Binance, one of the world's largest cryptocurrency exchanges, announced that it will delist certain trading pairs to maintain the quality of trading in the spot market. In an official statement published on February 5, 2026, the company announced that a total of 20 spot trading pairs will cease trading as of 11:00 AM UTC on February 6, 2026. Two cryptocurrency pairs will also be removed from the futures trading platform.

Binance Prepares for Delisting

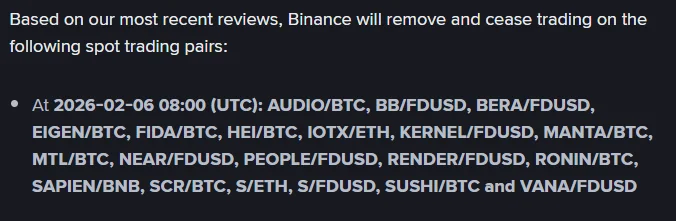

In its statement, Binance emphasized that this decision is a result of periodic liquidity and trading volume analyses conducted on the platform. The company stated that each trading pair is regularly evaluated in terms of market depth, volume stability, and user experience, and pairs that do not meet the criteria are delisted. The following trading pairs will be delisted: AUDIO/BTC, BB/FDUSD, BERA/FDUSD, EIGEN/BTC, FIDA/BTC, HEI/BTC, IOTX/ETH, KERNEL/FDUSD, MANTA/BTC, MTL/BTC, NEAR/FDUSD, PEOPLE/FDUSD, RENDER/FDUSD, RONIN/BTC, SAPIEN/BNB, SCR/BTC, S/ETH, S/FDUSD, SUSHI/BTC, and VANA/FDUSD. Spot trading in these pairs will be completely suspended after the specified date and time.

Binance states that such delisting decisions are mostly driven by low trading volume, weak liquidity, and conditions that negatively impact market efficiency. The company says these steps aim to enable users to trade in a fairer, more transparent, and deeper market environment. On the other hand, delisting a spot trading pair does not mean that the token in question is completely removed from the Binance spot market. Users will be able to continue buying and selling the same token through other trading pairs. For example, a token removed from the BTC pair can continue to be traded through the USDT or FDUSD pair.

The exchange also announced that the Spot Trading Bots services associated with these trading pairs will also be disabled on the same date and time. Binance warned investors using automated trading bots about potential problems. Users were advised to close their active bots or update the relevant settings before the delisting date to avoid the risk of loss. Otherwise, it was reminded that unexpected positions or losses may arise due to the bots stopping.

Two pairs also being delisted from futures trading

In addition to the spot market delisting decision, Binance announced that it will also delist the RVVUSDT and YALAUSDT USDⓈ-M perpetual contracts from its futures trading platform, Binance Futures; All positions in these contracts will be subject to automatic settlement on February 10, 2026 at 12:00 PM and will then be completely delisted from the platform.

Market analysts point out that such delisting announcements can often create selling pressure on the relevant tokens in the short term. Investors, especially those trading in low-volume pairs, warn that price volatility may increase with decreased liquidity. However, according to experts, these adjustments by Binance are paving the way for a more stable, reliable, and sustainable spot market structure across the platform in the long term.

Binance has conducted similar assessments regularly in the past and has adhered to dynamic listing policies to adapt to market conditions.