On October 15, 2025, stablecoin company Paxos made a mistake of historic magnitude. The company mistakenly minted $300 trillion worth of unsecured tokens for PayPal USD (PYUSD). The error was quickly rectified with a burn after being discovered, but the incident caught the attention of the New York Department of Financial Services (NYDFS).

NYDFS released a statement regarding Paxos's error

The NYDFS confirmed that it had contacted Paxos and PayPal in a statement. The agency stated that this incident, which occurred as a result of "human error," constitutes a serious warning regarding the operational security of stablecoins. The incident was first noticed in on-chain data during a routine $300 million transfer. In this transaction, which took place between Paxos's own wallets, a simple numerical error in the system created 300 trillion PYUSD. The entire excess was burned within an hour, restoring balances and confirming that customer funds were unaffected. However, the magnitude of the incident caught the attention of the global financial market. Sam Ramirez, a former Salesforce engineer, commented on the incident, saying that Paxos “mistakenly reprinted a 300 million transaction as 300 trillion.” “This wasn’t software-related; it was pure human error,” he said. Following the incident, attention turned to stablecoin collateral systems. The lack of on-chain verification tools, the fragility of manual controls, and the frequency of system audits became a renewed topic of discussion.

Chainlink community representative Zach Rynes argued that the incident proved that Proof of Reserve systems should be made mandatory. According to Rynes, if Chainlink’s PoR system had been integrated, a printing transaction of this magnitude wouldn’t have been possible without comparing it with reserves. “This incident demonstrates that on-chain verification systems are no longer a luxury, but a necessity,” he said.

On social media, the incident was discussed from various perspectives. The financial blog Zero Hedge raised the question, “What exactly was this $300 trillion worth of ‘stablecoin’ collateralized by?” Some analysts argued that the error revealed a systemic vulnerability rather than a technical one. A DeFi researcher noted that the incident coincided with PayPal's announcement of a new liquidity partnership, saying, "Everyone dismissed it as a software bug, but the timing is striking. This happened at the very moment when traditional finance and tokenized securities met."

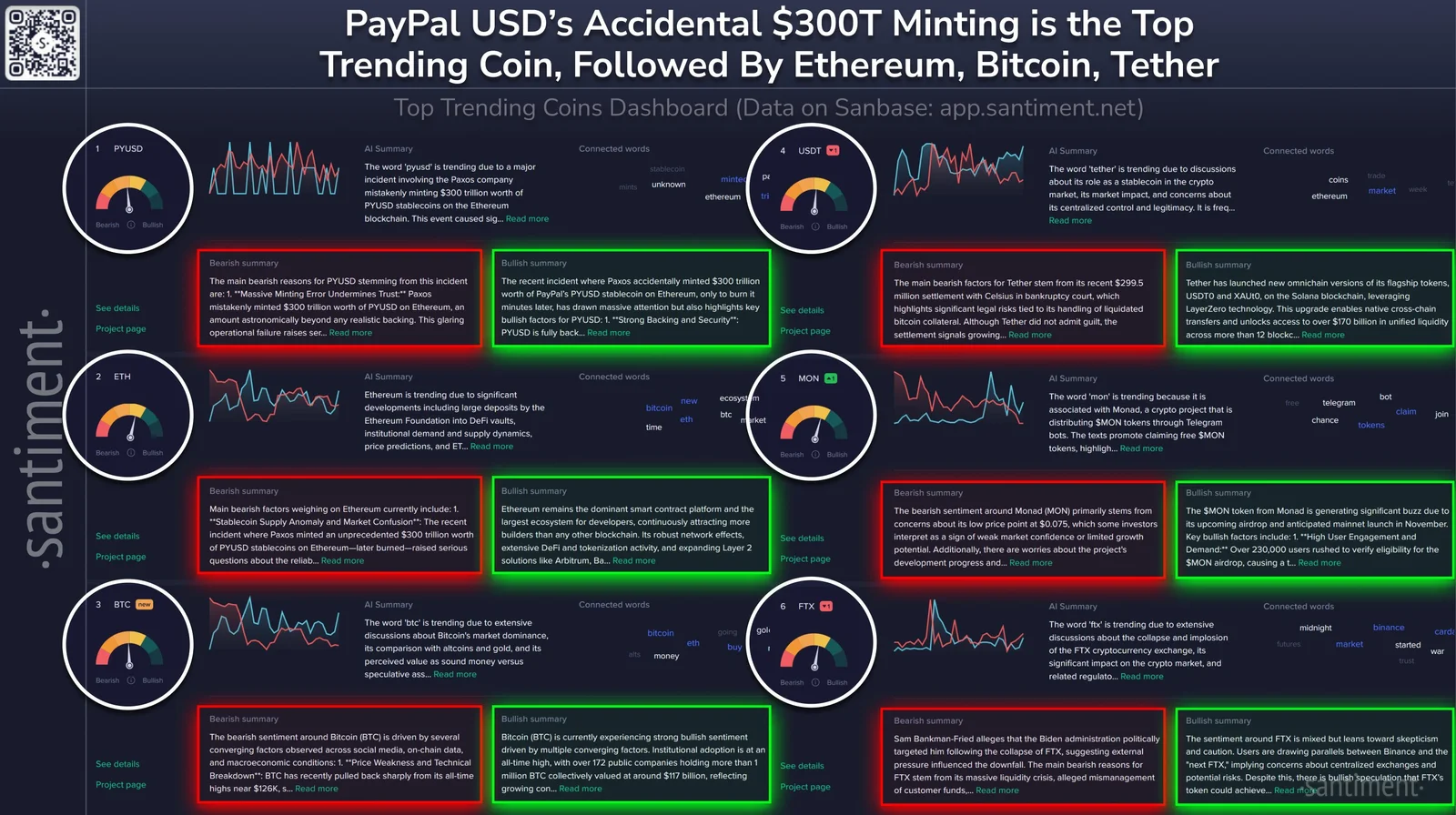

Data analytics firm Santiment also stated that "the creation and burning of such a large supply in such a short time demonstrates the delicate balance of the stablecoin market."

The total value of the stablecoin market is currently close to $310 billion. However, Paxos' $300 trillion error could have completely shaken the system. Regulators are now preparing to mandate Proof of Reserve integrations, instant audits, and more transparent reserve verification standards.