Donald Trump's media company, Trump Media & Technology Group (TMTG), is expanding its claim in the cryptocurrency space. The company's Bitcoin and Ethereum-focused ETF, named after its social media platform Truth Social, has been accepted into the official listing application process by NYSE Arca, affiliated with the New York Stock Exchange.

New development in Truth Social's Bitcoin and Ethereum ETF

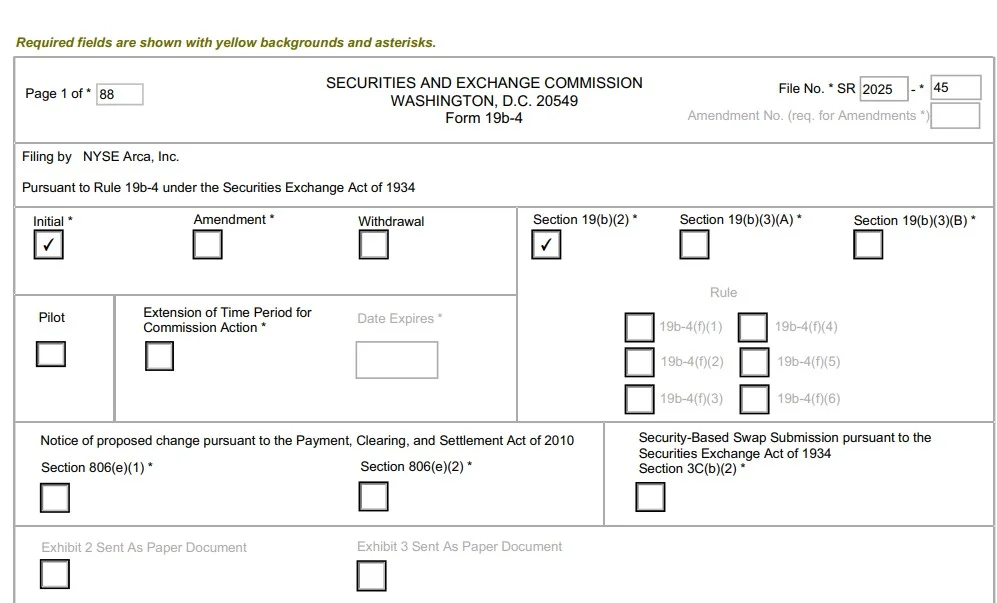

In fact, the ETF application in question was made a few weeks ago. However, now the process has officially entered a new phase. NYSE Arca has filed a "Form 19b-4" with the U.S. Securities and Exchange Commission (SEC), requesting the necessary rule changes for the ETF to be traded on the stock exchange. This step officially signals the start of the listing process for the ETF.

Truth Social Bitcoin and Ethereum ETF, which has a passive investment strategy, aims to directly track Bitcoin and Ethereum prices. The fund's portfolio distribution will be 75% Bitcoin and 25% Ethereum. This ratio shows that Bitcoin maintains its digital gold status, but Ethereum is also included.

The fund will be sponsored by Yorkville America Digital, while custody services will be provided by Foris DAX Trust Company. Market pricing will be provided by CF Benchmarks, as with other ETFs previously approved by the SEC. Net asset value (NAV), total assets, and intraday values will be updated every 15 seconds.

The ETF's creation and redemption transactions will be made directly with crypto assets via blocks of 10,000 shares. This system aims to reduce tax burdens and increase price efficiency. NYSE Arca also stated that it will use data from CME's futures markets and its own surveillance infrastructure to prevent fraud and market manipulation.

Crypto initiatives continue to grow

Trump Media is not limited to this ETF. In June, the company filed both a Bitcoin-only spot ETF application and a Bitcoin-Ethereum hybrid ETF application. With the announcement made in May, Trump Media announced that it was aiming for a total capital increase of $2.5 billion and announced that it would purchase Bitcoin with the majority of this fund. The company had also created share buyback plans within this scope.

The activities of World Liberty Financial, which is affiliated with the Trump family, are also drawing attention in cryptocurrencies. The company in question entered the market with a stablecoin project called USD1. It has also made headlines with its purchases of other cryptocurrencies.

If approved, the Truth Social Bitcoin and Ethereum ETF will be one of the first dual-asset crypto ETFs to be traded on US exchanges. In order for the SEC to evaluate the application, it must first be published in the Federal Register and then the evaluation process must begin with comments from the public.