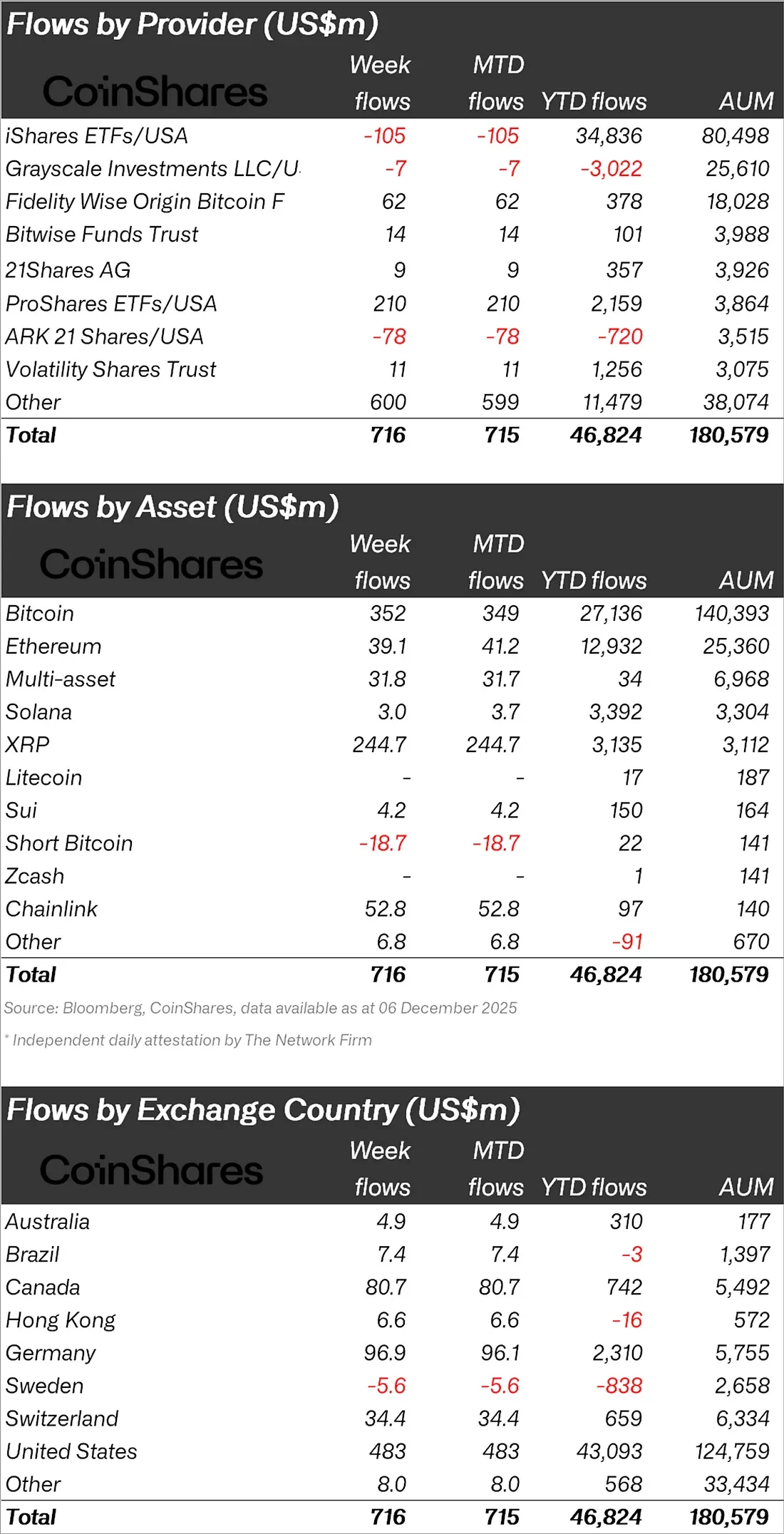

Digital asset investment products saw a significant recovery last week. According to CoinShares data, global ETPs saw a total net inflow of $716 million. This increase signals a revival of investor appetite after the lows in November. Total assets under management (AuM) thus rose to $180 billion, a figure that, while strong, still falls short of the $264 billion peak seen in 2021.

Inflows were spread throughout the week, with slight outflows on Thursday and Friday due to inflation signals from the US. Despite this, the overall improvement in market sentiment remained.

The largest inflows came from the US, Germany, and Canada

The report also points to a broadly positive picture across geographic distribution. The US, with $483 million, Germany, $96.9 million, and Canada, with $80.7 million, were the three strongest regions for the week. Consequently, buying flows were observed in nearly all major investment centers. This is considered another indicator that institutional investors' risk appetite is beginning to increase again.

Bitcoin sees $352 million inflows, sharp outflows in shorts

Bitcoin once again saw the largest share of the week. BTC products received a net inflow of $352 million, bringing its total year-to-date inflow to $27.1 billion. While this figure is strong, it falls short of the $41.6 billion inflow recorded in 2024.

Another significant indicator is the strong outflows in Bitcoin shorts.

Last week, shorts saw an outflow of $18.7 million, the largest since March 2025. Similarly, at that time, prices nearing bottom indicated that investors were beginning to withdraw from bearish positions. Today's data suggests that negative sentiment is weakening.

Record interest in XRP and Chainlink

The most notable movement in recent weeks occurred in altcoins.

XRP surged ahead with a weekly inflow of $245 million, bringing XRP's total inflow for the year to $3.1 billion. This figure far surpasses the $608 million inflow in 2024, demonstrating a strong institutional focus.

On the Chainlink side, a historic record was broken. Link products saw $52.8 million inflow last week. This was the largest weekly inflow on record and represents over 54% of the fund's total assets. According to the figures, Chainlink was among the fastest-growing choices of institutional investors.

Multi-Asset, Sui, and Solana See Moderate Inflows

Multi-asset products saw $31.8 million inflows, Solana saw $3 million, and Sui saw $4.2 million. While these inflows are more limited, they indicate a general recovery trend in the altcoin market, not just a few major assets.