Japan-based financial giant SBI Holdings has officially filed an application with the Japan Financial Services Agency (FSA) for a dual-asset crypto ETF (Exchange-Traded Fund) featuring Bitcoin and XRP, marking a first in the country. This move could mark the first time XRP has been considered an institutional-level investment product in the Japanese financial market.

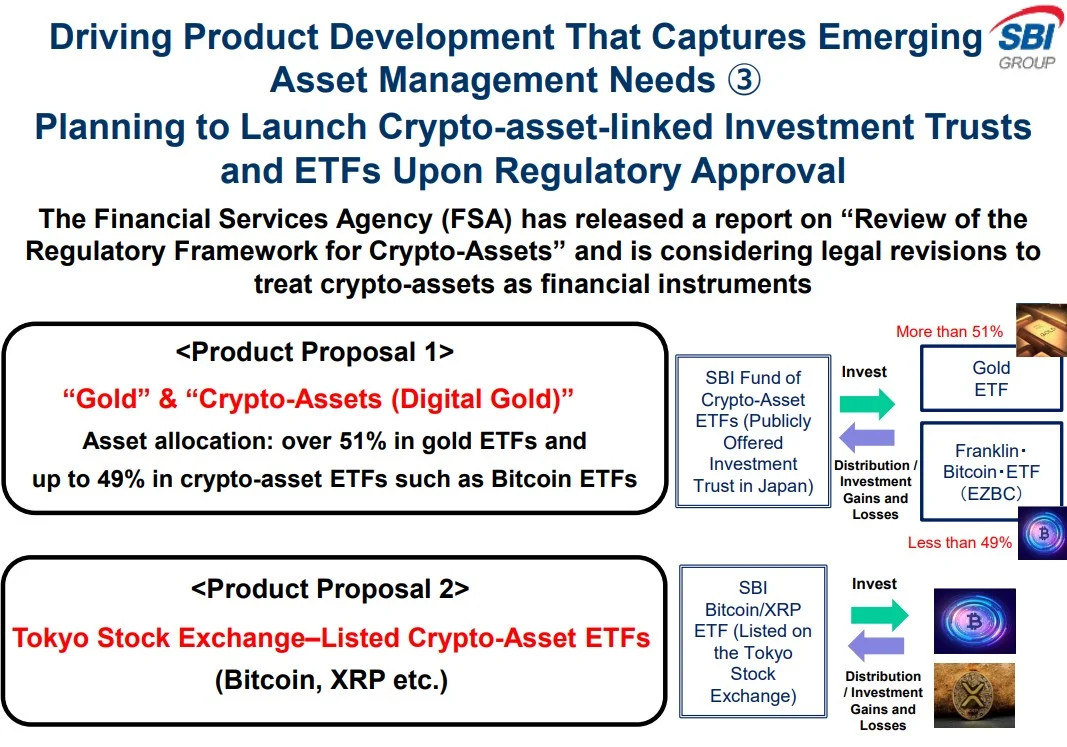

Announced in the company's second-quarter 2025 financial report, this new product is called a "Crypto-Assets ETF." The fund aims to provide investors with a single investment gateway offering direct access to both Bitcoin and XRP. The fund's structure aims to offer investors a diversified crypto portfolio by simultaneously monitoring the performance of both assets.

Another ETF application is also mentioned

SBI has also filed an application for a second product, the "Digital Gold Crypto ETF." This fund plans to allocate more than 50% of its portfolio to gold ETFs and invest the remainder in gold-backed cryptocurrencies. This hybrid structure particularly appeals to investors who are wary of volatility but don't want to completely avoid crypto assets.

If the applications are approved by the FSA, XRP will be offered to investors in Japan as part of a regulated investment product for the first time. This is seen as a significant step in the global legitimacy of XRP, which is based on Ripple's payment technologies. As you may recall, XRP remains excluded from many major institutional investment products due to regulatory uncertainties in the US.

SBI Holdings CEO Yoshitaka Kitao stated, "This initiative reflects our commitment to integrating blockchain-based assets into the regulated financial system in Japan and Asia."

SBI's move is significant for investors in Japan, as well as in Asia in general. It's a fact that institutional investors in this region may see a softening of their approach to cryptocurrencies. Furthermore, the greater acceptance of XRP in Japan could encourage other financial institutions in the region to develop similar products. This development has been met with great excitement in the crypto community, especially among XRP supporters. This group, known as the "XRP Army," interprets SBI's ETF application as a significant milestone in gaining institutional recognition for XRP.

As of August 6, 2025, when the news broke, the price of XRP was trading around $2.95. According to JrKripto data, XRP is listed as the third-largest cryptocurrency with a market capitalization of $174.5 billion. Having gained approximately 30% in the last 30 days, XRP has attracted renewed attention due to increased institutional adoption. However, it's worth noting that SBI's move has not yet been reflected in the price.

While official approval has not yet been received, SBI's application can be expected to open a new chapter in Japan's crypto finance sector.