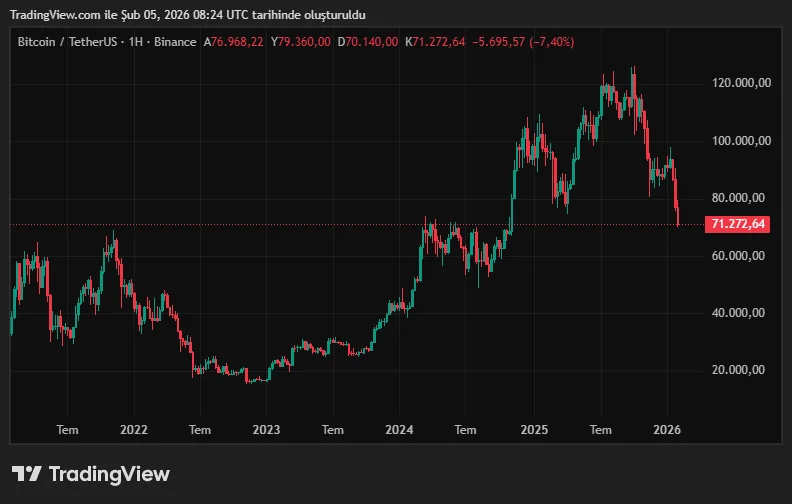

Selling pressure in the Bitcoin market continued unabated in the middle of the week. As of Thursday morning, the leading cryptocurrency fell below $71,000, reaching its lowest levels since October 2024. The increasing risk aversion trend in global markets led to sharp declines in crypto assets as well as crypto-related stocks.

Bitcoin in decline

Data from the last 24 hours shows that Bitcoin lost over 7% of its value, falling to $70,894. During the same period, Ethereum also fell by 7.8% to $2,091. This pullback across the market accelerated further as short-term recovery attempts failed.

Vincent Liu, CIO of Kronos Research, states that the recent decline in Bitcoin deepened due to a combination of multiple factors. According to Liu, “The loss of critical support levels following a failed rebound led to the liquidation of long positions. Combined with the contagion effect from sharp sell-offs in US technology stocks and ongoing outflows from ETFs, this accelerated downward pressure on the crypto market.”

The sell-off wasn't limited to cryptocurrencies alone. Companies traded on crypto-related exchanges also saw declines. Shares of the US-based cryptocurrency exchange Coinbase closed down 6.14% on Wednesday, while Bitmine, known for its Ethereum treasury, fell by over 9%. In traditional markets, the technology-heavy Nasdaq Composite dropped 1.51%, while the Dow Jones Industrial Average remained slightly positive. This picture shows investors moving away from risky assets and towards more cautious positions.

What's behind the decline?

Analysts point out that the current pullback is linked to broader macroeconomic dynamics rather than a singular shock specific to crypto. Presto Research Director Peter Chung says that crypto price movements have closely followed the "risk-off" sentiment in the general markets in recent days. According to Chung, falling to the lowest levels seen since the beginning of the year has brought investor psychology to its weakest point since the last bear market. This weakness is also reflected in sentiment indicators. The Crypto Fear & Greed Index being at 12 indicates that the "extreme fear" zone continues in the market. While most investors prefer to remain cautious in the short term, a significant decrease in trading volume is also noticeable. However, some analysts argue that the current pessimistic picture may overshadow long-term opportunities. Chung states that crypto assets are still not sufficiently adopted by a large part of the global investment world, which holds significant potential in the long term. According to him, short-term fluctuations can cause this broader perspective to be overlooked. Selling pressure became even more pronounced in the Asian session. Bitcoin fell as low as $69,101 on the Bitstamp exchange, while prices on other major platforms like Coinbase stabilized around $70,000. This discount seen on Bitstamp is believed to be due to more intense selling pressure on the platform. Some market observers suggest the decline is not yet over and Bitcoin could retreat to the $60,000 level. In this scenario, this region could potentially constitute a bottom. In the short term, investors will be watching to see if the psychologically critical $70,000 level can be maintained.