A historic turning point is underway in the cryptocurrency markets. Bitcoin (BTC) surpassed $120,000 late Sunday night, reaching an all-time high. Increasing interest from institutional investors and regulatory changes to be addressed during "Crypto Week" in the US are among the key factors driving this surge.

Bitcoin Reaches $123,000

Bitcoin surged above $120,000 around 11:40 PM Sunday night, boosting the market. As of writing, it is trading at $123,036, a 3.32% increase. The daily inflow of more than $1 billion into Bitcoin ETFs is noteworthy. Currently, more than 6% of Bitcoin's market capitalization is held through ETFs.

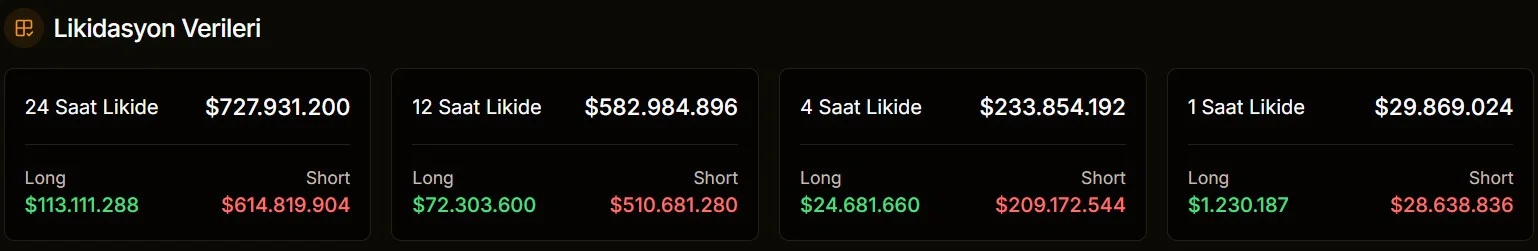

Liquidations Break Record

Bitcoin's rapid rise has also had a significant impact on futures markets. In the last 24 hours, $680 million worth of positions were liquidated in the crypto market. According to JrKripto data, $614 million of this came from short positions. The largest single liquidation was a $92.5 million BTC short position on the HTX exchange. This wave of liquidations wasn't limited to Bitcoin. Ethereum experienced a $68 million forced closure, XRP a $17 million closure, while altcoins such as XLM, PEPE, DOGE, and SUI also saw heavy trading volume.

Bitcoin is now the world's fifth most valuable asset.

Bitcoin's market capitalization has surpassed $2.4 trillion, surpassing Amazon, Google, and silver. Currently, only gold, NVIDIA, Microsoft, and Apple have a larger market capitalization than BTC. Vincent Liu of Kronos Research describes this rally as an "infrastructure-driven" rally, adding: "ETFs, policy momentum, and abundant liquidity combined to create this picture."

According to Liu, BTC could test the $130,000 to $150,000 range by the end of the year. However, reaching these levels will depend on whether retail investors re-enter the market.

Altcoins are also on the rise

The Bitcoin-fueled rally led Ethereum to rise above $3,000, while XRP rose 4.82 percent to $2.91, and Solana rose 3.21 percent to $165.9. According to market analysts, this rally is likely to strengthen further in the coming weeks if ETF inflows continue and crypto-friendly regulations come from the US.