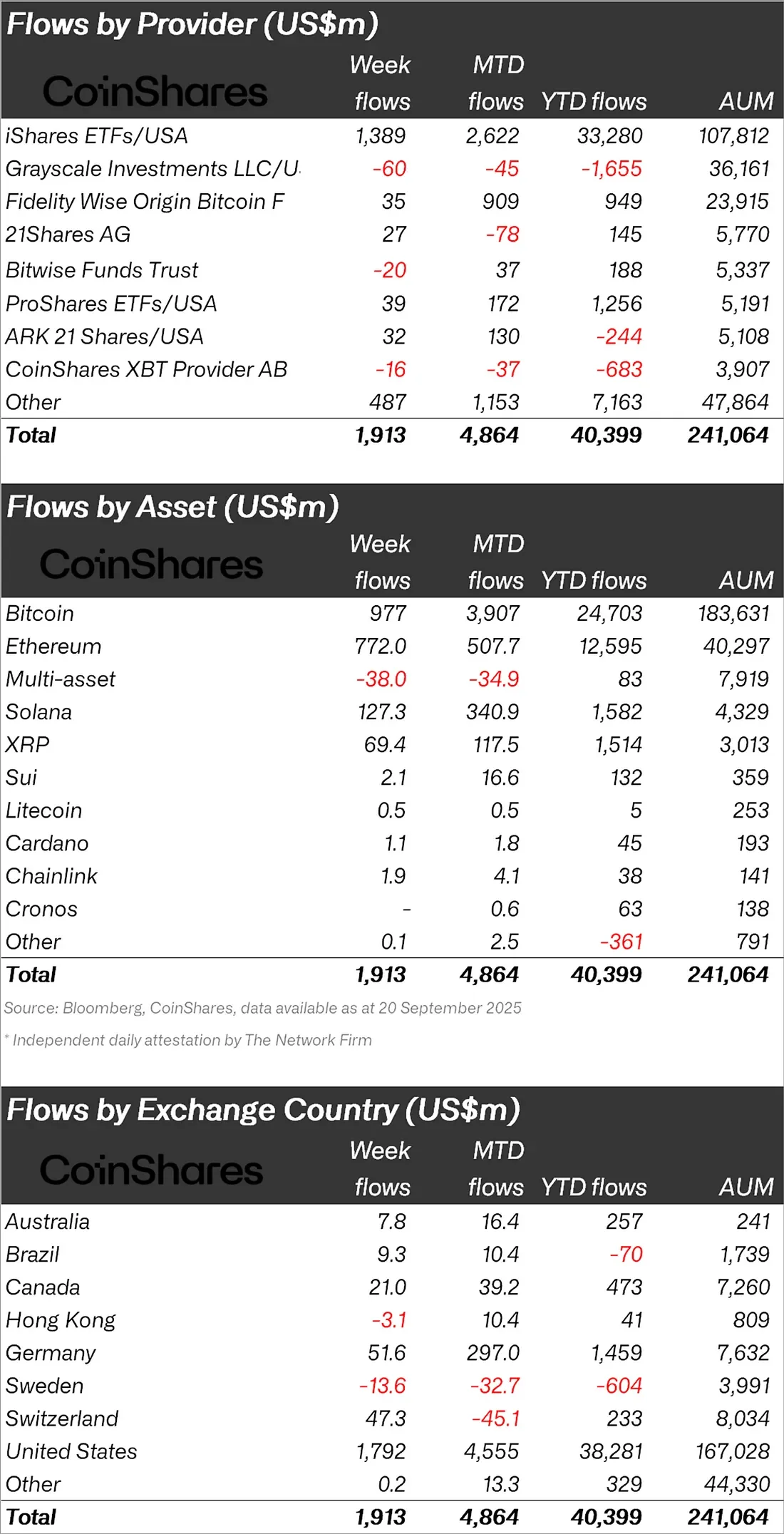

Crypto asset investment products saw strong inflows for the second week following the US Federal Reserve's interest rate cut decision. According to CoinShares data, a total of $1.9 billion in investment products entered the market last week. This brings total inflows since the beginning of the year to $40.4 billion, and assets under management (AuM) reached a year-to-date high of $241 billion.

Bitcoin once again took the lead. The leading cryptocurrency, which saw $977 million in inflows last week, is clearly ahead with $24.7 billion in inflows since the beginning of the year. Ethereum, on the other hand, saw a notable weekly inflow of $772 million. This brings the total inflows in ETH products to a record high, exceeding $12.6 billion since the beginning of the year. Ethereum's assets under management also reached an all-time high of $40.3 billion.

What is the current state of investment flow in altcoins?

The altcoin market was also quite active. Solana closed the week with $127.3 million in inflows, reaching a monthly total of $340 million. XRP saw strong demand with $69.4 million inflows; since the beginning of the year, the inflow into this product has reached $1.5 billion. Although smaller, Sui saw $2.1 million, Cardano $1.1 million, and Chainlink $1.9 million. Litecoin saw $0.5 million inflows, while Cronos saw a limited $0.6 million increase. In contrast, $38 million in outflows from multi-asset products were noteworthy, suggesting investors are turning to single coins in this area.

Latest Regional and Provider Data Table

The US leads the way in regional data. Last week, the US accounted for almost all of the total volume, with $1.8 billion in inflows. Germany recorded $51.6 million, Switzerland $47.3 million, and Canada $21 million. Brazil saw $9.3 million, and Australia $7.8 million. Hong Kong saw $3.1 million in outflows. Sweden and Switzerland also saw notable monthly outflows, with Sweden recording a total of $32.7 million in outflows since the beginning of September.

By provider, the largest inflow was to iShares ETFs, at $1.4 billion. Fidelity received $35 million, ProShares $39 million, ARK $32 million, and 21Shares $27 million. Grayscale and CoinShares XBT Provider products saw outflows of $60 million and $16 million, respectively. Grayscale's $1.6 billion outflow since the beginning of the year is particularly noteworthy.

Overall, the interest in crypto investment products represents a cautious yet positive response to the Fed's interest rate cut decision. Strong inflows in Bitcoin and Ethereum, in particular, confirm institutional investors' confidence in the market's long-term potential. Whether this trend continues in the coming weeks will depend on macroeconomic data and the Fed's next steps.