While the week started quickly in the cryptocurrency market, the start of "Crypto Week 2025" has become a sell-the-news event. Bitcoin (BTC) has retreated approximately 5% from its recent all-time high of $123,000. Similarly, leading altcoins such as Ethereum (ETH), Solana (SOL), XRP, and Dogecoin (DOGE) have lost value by between 3% and 8%.

This decline in Bitcoin, in particular, has triggered a large-scale selling wave in the market. According to Coinglass data, a total of $681 million in positions were liquidated in the last 24 hours, $406 million of which originated from long positions. This market-wide pullback is driven not only by profit-taking but also by concerns about upcoming US inflation data.

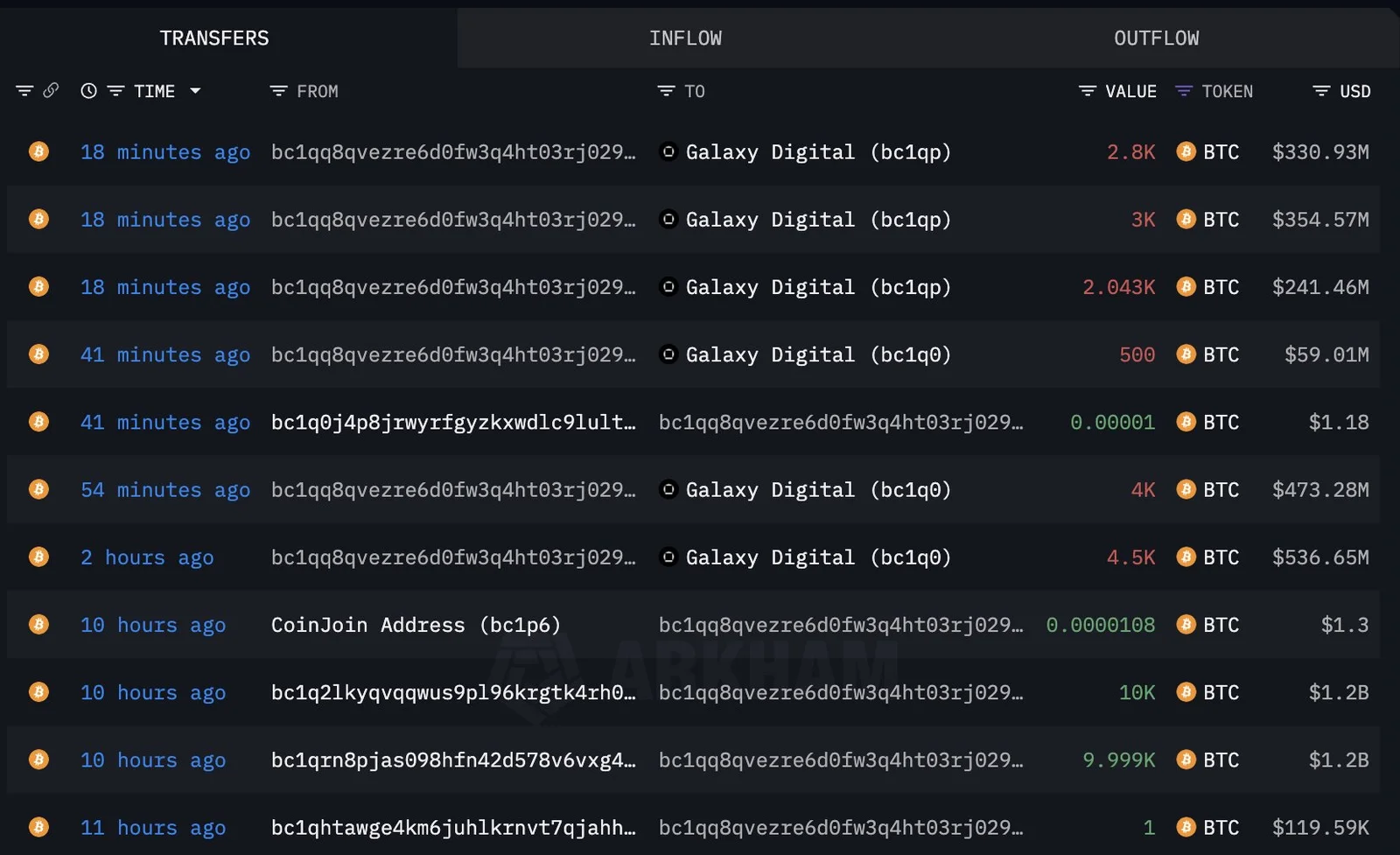

Massive Transfer from the Satoshi Era: $2 Billion in BTC Movement

Amidst the market turmoil, another noteworthy development occurred: a Satoshi-era "Bitcoin whale" transferred approximately 18,643 BTC (worth approximately $2 billion) to Galaxy Digital. According to LookonChain, 2,000 BTC of these assets have already been transferred to exchanges like Bybit and Binance. This move is likely profit-taking.

The relevant wallet reportedly still holds 80,009 BTC, with a current market value of approximately $9.46 billion. Such whale movements have the potential to increase market volatility and are closely watched by investors.

Sharp Drop in Altcoins

Altcoins, which have seen double-digit gains in recent weeks, have also retreated, similar to Bitcoin. Ethereum has fallen below the $3,000 level, and XRP has fallen below the $3 psychological resistance level. In other words, it appears the sustained rally investors are anticipating hasn't materialized yet.

Inflation data will be decisive

Markets are now focused on the June Consumer Price Index (CPI) and Producer Price Index (PPI) data from the US. These figures are expected to be released tomorrow, July 16. Economists predict annual inflation will rise from 2.4% to 2.6%. If these forecasts come true, selling pressure on risk assets could intensify.

Critical support zone for Bitcoin

According to Glassnode data, Bitcoin spot trading volume has increased by 50% since July 9, indicating growing investor interest. Specifically, 189,590 BTC were purchased in the $114,000-$117,500 range. This zone represents a strong support area for Bitcoin.

Bitcoin is currently trading at $117,209. Although it has fallen from its recent peak, a roughly 9% rise since early July remains in place. Analysts predict that BTC could retreat to $115,000 in the short term before retesting $120,000.

However, higher-than-expected inflation data could reverse this scenario. In such a scenario, the BTC price could fall to $110,000, temporarily ending the current uptrend.