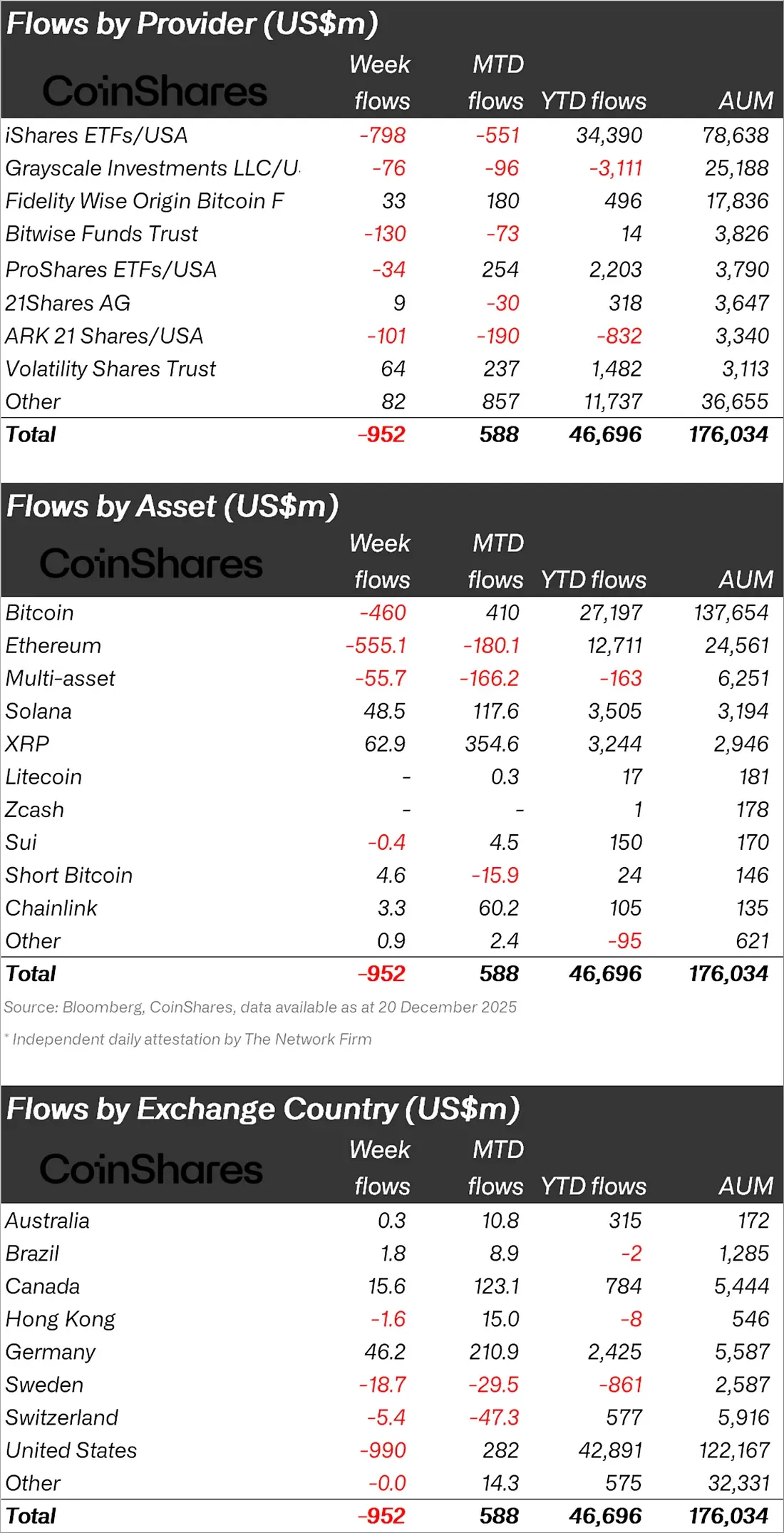

According to CoinShares' Volume 265: Digital Asset Fund Flows Weekly Report, digital asset investment products reversed course after a four-week streak of uninterrupted inflows. A total net outflow of $952 million was recorded last week. The report attributes this reversal primarily to the prolonged regulatory uncertainty stemming from the delayed US Clarity Act and growing concerns about large-scale investor sell-offs. Almost all fund outflows originated in the US, with a net outflow of $990 million from US-based investment products on a weekly basis. However, limited inflows from Canada and Germany indicated that global risk appetite hasn't completely disappeared. Canada saw a weekly inflow of $15.6 million, while Germany recorded $46.2 million. Nevertheless, these positive trends weren't enough to offset the sharp outflows from the US. Looking at assets individually, Ethereum experienced the strongest selling pressure, closing the week with a net outflow of $555 million. CoinShares stated that this reaction is understandable, given that Ethereum is one of the main assets directly affected by the Clarity Act. Despite this, Ethereum still presents a strong picture when viewed throughout the year. Since the beginning of 2025, there has been a net inflow of $12.7 billion into Ethereum products. This figure is significantly higher than the $5.3 billion recorded in 2024. On the Bitcoin side, a weekly outflow of $460 million was noteworthy. While Bitcoin products managed to remain in positive territory with a net inflow of $27.2 billion since the beginning of the year, this performance falls short of the $41.6 billion inflow recorded during the same period last year. This indicates that interest in US spot ETFs, in particular, is weakening as the year draws to a close. On the altcoin front, the picture is more balanced and selective. Solana products completed the week with a net inflow of $48.5 million, while interest in XRP products was even stronger, recording an inflow of $62.9 million. These two assets demonstrate that investors maintain confidence in certain networks despite regulatory uncertainty.

How did other altcoins perform?

Other altcoins and products saw more limited movements. Chainlink investment products saw a weekly inflow of $3.3 million, while Sui recorded a limited outflow of $0.4 million. Litecoin and Zcash products did not experience significant weekly fund movement, while year-to-date figures revealed lower levels of interest in these assets. Multi-asset investment products closed the week with a net outflow of $55.7 million. On the other hand, a $4.6 million inflow into Short Bitcoin products indicated that some investors maintained short-term bearish expectations for Bitcoin.

On the fund providers side, a picture emerged where large US-based issuers stood out. iShares ETFs saw a weekly outflow of $798 million, and Grayscale products saw a weekly outflow of $76 million. However, some providers, such as Fidelity and Volatility Shares, have still managed to achieve positive growth on a monthly basis. Total fund flows have remained positive at $588 million since the beginning of the month. According to CoinShares data, the total assets under management for digital asset investment products are at $176 billion. However, the total assets of ETPs are at a lower point compared to the same period last year. Total ETP assets, which were projected to be $48.7 billion at the end of 2024, are currently at $46.7 billion.