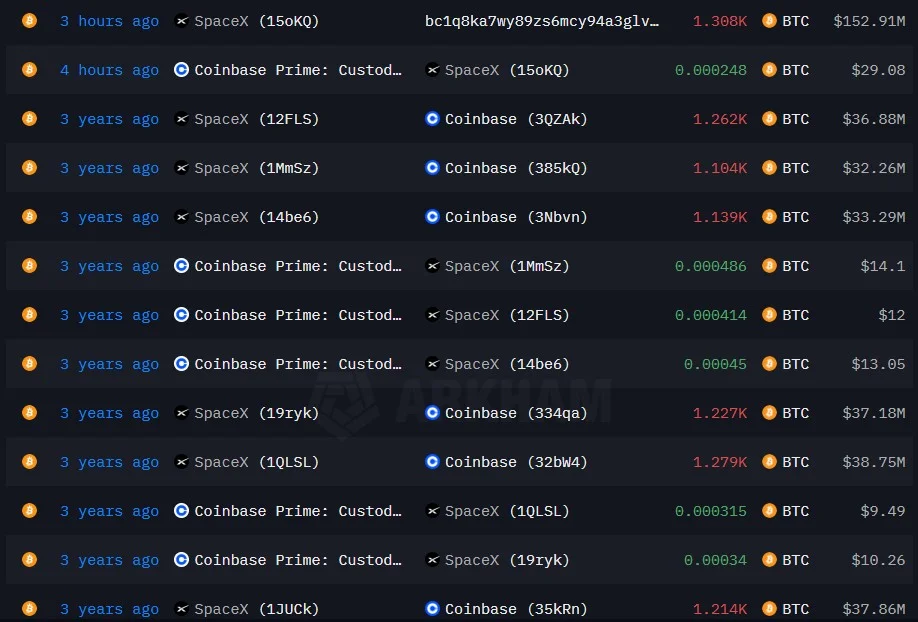

Elon Musk's space company, SpaceX, has activated its Bitcoin wallet for the first time in three years. On-chain data revealed that the company transferred 1,308 BTC (approximately $152 million) to an unknown wallet. This sparked significant curiosity in the crypto market.

First Bitcoin Move in Three Years

According to data shared by blockchain analysis platform Arkham, the transaction in question occurred on the morning of July 22nd. This transfer from SpaceX's Bitcoin wallet was the first recorded transaction since June 2022. At the time, the company transferred 3,505 BTC directly to Coinbase. Now, it's noteworthy that the new transaction sent the BTC to an anonymous wallet rather than another exchange.

This is interpreted as an internal reorganization for security reasons rather than a sales purpose. The possibility of an update to the cold storage architecture or a more secure relocation of funds is emerging. SpaceX still has 6,977 BTC in its wallet. At current prices, these assets are worth approximately $815 million, indicating that the company has largely preserved its Bitcoin holdings.

According to previous reports from Arkham, Tesla and SpaceX hold a combined $2 billion in Bitcoin. Both companies purchased BTC at an average price of $32,000. Based on current prices, they are estimated to have generated approximately $1.5 billion in unrealized profits.

While Tesla's Bitcoin reserves have been publicly available since 2021, SpaceX's crypto assets have remained largely silent. However, these wallet movements reveal how large companies manage their crypto investments behind the scenes and are able to quietly reap substantial profits.

Whales take action, BTC suffers a slight pullback

Around the same time as SpaceX's move, another major surge in crypto activity occurred in the crypto market. As you may recall, on July 17th, Bitcoin whales sent a staggering 61,000 BTC to exchanges. This was the largest daily inflow in a year and caused a 4% drop in Bitcoin's price. BTC fell from $123,000 to $117,000.

According to CryptoQuant data, the total value of BTC inflows to exchanges between July 14 and 18 rose from $28 billion to $45 billion. Such sudden inflows are considered classic sell signals, often seen at market peaks.

However, daily inflow volumes have now declined. If this trend continues, selling pressure in the market may ease and Bitcoin could rebound.

Whether Tesla sells in the coming period will be determined by on-chain data.