APT

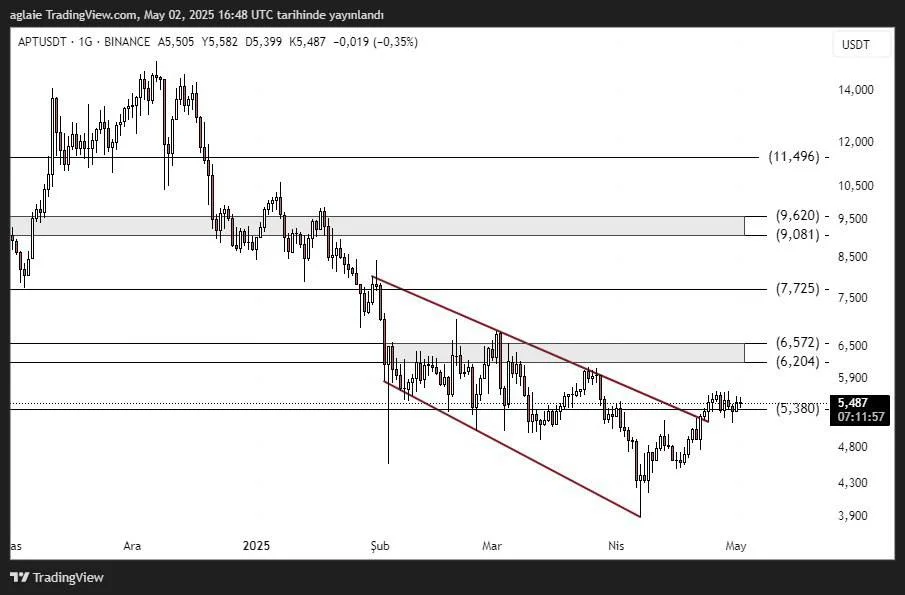

Aptos (APT) has broken upward from the descending channel structure in which it has been priced for a long time, giving a clear signal of change in the technical outlook.The price is currently trading around $5.487, indicating that the $5.38 resistance level has been surpassed, possibly signaling the start of a new upward wave.

Channel breakouts are strong indicators of trend reversal in technical analysis.In particular, the formation of higher lows in recent weeks and volume-supported upward moves suggest that this breakout is not just a “reaction” but a structural reversal.

Support and Resistance Levels

Support Zones:

- $5.380: Support-resistance flip (SR Flip)

- $5.000 – $4.800: Demand zone to monitor during pullbacks

- $4.200 – $3.900: Major support

Resistance Zones:

- $6.204 – $6.572: First major target zone

- $7.725: Broad time-frame resistance area

- $9.081 – $9.620: Psychological resistance

- $11.496: Long-term major resistance

With APT breaking above the descending channel, the technical outlook has clearly changed.The trend direction has now turned upward, and each new rise is being supported by a higher high than the previous one.

If the price holds above this level, it is technically possible for it to climb first to the $6.20 – $6.57 range, and then to $7.72.

If the price maintains stability above $5.38, it could move towards the $6.20 – $6.57 band and later towards $7.72.Closures below $5.00 could weaken the bullish scenario in the short term.Volume-supported new breakouts could accelerate the upward movement.

In summary, APT Coin has given a strong technical signal of change by breaking out of the descending channel structure.The break above $5.38 and staying above it indicates that the bullish scenario has now become the main expectation.In the coming days, the $6.20 – $6.57 range should be followed as a critical target.

These analyses do not constitute investment advice.They focus on support and resistance levels that are believed to offer short- and medium-term trading opportunitiesdepending on market conditions.All trading and risk management responsibilities lie entirely with the user.The use of stop-loss is strongly recommended for any shared trade ideas.