The cryptocurrency market declined as it entered the last full trading week of the year, amid weakness in global risk appetite. Investors are adopting a cautious stance, particularly due to increasing questioning of high valuations in technology stocks, a loss of momentum in US equity markets, and conflicting signals from the US Federal Reserve (Fed). This cautious atmosphere has caused volatility in traditional markets to be reflected in crypto assets as well.

Stagnation in Bitcoin and altcoins

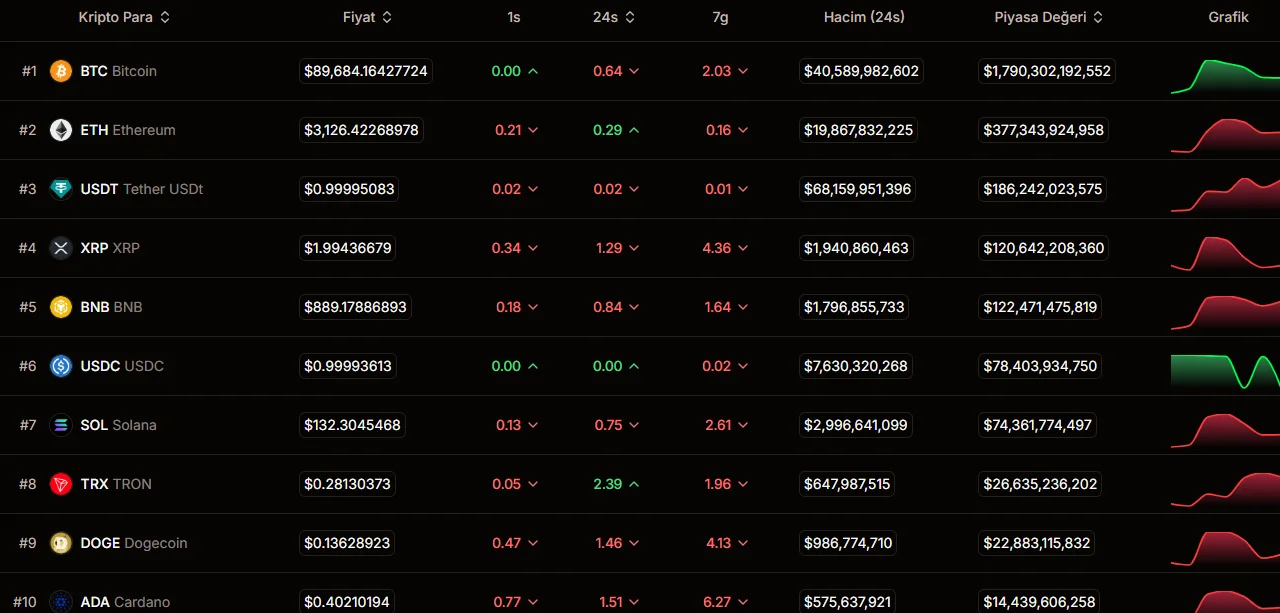

According to market data, Bitcoin traded at around $89,600 on Monday morning, down approximately 0.5%, and struggled to hold just above last week's lows. Ethereum also saw limited losses, falling to around $3,120. Major altcoins such as XRP, Solana, and Dogecoin experienced losses of up to 2%. The overall picture revealed that risk appetite remains fragile and buying appetite is weak.

This volatility occurred despite US stock index futures showing a limited recovery in the morning hours following last week's sell-off in technology stocks. While S&P 500 and Nasdaq 100 futures rose around 0.2%, investors remain doubtful about whether current valuations of technology companies can be sustained into 2026. Increased spending on AI investments and the question of how much this spending will be supported by profitability are putting pressure on risky assets. This cautious approach is also hindering recovery efforts in the cryptocurrency market following the sharp pullback in October. A significant drop in trading volumes has been observed in recent days, and low liquidity is making price movements more volatile. This is leading to a defensive tone in the market. Jeff Mei, the operations director of the BTSE crypto exchange, notes that investors are reluctant to invest in crypto assets. According to Mei, the decline in October, coupled with concerns that the US stock market is overvalued and the Fed's unclear messages, is causing investors to shy away from risk. However, Mei emphasizes that net inflows into Bitcoin ETFs continue and that the Fed's securities buybacks are providing liquidity to the system. He points out that this liquidity has the potential to flow into both stocks and cryptocurrencies over time.

Mei also states that year-end position adjustments play a significant role in the current weakness. Investors taking profits and waiting until early 2026 to open new positions is increasing selling pressure in the market.

Augustine Fan, head of research at SignalPlus, warns that low liquidity could further exacerbate downward movements in the coming weeks. Fan says that trading volumes have decreased significantly since a specific market event in October, and overall market sentiment has turned negative. In this environment, he notes that Bitcoin and Ethereum are being used as a kind of balancing factor by investors as they adjust their portfolio risks. Fan emphasizes that short-term price movements should not be exaggerated, stating that hourly or daily fluctuations can be misleading under current conditions. However, he adds that overall sentiment remains weak and that pressure on prices may continue until the end of the year.