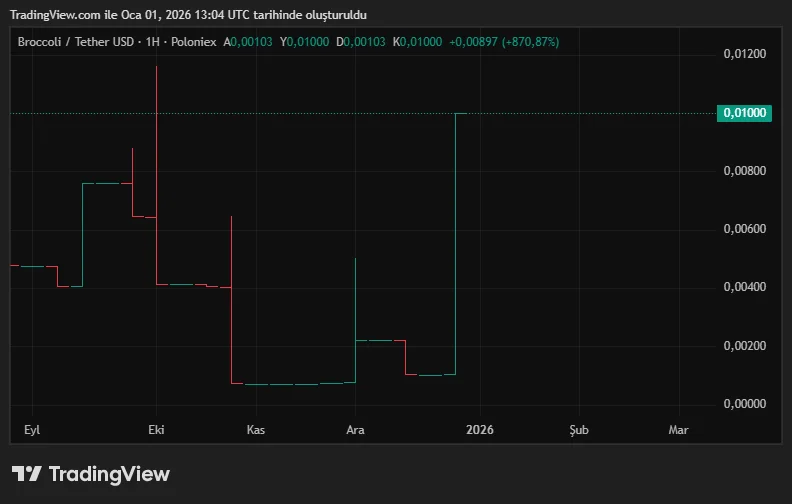

The crypto market entered 2026 with an extraordinary price movement. BROCCOLI(714), a meme coin on BNB Chain named after CZ's dog, caused a stir in the market by experiencing a surge exceeding 1,200% in a short period. While initially appearing as a sudden rally, this movement later raised suspicions of possible market manipulation and hacking. The events saw both high gains and significant losses. According to data, BROCCOLI(714) rose from approximately $0.012 to $0.16 in just a few hours. Along with this sharp price increase, trading volume exploded. Normally having very limited liquidity, the token's volume increased by nearly 4,800%, exceeding $500 million. This magnitude is considered extremely unusual for a small-scale meme coin. According to information shared by the on-chain analytics platform Lookonchain, the price movement in question was centered on unusual transactions in a market maker account allegedly linked to Binance. Allegedly, aggressive purchases were made in the spot market through this account. Because the token has low liquidity, even relatively limited capital had a significant impact on the price, creating a sharp upward momentum.

According to the possible scenario, the spot market purchases were simultaneously supported by long positions opened in the futures market. Thus, while the price was rapidly pushed up, it was claimed that funds were circulated between different accounts. Large buy orders appearing in the order book also attracted the attention of market participants. The fact that the futures price rose more limitedly compared to the spot market strengthened suspicions of manipulation.

Not everyone lost in this chaotic environment. A trader using the pseudonym Vida took action thanks to automated alarm systems that noticed a rise of over 30% in BROCCOLI (714) in less than 30 minutes. Vida, noting that intense buying pressure on a small token doesn't seem normal, entered the position early and proceeded cautiously throughout the rise. With the sudden withdrawal of large buy orders, Vida closed his position and reversed course, profiting from the subsequent decline. Allegedly, the trader made a profit of approximately $1 million from this process.

Eyes on Binance

Following these events, attention turned to Binance, one of the world's largest cryptocurrency exchanges. In an official statement on January 1st, it was stated that they were aware of the extreme volatility seen in the BROCCOLI714 price and that the situation was being investigated as part of a comprehensive internal investigation. Binance stated that initial system checks showed that risk management and security mechanisms were functioning normally and that no concrete evidence of a cyberattack or hacking attempt was found. Exchange officials also emphasized that they had not received any notification regarding account takeover through customer service channels or communication lines specifically for large accounts. The statement said that in order to clarify the reason for the price movements, the order book, transaction history and liquidity data of the BROCCOLI714 pair were analyzed in detail. It was stated that the examination covered not only technical elements but also possible market manipulation and unusual trading behavior. Following all these developments, the BROCCOLI(714) price quickly retreated to around $0.01.