Crypto asset management company Bitwise is expanding its reach in the altcoin-focused ETF space with new applications to the US Securities and Exchange Commission (SEC). The company has formally applied for a total of 11 “crypto strategy ETFs,” each focusing on a single crypto asset. This move demonstrates Bitwise’s goal of offering investors a broader altcoin universe through regulated investment vehicles, going beyond its existing products based on major assets like Bitcoin and Ethereum. According to the application documents, these ETFs have a different structure than classic spot ETFs. Bitwise describes these products as “Strategy ETFs.” Accordingly, each fund will be able to invest directly in the relevant crypto asset, as well as take positions in exchange-traded products (ETPs) and, if necessary, derivative instruments that reference that asset. The plan is for up to 60% of the funds’ portfolios to be directly invested in the relevant token, with at least 40% structured in securities or financial instruments that track that asset.

Which altcoins are on the agenda?

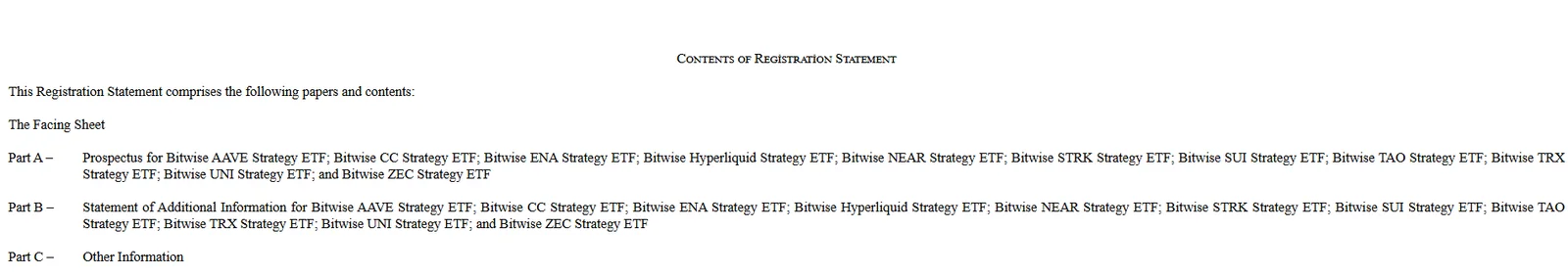

The targeted asset list is quite broad. The application includes prominent projects such as Aave, Uniswap, Zcash, Bittensor, Sui, and NEAR, as well as tokens from different ecosystems like Ethena, Hyperliquid, Starknet, Tron, and Canton. This means that decentralized finance, AI-themed blockchain projects, privacy-focused networks, and layer-1 platforms can be individually opened to investors under the ETF umbrella. Until now, these areas have mostly been accessible through crypto exchanges; Bitwise's proposal aims to bring these assets to the traditional market infrastructure. Bitwise's current product line already holds a significant place in the US market. The company offers spot Bitcoin and Ethereum ETFs, as well as a Solana staking-focused ETF and XRP-based products. In addition, its portfolio includes equity ETFs covering publicly traded companies in the crypto sector, multi-asset index products, and strategies based on CME futures. The newly submitted single-token strategy ETF applications stand out from these products in terms of risk profile, as each focuses solely on a single crypto asset. This initiative is also considered part of a general wave of ETF applications in the market. In recent months, various issuers have taken steps towards spot or thematic ETFs based on altcoins such as Solana, XRP, Dogecoin, and Avalanche. Grayscale's application to transform its Bittensor trust into a spot ETF is another example of this trend. Bitwise's approach, however, is noteworthy for presenting a holistic series of 11 funds with a common strategy template, rather than individual applications. Despite market fluctuations, long-term optimism is maintained on the Bitwise front. Matt Hougan, commenting on the company's investment perspective, argues that Bitcoin could break away from its traditional four-year cycle and reach new highs in 2026. According to Hougan, interest rate cuts, regulatory clarity, and increased institutional demand are among the main factors supporting this process.