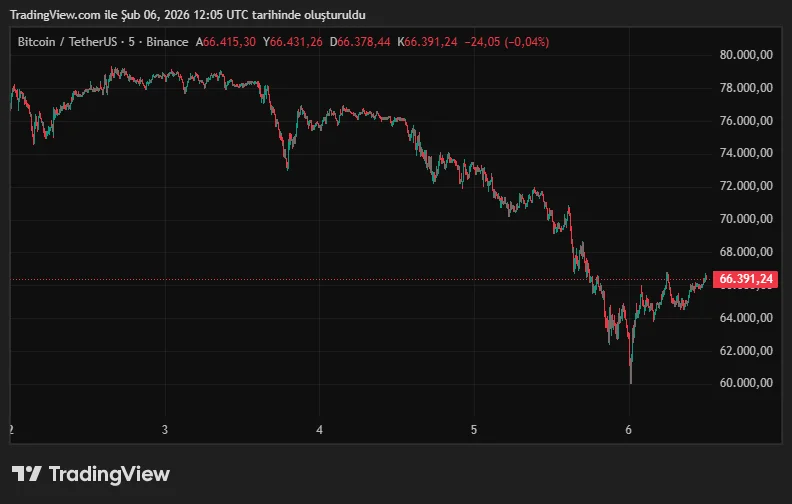

On February 5, 2026, Strategy released its fourth-quarter 2025 earnings report, once again highlighting the high risk of its Bitcoin-focused treasury model. The company reported a net loss of $12.4 billion, largely due to the revaluation of its Bitcoin assets relative to market price. Loss per share was $42.93. While software activity slightly exceeded expectations, the overall tone of the report was overshadowed by a sharp market crash. Fourth-quarter software revenue reached $123 million, slightly exceeding market estimates, while subscription revenue increased 62% year-over-year to $51.8 million. However, the sharp sell-off in Bitcoin during "Black Thursday," which saw the price fall to $62,353, resulted in a significant paper loss on the company's digital assets.

This decline also pushed Michael Saylor's massive Bitcoin portfolio, accumulated over the years, into a noticeable "loss" position for the first time.

Strategy Remains the Largest Bitcoin Treasury Company

According to data released by the company, as of February 1, 2026, Strategy continues to be the world's largest institutional Bitcoin holder with 713,502 BTC. The total cost of these assets is stated to be $54.3 billion, with an average purchase price of $76,052. In a scenario where Bitcoin trades around $64,400, the market value of the portfolio has fallen to approximately $45.9 billion. This represents an unrealized loss of approximately $8.4 billion. Despite this, the company demonstrated that it did not abandon its aggressive accumulation strategy even during periods of decline by purchasing 41,002 BTC alone in January 2026. The fact that Bitcoin inflows were directed to exchanges such as Binance during the same period indicated that selling pressure and panic perception in the market were strengthening.

In response to balance sheet concerns, Strategy management points to a strong liquidity buffer. The company slowed down Bitcoin purchases towards the end of 2025, creating a cash reserve of $2.25 billion. CEO Phong Le emphasized that this reserve has the capacity to cover dividends paid on preferred shares and debt interest for over two and a half years, regardless of the Bitcoin price. Furthermore, the fact that a large portion of Bitcoin assets are not pledged as collateral for any loans significantly reduces the risk of forced sales.

CFO Andrew Kang, evaluating the fourth-quarter results, stated that the loss was primarily due to market valuation and did not indicate an operational disruption. Michael Saylor urged investors not to panic, stating that the company's long-term approach to "digital lending" and Bitcoin accumulation is not shaped by short-term price fluctuations.

The earnings call also addressed security risks stemming from quantum computing. Saylor characterized these concerns as an exaggerated wave of FUD, arguing that it will take at least ten years for quantum computers to reach a level that threatens Bitcoin. He added that Bitcoin's open-source nature allows for quantum-resistant updates to be implemented through global consensus when deemed necessary. In this context, Strategy plans to launch a new Bitcoin Security program aimed at bringing together developers and security experts. In summary, although Strategy has announced one of the hardest quarterly losses in its history, it argues that it can weather this volatile period thanks to its strong cash reserves, flexible debt structure, and long-term Bitcoin vision. While the company's shares remain highly sensitive to the Bitcoin price, the management team believes that this volatility is a natural part of the strategy.