is concentrated particularly on Bitcoin and Ethereum. In altcoins, investors are cautious, but there is selective interest in some projects.