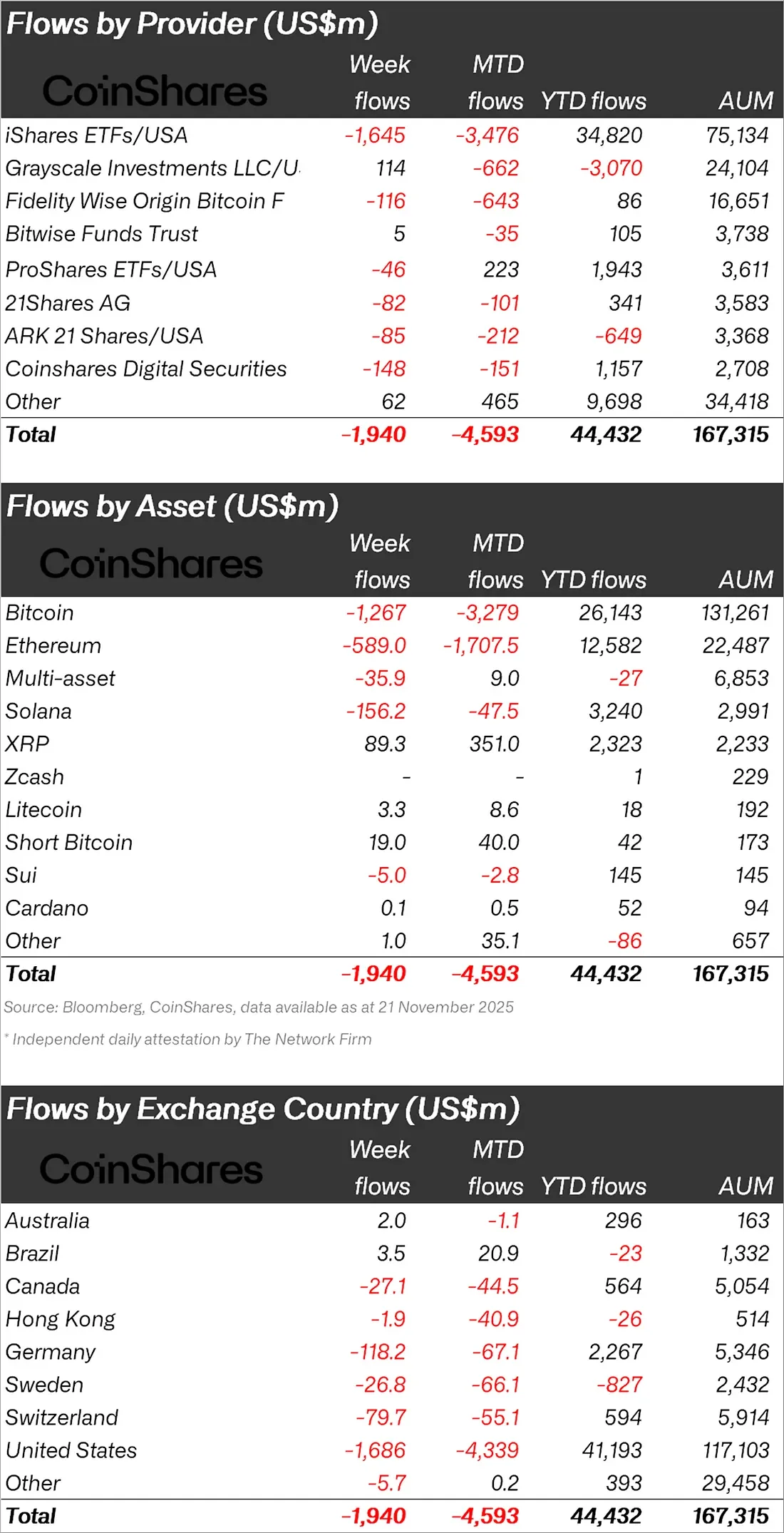

Crypto asset investment products experienced a significant wave of outflows last week. According to CoinShares' latest report, a total of $1.94 billion in outflows from crypto funds occurred. This brings the total outflow over the last four weeks to $4.92 billion. This period marked the third-strongest series of outflows since 2018.

The weakening of investors' risk appetite continues to pressure both prices and fund flows. Nevertheless, the $258 million inflow on the last trading day of the week signaled a limited, albeit drastic, recovery in market sentiment.

Bitcoin funds recover after a large outflow

Bitcoin products were hit the hardest. $1.27 billion in outflows from BTC funds during the week. This level of outflow suggests that investors remain cautious in the short term. However, the picture changed somewhat on Friday, with $225 million inflows into Bitcoin funds. This movement suggests that, despite the weak weekly outlook, investors are looking to buy at the dips.

Interest in short Bitcoin products continues to strengthen. Funds holding short positions saw $19 million in inflows during the week. The total inflow over the last three weeks reached $40 million, representing 23% of the product's assets under management. The increase in AUM for short products is striking; it grew by 119% in just three weeks.

Ethereum investment products were also affected by the downturn. $589 million in outflows from ETH funds occurred during the week. This figure represents 7.3% of the funds' total assets. However, similar to Bitcoin, $57.5 million in inflows were seen on Friday, with a limited recovery.

Solana weakened in altcoins, while XRP rose

The picture on the altcoin side is mixed.

• Solana closed the week negatively with $156 million in outflows.

• XRP, however, bucked the general trend and attracted attention with $89.3 million in inflows.

XRP emerged as the strongest performing asset of the week. Strong interest in fund flows could also have a supportive effect on the price.

The sharpest outflow came from the US.

The largest outflow in the regional breakdown came by far from US funds.

• US: $1.68 billion outflow

• Germany: $118 million outflow

• Canada: $27 million outflow

• Brazil: $20.9 million inflow

• Switzerland and Sweden: total outflows exceeding $130 million

Fund flows originating in the US continue to shape the general direction of global flows. This region, where institutional investor behavior is particularly concentrated, was a key factor in the week's downturn.

Although there have been heavy outflows in the last four weeks, total inflows since the beginning of the year still stand at $44.4 billion. This suggests that institutional interest remains strong in the bigger picture.

Friday's inflows indicate that some investors are beginning to see the decline as an opportunity. If the market strengthens this signal in the coming weeks, fund flows may stabilize.