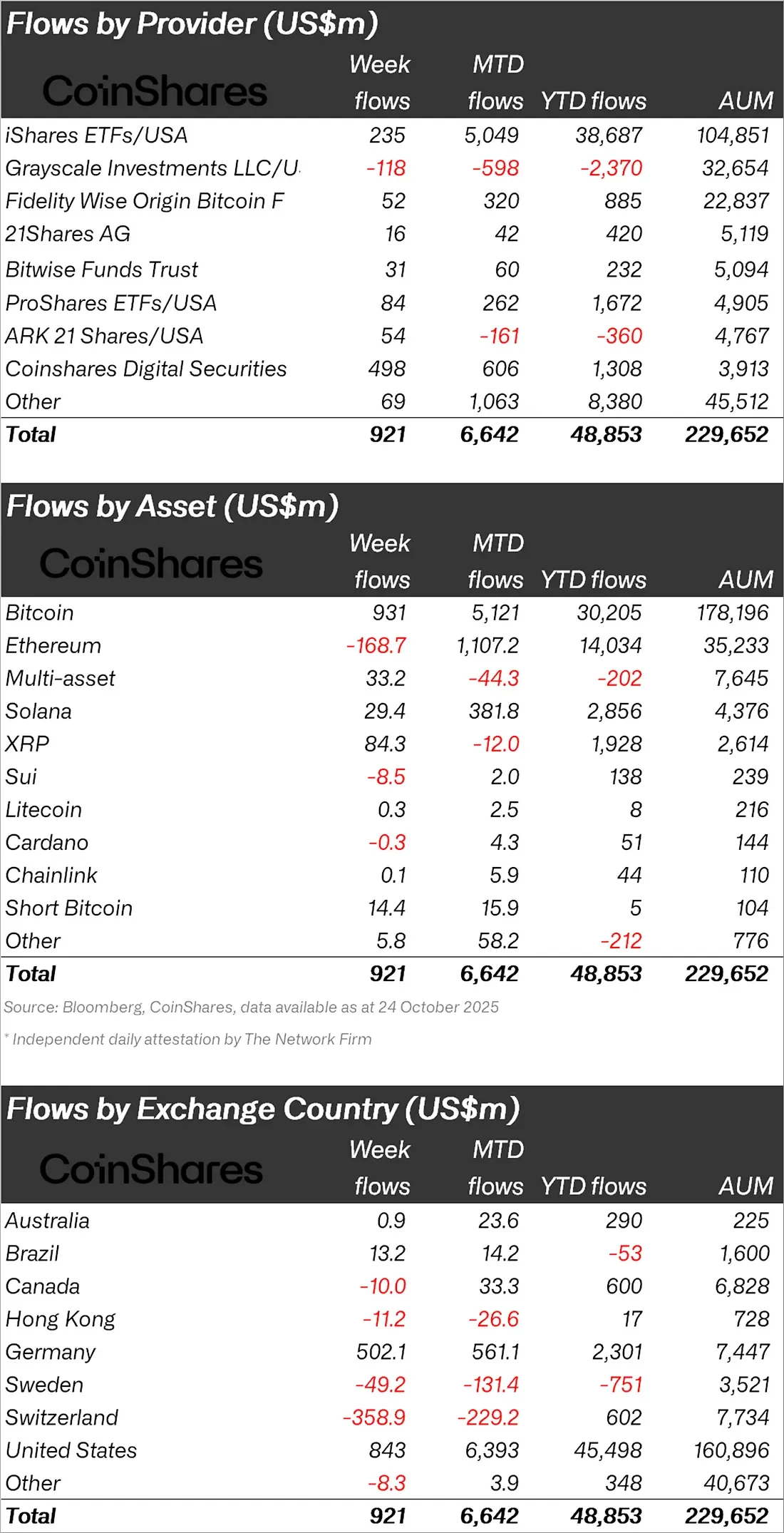

According to CoinShares' weekly report dated October 24th, there was a total inflow of $921 million into digital asset investment products in the last week. This strong performance was attributed to the recovery of investor confidence following the release of the US CPI (Central Price Index) data, which fell short of expectations. Expectations that the US Federal Reserve (Fed) may implement further interest rate cuts this year appear to have renewed buying appetite in digital asset markets.

Weekly trading volumes reached $39 billion globally, well above the yearly average. This indicates that market interest and volatility remain high. US-based funds, in particular, saw inflows of $843 million, while Germany experienced a near-record week with $502 million. Meanwhile, Switzerland saw outflows of $359 million. CoinShares stated that this outflow was not due to selling pressure but rather to asset transfers between fund providers.

Investors Turn to Bitcoin

On an asset basis, Bitcoin was the clear winner of the week. With $931 million inflows, investors' risk appetite shifted back to Bitcoin. This brings the total inflow of $30.2 billion into Bitcoin products since the beginning of the year. While this figure is below last year's $41.6 billion, it's noteworthy that it has regained momentum with the start of the Fed's interest rate cut cycle.

The situation was quite the opposite for Ethereum. A five-week streak of uninterrupted inflows ended this week with an outflow of $169 million. It was reported that investors held short positions throughout the week, despite continued interest in leveraged Ethereum ETPs (exchange-traded products). Volumes for Solana and XRP slowed significantly ahead of the expected ETF approvals in the US. Solana saw $29.4 million inflows, while XRP saw $84.3 million inflows.

Meanwhile, limited outflows were observed for Sui and Cardano, with investors largely holding positions in market leaders. Litecoin, Chainlink, and multi-asset funds followed a balanced course, finishing the week with small positive inflows.

By provider, CoinShares Digital Securities funds led the week with $498 million in inflows. iShares ETFs followed with $235 million and ProShares ETFs with $84 million. Grayscale Investments, however, fared negatively with an outflow of $118 million. The company has experienced a total outflow of $2.37 billion since the beginning of the year.

In terms of country-by-country distribution, the US contributed $843 million, accounting for the majority of inflows, while Germany accounted for $502 million. In contrast, Switzerland was the weakest link with an outflow of $359 million. Canada and Brazil saw limited inflows, while investors in Hong Kong and Sweden remained cautious.

The overall picture suggests that market participants are repositioning themselves in anticipation of interest rate cuts.