Binance Futures continues to expand its futures product line. The platform is launching two new USDT-backed perpetual futures contracts as of January 16, 2026. According to the official announcement, the SPORTFUNUSDT and AIAUSDT perpetual contracts offer investors leverage of up to 20x. With the addition of these new contracts, Binance Futures has brought together different investment themes by offering both sports-themed and AI-focused projects in the futures market.

SPORTFUN and AIA are now available to investors as USDT-backed perpetual futures contracts

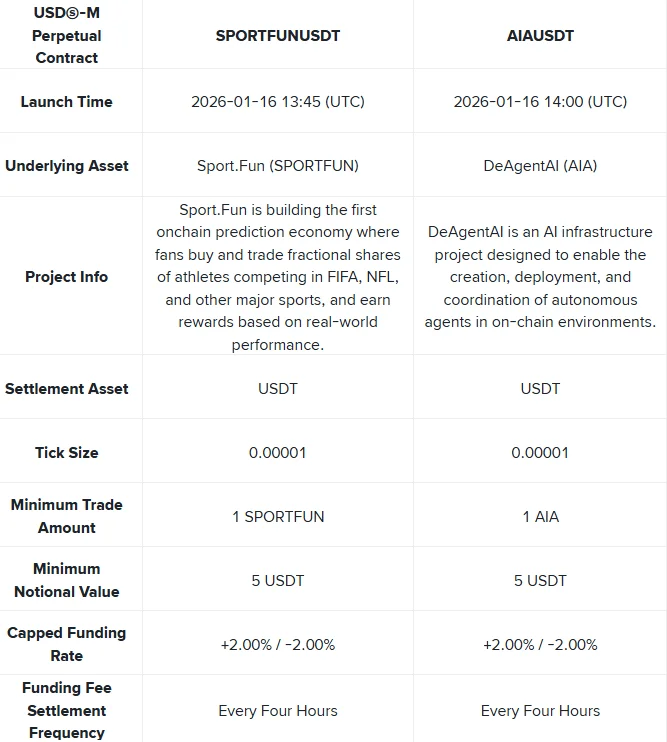

According to information shared by Binance, the SPORTFUNUSDT perpetual contract will open for trading on January 16 at 16:45 UTC, and the AIAUSDT perpetual contract will open at 17:00 UTC on the same day. Both contracts are settled with USDT and are designed for 24/7 trading. The maximum leverage ratio is set at 20x, while the minimum transaction size is kept at 1 unit for both contracts. The minimum position value is announced as 5 USDT.

The underlying asset of the SPORTFUNUSDT contract, Sport.Fun, stands out as a project focused on an on-chain prediction economy. Sport.Fun tokenizes the performance of professional athletes competing in popular sports such as soccer and American football. Users can buy and sell fractional shares based on the athletes' real-life performances and earn rewards according to the results obtained. This model aims to establish an economic structure based on prediction and performance, unlike sports betting.

The underlying asset of the AIAUSDT contract, DeAgentAI, is an infrastructure project focused on autonomous artificial intelligence agents operating on the blockchain. DeAgentAI aims to create AI agents that can interact with smart contracts, perform tasks independently, and coordinate in on-chain environments. The project develops solutions that aim to make automation, data analysis, and decision-making processes more efficient in the Web3 ecosystem. According to the technical details shared by Binance Futures, the upper and lower limits for the funding rate in both contracts are set at +2% and -2%. Funding fees are calculated and collected every four hours. Furthermore, thanks to Multi-Assets Mode support, users can use different assets such as BTC as collateral, subject to appropriate haircuts. This feature provides flexibility, especially for investors who want to trade futures while maintaining portfolio diversification. The platform stated that these contracts will also be accessible within the Futures Copy Trading framework within 24 hours of opening. This will allow users to automatically copy the strategies of experienced investors. Binance also reminded users that it may make changes to technical parameters such as leverage ratio, collateral requirements, funding fees, and minimum price increment depending on market conditions. Finally, Binance emphasized that listing a token on the futures side does not guarantee its listing on the spot market. It was stated that this announcement should be evaluated within the scope of the applicable Binance Futures Terms of Service and Terms of Use.